New “IOTA Manifesto”: Schiener relies on trading instead of speculation

- Dominik Schiener’s new “IOTA Manifesto” positions the project as a neutral infrastructure for global trade.

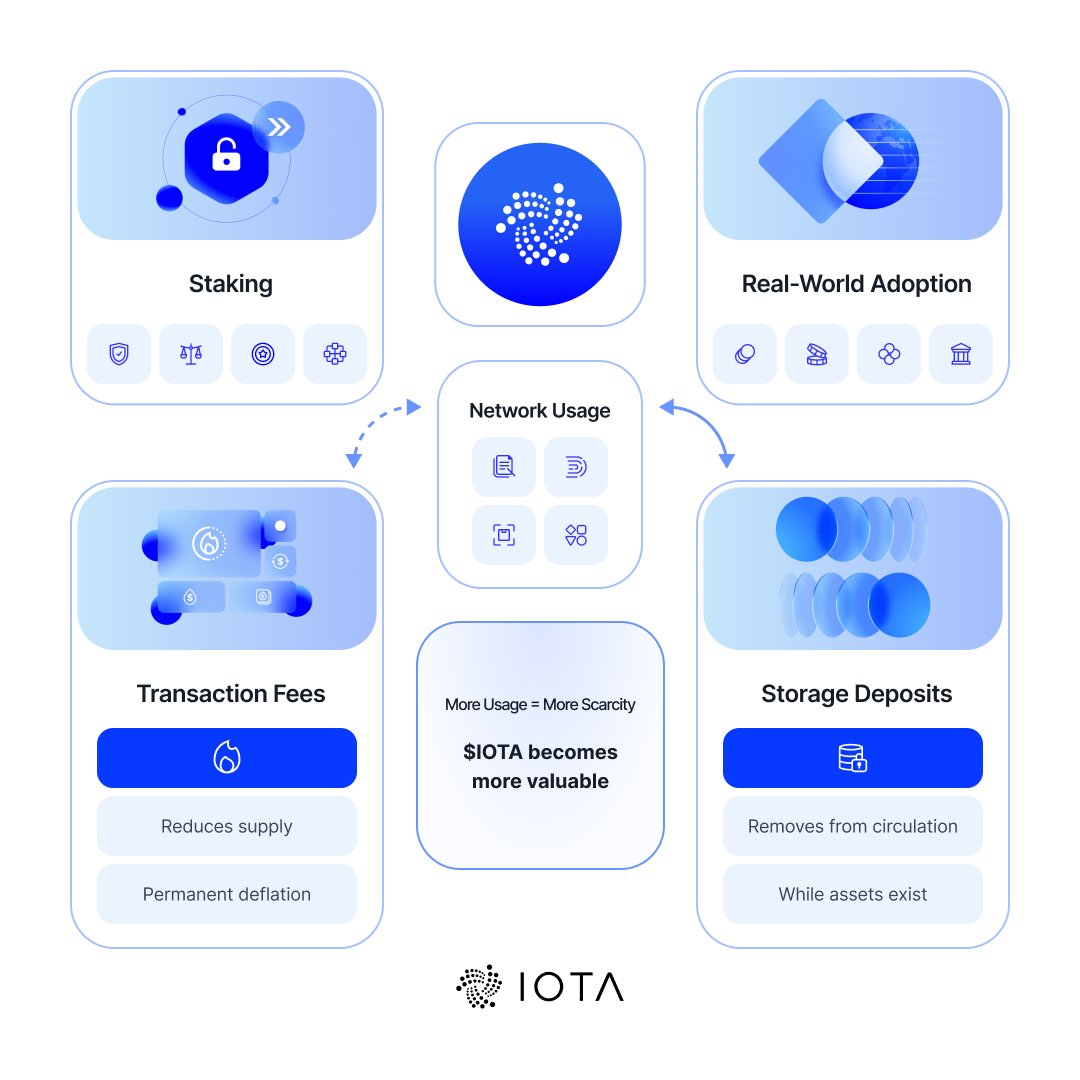

- Real trading transactions should trigger fees and deposits and thus make IOTA scarce.

IOTA co-founder Dominik Schiener has published a new “IOTA Manifesto” that is intended to position the project beyond speculative crypto markets. IOTA wants to position itself as an infrastructure for global trade, a market that the manifesto values at $35 trillion.

Schiener designated the step via X as a consequence of 15 years of experience in the crypto market:

“In my 15-year career in crypto, I have seen our industry go through cycles of hype, noise and speculation – but also real, exciting and impactful innovation. One of the most important lessons is: you will only survive in this market if you have a deeply rooted conviction. We have been in the market with IOTA for ten years. It has certainly been a wild ride with extreme ups and downs, but one thing has never changed: our commitment to bringing the real world on-chain.”

The manifesto is intended as a guideline: IOTA should consciously differentiate itself from pure crypto speculation. In the manifesto, trade is described primarily as a bureaucratic problem: too much paper, too many interfaces, too little standardization.

To support this, the manifesto cites a number of frictions: four billion trade documents every day, up to 30 parties involved per trade and around 240 document copies per transaction. The administrative burden in cross-border trade is estimated at up to 20 percent, and annual losses due to document forgery range from 2 to 5 billion US dollars. The diagnosis is particularly stark when it comes to financing: an annual gap of $2.5 trillion.

Although MLETR has been a legal framework for electronic documents since 2017, according to the manifesto, there is still a lack of a neutral technical basis on which everyone can agree. According to the manifesto, states and corporations would not bind themselves to “a competitor’s private blockchain”.

The failed IBM/Maersk TradeLens project is cited as an example of the limits of private sector models. IOTA draws a clear conclusion from this: the basis must be neutral and open, not the proprietary system of a single provider.

Are IOTA’s TWIN and ADAPT the answer?

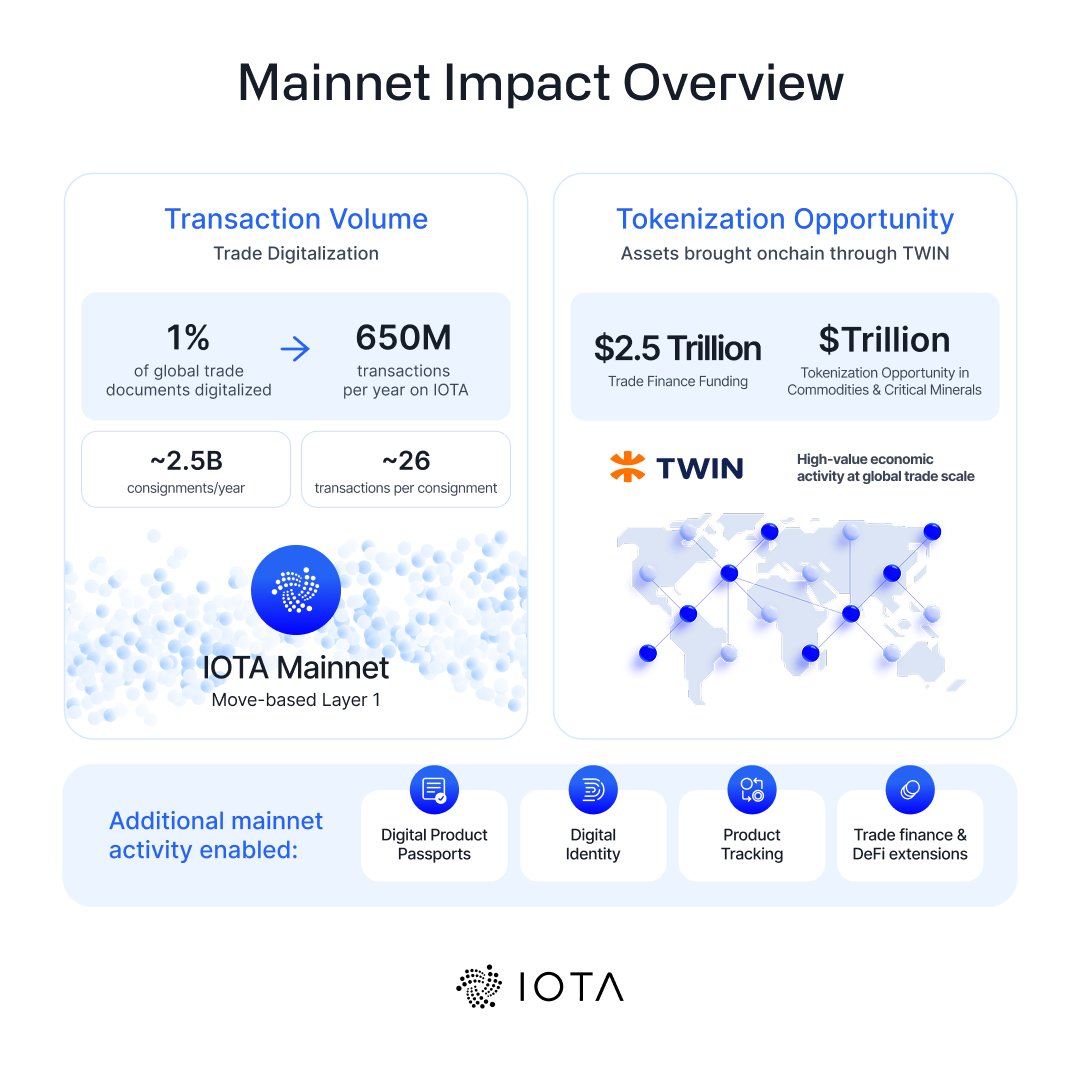

The central solution is TWIN (Trade Worldwide Information Network) – a system on the IOTA mainnet that is intended to digitize documents and secure the flow of goods. The manifesto describes TWIN as “production-ready” and cites live use in Kenya and a UK pilot program as evidence.

For Kenya, it is said that TWIN is live in the trading system and has started flower exports: “7 million stems per day” in the pilot. The expansion should follow “at the beginning of 2026” to all goods. In the UK, the summary refers to a Cabinet Office pilot to simplify UK-EU freight: In 2024-2025, “over 2,000 poultry shipments” from Poland to the UK were tracked on IOTA to give border authorities real-time visibility. A signal that IOTA clearly attaches importance to:

“TWIN has been fully integrated into the IOTA mainnet since January 2026. Real transactions for goods crossing borders now run live on the public ledger.”

Even larger is ADAPT (Africa Digital Access and Public Infrastructure for Trade), a project with the AfCFTA Secretariat, the World Economic Forum and the Tony Blair Institute. The goal is to connect 1.5 billion people by 2035; The source cites a reduction in border clearance from 14 days to hours as well as a reduction in cross-border payment fees by more than 50 percent as potential effects.

The impact on the IOTA token

The manifesto explicitly links the infrastructure story to the token economy. When trading processes run on-chain, the volume of transactions increases and with it the role of fees and deposits that bind or consume tokens.

The manifesto puts the transaction profile at “an average of 26 transactions” per shipment and deduces that just 1 percent of global trade documents could mean “650 million transactions per year” on the IOTA mainnet. Fees should “burn” IOTA, bind storage deposits tokens; Staking is quoted at around 11 percent APY.

The value of the IOTA token comes from real adoption:

“By connecting the physical and digital worlds, we bring data, assets and identities onchain. Instead of creating speculative or worthless tokens, we tokenize real-world assets – from raw materials and critical minerals to trade receivables and warehouse receipts – and make them available in dedicated DeFi applications and stablecoins on IOTA. This creates a new class of decentralized finance applications backed by real assets that generate real returns.”

However, Schiener also emphasizes that the global application of IOTA still means a lot of work, which the IOTA Foundation will only be able to accomplish with the help of its partners:

“We have an incredibly exciting but challenging journey ahead of us. Together with our partners and our ecosystem, we are here to build technologies that create real positive change around the world.”

No Comments