- Michael Saylor wants for his company Generate funds through the sale of perpetual Euro preferred shares; with that mehr Bitcoin be procured.

- It’s specific 3.5 million shares of the 10% Series A Perpetual Stream Preferred Stock is 100 € .

Michael Saylor’s Bitcoin-focused company Strategy sharedto launch an initial public offering of euro-denominated perpetual preferred shares as part of its long-term strategy to expand Bitcoin holdings.

The move reflects the company’s ongoing efforts to bolster its fortunes with digital assets while diversifying its funding sources.

Strategy is offering $STRE (“Stream”), our first ever Euro-Denominated Perpetual Preferred Stock, to European and global institutional investors. $mstrer pic.twitter.com/tCectc2uA2

— Michael Saylor (@saylor) November 3, 2025

According to the Press release Strategy intends to purchase 3,500,000 shares of its 10% Series A Perpetual Stream Preferred Stock, known als STRE Stock, to spend .

Every share has a value of 100 euros and an annual cumulative dividend of 10%. The funds raised will be used for general corporate purposes, specifically acquiring more Bitcoin, underscoring Saylor’s vision of positioning Bitcoin as the company’s core reserve.

The dividend payments take place quarterly, beginning on December 31, 2025. In the event that a dividend is not paid, dividends will accumulate at an increasing rate of up to 18% per year until full payment is made is. This structure offers investors a steady return and allows the Strategyto remain flexible in capital allocation.

Dividend deferral rules provide strategic flexibility

The Offer contains detailed provisions for dividend deferrals and redemptions. If the Strategy defers dividend payments, it must attempt to raise sufficient proceeds by selling other classes of shares to cover unpaid dividends.

In addition, the Company reserves the right to redeem all outstanding STRE Shares under certain conditions, such as: B. in the event of tax events or if the total number of outstanding shares falls below 25% of the original issue.

Each stock has a €100 liquidation preference, which is adjusted daily based on trading performance or market price benchmarks.

This approach closely ties the value of the stock to market demand and reflects a dynamic mechanism that is attractive to institutional investors.

Strategy increases its Bitcoin holdings with further purchases

Strategy’s consistent capital raising continues to serve its aggressive Bitcoin accumulation strategy. Recently bought this Company 397 BTC worth about $45.6 million at an average price of $114,771 per BTC.

Strategy has acquired 397 BTC for ~$45.6 million at ~$114,771 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/2/2025, we hodl 641,205 $BTC acquired for ~$47.49 billion at ~$74,057 per bitcoin. $mstrer $ StrC $STRK $STRF $STRD https://t.co/gEuzDaloRb

— Michael Saylor (@saylor) November 3, 2025

Through this the assets increased to an impressive 641,205 BTC for around $47.49 billion was purchased at an average price of $74,057 became.

But the mood on the Bitcoin market is currently mixed. Analyst Lark Davis noteddespite the fact that Bitcoin is holding above $100,000, the lack of a new high raises questions about whether the four-year cycle was extended or peaked at $126,000.

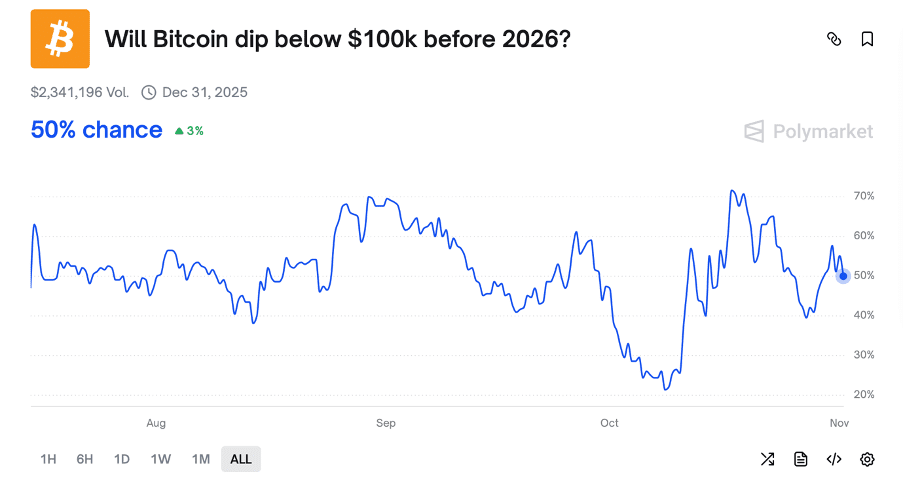

Prediction markets like Polymarket show a 50/50 chance that Bitcoin over $100,000 by the end of the year will remainwhat the dealers vigilant holds as Saylor’s firm continues to expand its high-stakes Bitcoin strategy.

No Comments