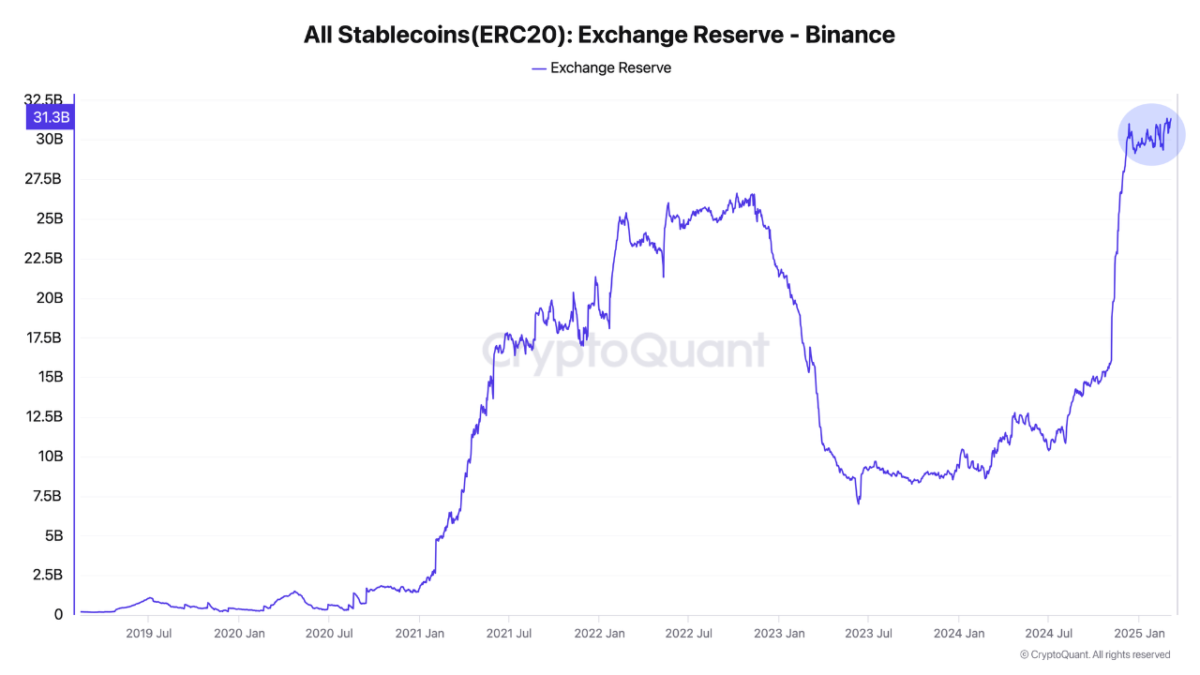

Krypto News: $ 31.3 billion in stablecoins on Binance – harbinger of an upcoming crypto rose?

- Cryptoquant attributes the increase in Binance StableCoin reserves to institutional investors in anticipation of favorable market conditions that have moved a lot of capital.

- Binance seems to increase its reserves in order to be able to serve the increased demand for trading pairs and large -scale transactions.

New statistics from Cryptoquant have shown that Binance’s stable coin reserves have risen to more than $ 31.3 billion, an all-time high. This dramatic increase indicates a dramatic increase in liquidity on the platform, which could pave the way for higher trading volumes. Since stablecoins act as a gate for cryptophaders in order to simply get in and out of positions, this message indicates a developing house-in-house mood on the market.

Binances StableCoin reserves reach ATH

The world’s largest crypto exchange Binance has had significant tributaries for stable coins in the past few weeks. Increased reserves of these cryptocurrencies usually indicate that investors are preparing to take strategic market positions. Such a trend was always preceded by strong market resolutions, which means that the dealers could prepare the soil for a new price movement.

According to one Contribution The analysts from Cryptoquant indicate two key factors that cause this increase in the stable coin reserves. First, institutional investors seem to transfer large capital amounts into Binance, possibly in expectation of favorable trade conditions. Such movements often reflect trust both in the stability of the stock exchange and in the wider cryptoma market. Second, Binance seems to increase its reserves itself to support the increased demand for trading pairs and large -scale transactions.

To another context: Stable coins are a buffer for liquidity and enable an immediate introduction to assets such as Ethereum and Bitcoin in times when the market is growing. As a rule, an increased purchase pressure is preceded by an increase in the reserves, which indicates that investors are stocked in order to relieve capital at due time. In the past, such tendencies fell together with phases of the housesee in the crypto sector, in which an increase in liquidity led to a price increase.

However, market participants are still vigilant, since external forces also influence the crypto trends. Macroeconomic conditions, regulatory updates and institutional moods still determine the market direction. Although the steady influx of stable coins to Binance is an encouraging sign, the dealers pay close attention to other market indicators before they go into fixed positions.

Investors act carefully

Despite the optimistic image, which results from the growth of Binance’s stable coin reserves, regulatory developments are still an important factor, as mentioned in our previous article. Governments and financial supervisory authorities around the world continue to work on their policy in terms of cryptocurrency exchanges and stable coins, and such developments can have an impact on market dynamics. Investors observe the explanations of the regulatory authorities carefully and are aware that political developments could further strengthen trust or create new ambiguities.

In addition, Binance, as the most active actor for digital assets, has a significant impact on market liquidity and the trade pattern. The growth of the stable coin reserves indicates a growing demand for crypto transactions. This change in liquidity can lead to an increased short -term market activity, especially if retailers try to benefit from the better conditions.

No Comments