- Toncoin-WAL transactions rose by 111 % within 24 hours and reached $ 5.75 billion.

- The sound course recovers easily, but remained behind expectations this week due to the market uncertainty.

Toncoin (tone), the native cryptocurrency of The Open Network, has experienced a strong increase in Wal activities, which triggered speculation about a possible spurt. According to the on-chain analysis platform IntoTheBlock The volume of large transactions-transfers over $ 100,000-rose by 111 % in the last 24 hours and reached $ 5.75 billion.

The volume of the large Toncoin transactions rose from 913.69 million tone to 1.82 billion tone on April 9. This significant increase indicates strategic movements of whales, which may position themselves for future price movements or internal transfers between large wallets.

In addition, the weighting of the whales that influence the market direction is relatively common when they switch off their positions before other investors trace. This happens at a time when the larger cryptom market is recovered with the return of Bitcoin to $ 83,000 and other digital assets that are traded higher in a relief phase.

However, Toncoin remains under pressure despite short -term profits. At the time of the creation of this article, sound is traded at $ 2.98 and has thus recovered by almost 1 % within 24 hours, but still has a weekly loss of 20 %.

On-chain metrics reflect bearish pressure

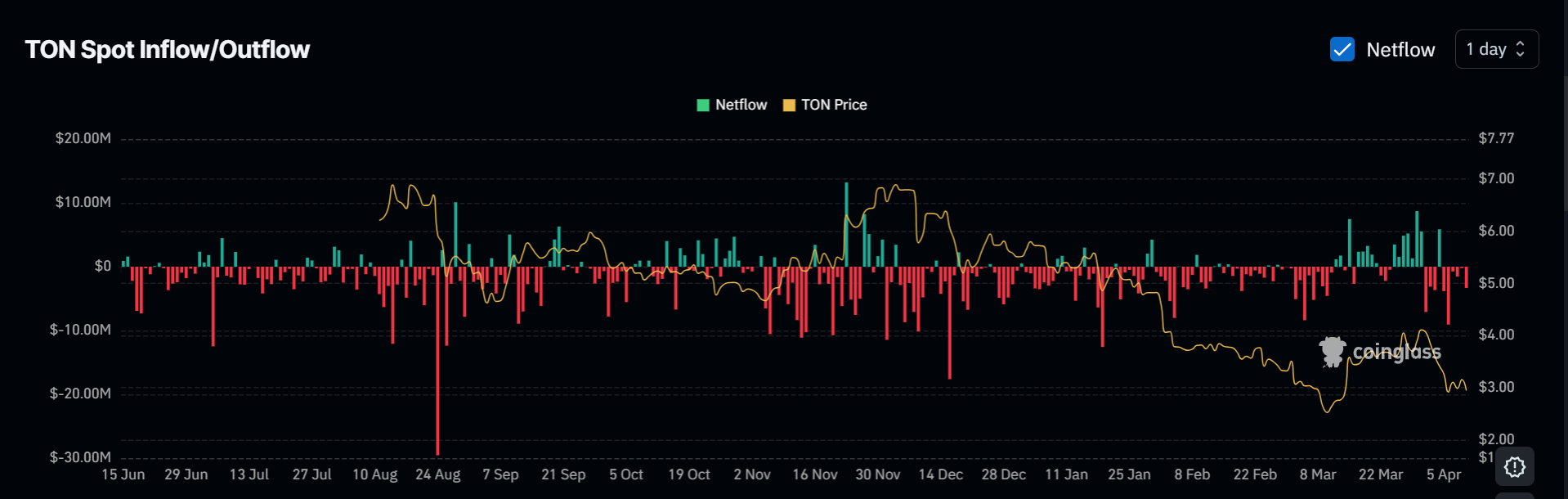

From the pattern of the access and drainage it shows that Toncoin is currently under persistent sales pressure. The analysis of the data on the purchase and sales volume, which comes from the Coinglass platform, shows that there are more drains in the spot markets, which indicates that investors reduce their positions due to the volatile market.

In addition, the open interest in tonal expressions has decreased significantly from its earlier highs of over $ 400 million, which indicates that the speculative interest in sound cools down. This trend reflects the recent price decline and indicates a careful attitude of the dealers.

Despite this headwind, the increase in whale transactions on accumulation strategies or a redistribution of the wallet could indicate. In response to the volatility of the market, stock exchanges or institutional investors could prepare for strategic chess trains.

The increase in Toncoin-Whale activities comes at a time when the crypto derivatives market has increased volatility. In the past 24 hours, crypto futures have recorded a total of $ 457 million, with short positions made $ 321 million-the highest value since the beginning of March.

The latest short liquidations have contributed to stabilizing the price after Bitcoin fell to $ 75,000 at the beginning of this week. Baisse positions were closed at short notice to prepare the soil for most of the market trends.

System growth drives up to $ 400 million funding boost

In a recently breakthrough, one of the largest risk capital companies announced that it invested more than $ 400 million in Toncoin. Some of the investors are Sequoia Capital, Ribbit, Benchmark, Draper Associates, Kingsway, VY Capital and Skybridge.

It was explained that the token purchases were made to improve the developing ecosystem of the sound project. While concrete plans have not yet been published, further means show that there is a lot of enthusiasm for the integration of blockchain into the Telegram messaging app.

Ton is an independent decentralized network, although it stands out from Telegram creators. It supports mini-apps in Telegram and enables crypto operations in the ecosystem; While Toncoin has remained the only accepted token for the payment of services since January.

No Comments