LINK whales are hoarding again and the price is recovering – optimists see $19 as the target

- Chainlink whales are hoarding again – 74,000 LINK flowed into reserves, and Millions were withdrawn from stock exchanges.

- Good sentiment, strong demand and technical support point to a rise in LINK towards $19.

Chainlink (LINK) is currently causing a stir in the market after a wave of accumulation signaled new confidence from major shareholders. Chainlink Reserve had a new inflow of 74,049.24 tokens, increasing its total supply to 803,387.65 LINK.

RESERVE UPDATE

Today, the Chainlink Reserve has accumulated 74,049.24 LINK.

The Chainlink Reserve now holds a total of 803,387.65 LINK.https://t.co/q9lDlIHip3

The Chainlink Reserve is designed to support the long-term growth and sustainability of the Chainlink Network by… pic.twitter.com/kWrB5tbxeK

— Chainlink (@chainlink) November 13, 2025

This constant growth of reserves is the dealers not missedand the reason for this is the changing trend the Position size for long term actors. At the same time have the bigger ones owner LINK coins von Binance and other exchangesdeducted.

LINK withdrawals show strong accumulation trend

Another note came by Analyst Ali Martinezwho pointed out that in the last month over 63 million LINKs from the stock exchanges deducted became. This extent indicates normally to an accumulation Only hinwho choose cold wallets and plan for the long term.

The decline of the Exchange from LINK and the increase in Demand can be given to the token a upswing bestowif the momentum continues.

In the past month, over 63 million Chainlink $LINK have been withdrawn from exchanges! pic.twitter.com/ZN8L921IKG

— Ali (@ali_charts) November 11, 2025

Market sentiment has continued to strengthen as buyers are in the range of 14.5 to 15 dollars participate.

This has long been the demand zone, and every time it has been reached, the investor response has been impressive. Many dealers have this Trend reversal waited.

Technical indicators point to $19

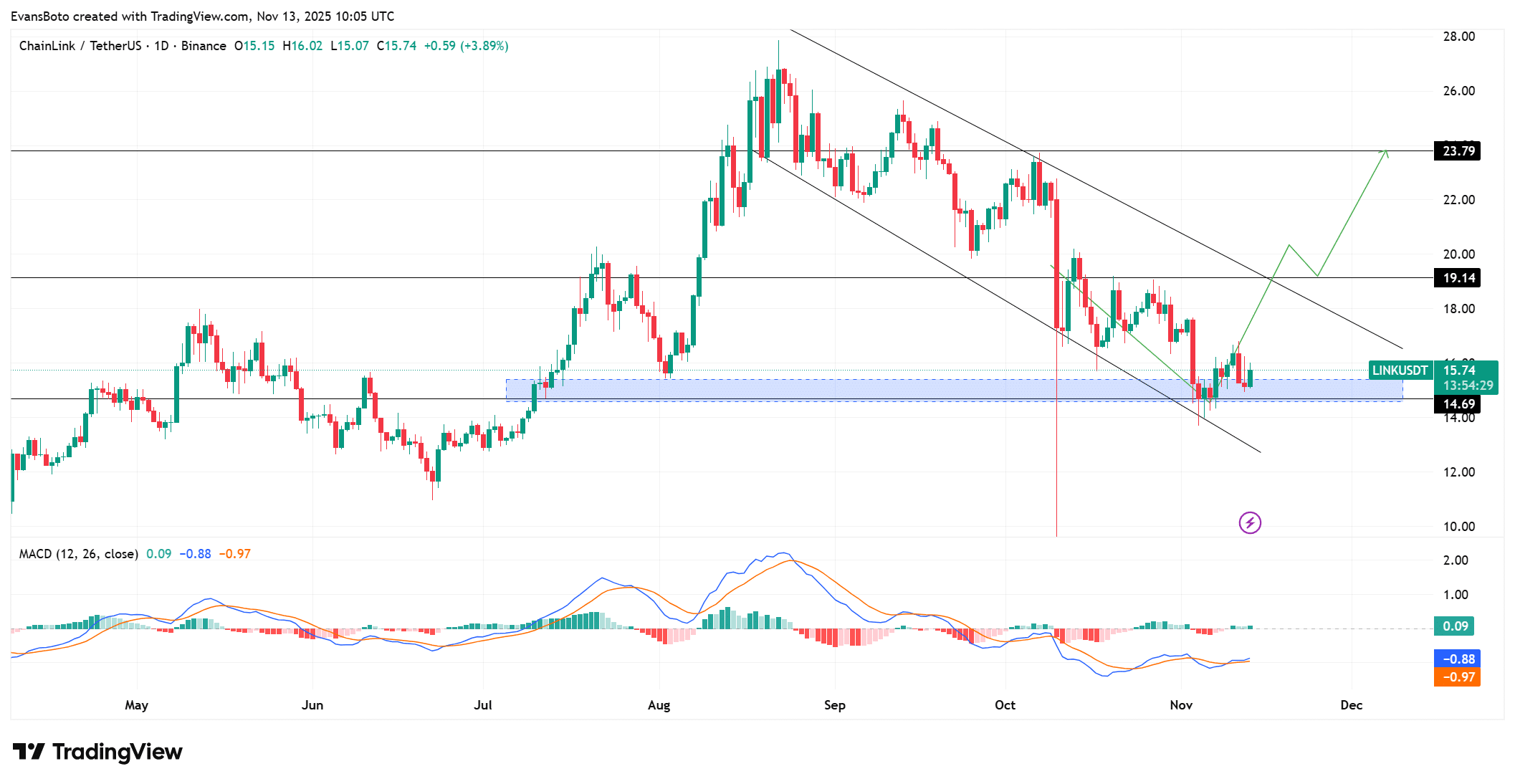

LINK’s recent rally has seen the token approach the upper boundary of the descending channel, marking the beginning of a possible breakout attempt.

Overall technical analysis also showed signs of healthier conditions. The histogram of the MACD indicator began himself up to narrowand the signal lines moved towards a positive orientation.

Although the price remained within the trading range, reinforcedevery new overcoming of the lower limit a trend reversal.

Given the on the current Level prevailing buying moment lies the next obvious target at $19.14 and then in the high range of $23.79.

The data from top traders also points to this development. The long position reached its highest level in weeks at over 70%.

The long-short ratio also moved significantly from it lower levels away what affects you massive mood change it High trading volume accounts indicates . The long positions rose even during price declines continue on.

Growk Finance brought a broader perspective a and pointed indicates that LINK has been moving within a symmetrical triangle since 2021.

Based on their analysis, the crypto market still has two years to go the market in one or the other Direction breaks out. They also pointed out that the region between $8 and $12 is the strongest long-term accumulation zone if the price reaches it again.

No Comments