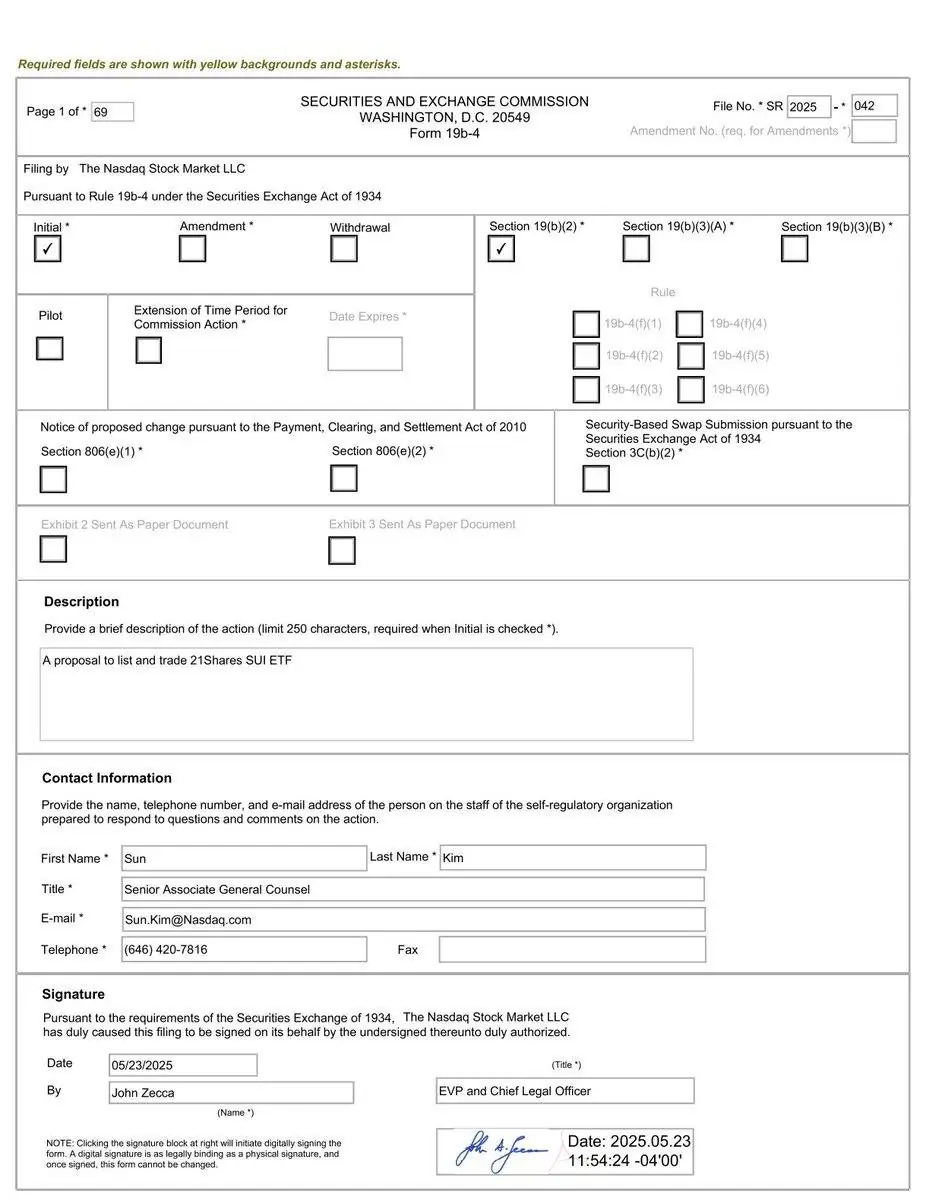

NASDAQ applies for SUI ETF-does the SEC play with the 21shares crypto fund?

- The SUI-ETF application from NASDAQ promotes the project of 21shares to write down the first SUI-Spot ETF on a US exchange.

- The ETF will only keep SUI that Bitgo kept, with the net inventory value to the daily course of CF-Benchmarks.

21Shares has undertaken an important step towards the introduction of the first stock market-traded fund (ETF), which is bound to the SUI blockchain token SUI. The Nasdaq exchange submitted the application to the SEC on behalf of 21shares, which started the official examination process. The application signals an increasing dynamic on the crypto-ETF market, since the institutional interest continues to increase beyond Bitcoin and Ethereum.

NASDAQ submits an application on behalf of 21shares regardless of the SUI turbulence

The requested ETF is to be noted and traded on the Nasdaq and map the spot price of SUI, the native token of the SUI network.

The ETF will calculate its net inventory value based on the SUI USD reference price, which is determined daily by CF Benchmarks. The fund will only hold Spot SUI tokens, without leverage or derivatives. Bitgo is said to be the consolidation for assets of the trust.

This happens after a larger security incident in the SUI system. The Cetus protocol was made easier last week due to an error in its mathematical library by $ 223 million. However, the SUI development team made it clear yesterday in a report that the problem with cetus and not with the network or the programming language Move was related.

So far, $ 160 million has been frozen on stolen assets, and a bounty program has been announced to regain the remaining funds. In response to this, the SUI Foundation set up a $ 10 million fund to improve system security.

ETF registration follows the first S1 registration of 21shares

If the 21shares SUI ETF is approved, institutional investors receive regulated access to SUI via traditional broker platforms. This is part of a wider trend of ETFs for the next generation blockchain platforms.

According to the application, the fund aims to increase transparency and to offer regulatory system options for commitment to digital assets. Sui is thus in a row with other leading crypto-assets such as Bitcoin and Ethereum, for which ETF registrations have already been granted or their applications are processed. This could be a big step for the SUI network to bring its native asset into the mainstream financial markets.

No Comments