- On X, the “XRP Supply Shock” theory is making a comeback, although the data looks different.

- At the same time, new on-chain signals indicate increasing selling pressure on Binane.

The trigger was a post from the XRP community account @unknowDLT, which shared a Glassnode graphic and from it the supply shock thesis derived:

“XRP ETFs are rapidly depleting the available supply. With only around 1.5 billion XRP left on exchanges and around 750 million XRP absorbed in a few weeks, a supply shock is likely by early 2026. This fits with the Clarity Act, which enforces price discovery and enables true institutional use.”

Why there is no XRP supply shock in sight

Objection came promptly from the XRP ledger dUNL validator xrp.vet (Vet). His central thesis: Exchange stocks and order books cannot be interpreted statically because supply can be mobilized in seconds.

“There is no XRP supply shock on exchanges. 1) Holders hold nearly 16 billion XRP on exchanges and have them available immediately. There is enough for everyone to get some. 2) Whether the price goes up or down, any of you who don’t have XRP on an exchange could send yours to an exchange within 3-4 seconds,”argued Vet.

Vet’s core argument is the “elasticity” of visible liquidity: “This means that the XRP supply that is for sale in the order books is also dynamic. It is elastic – it can condense or dry up, back and forth, in a matter of seconds.”

XRP influencer Zach Rector asked how sure Vet was that the data was correct. Vet explained: “I have full confidence that these numbers represent the lower bound of what is actually on exchanges. That is, these values are at the lower end in the worst case scenario and there are additional exchange accounts that we have not yet identified.”

He pointed to Upbit as an example. Four XRP accounts on the Korean exchange alone hold a total of 2 billion XRP (significantly more than @unknowDLT states), and this is “just a part” of Upbit’s total holdings.

Full confidence that these numbers are the lower bound of what actually is on exchanges. Means, these numbers are at worst on the lower end and that there are more accounts of exchanges we haven’t seen yet.

I mean just check upbit alone, lets only look at 4 out of many xrp… pic.twitter.com/CDotpZMoNS

— Vet (@Vet_X0) December 28, 2025

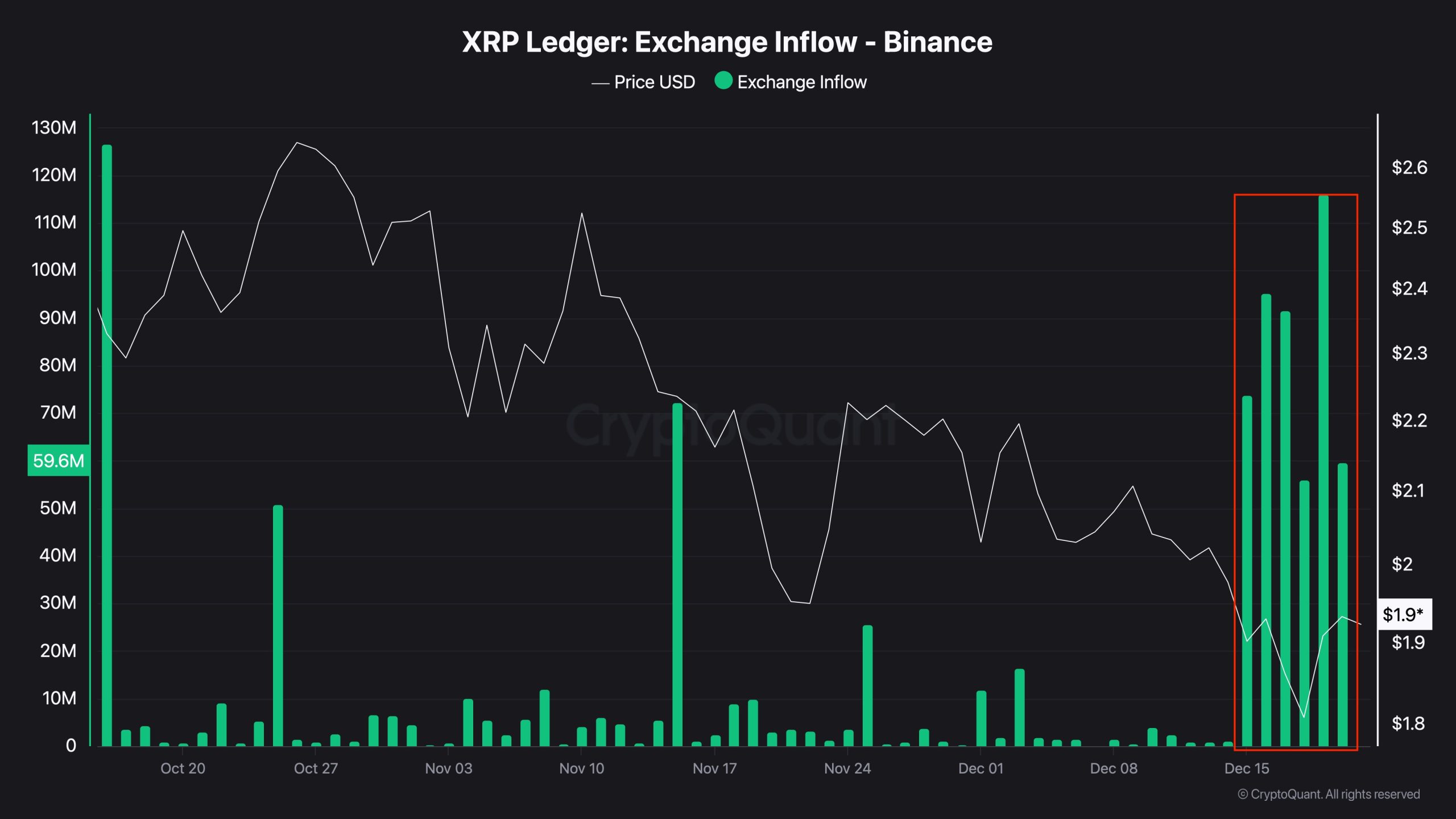

CryptoQuant: Binance inflows are increasing

In parallel with the supply shock debate, pseudonymous CryptoQuant analyst Darkfost (@Darkfost_Coc) provided new on-chain data that contradicts the supply shock narrative: rising inflows to exchanges as an indicator of selling intent, in an environment he describes as a sharp correction.

“Current data suggests a clear intensification of selling pressure on writes Darkfrost.

Darkfost uses XRP inflows to Binance as an example, as Binance has “the largest trading volumes among all exchanges,” and the data is clear:

“After a relatively calm period with moderate and stable inflows, the situation changed noticeably from December 15th. Since then, XRP inflows to Binance have increased sharply, with daily volumes ranging between 35 million XRP and a significant peak of 116 million XRP recorded on December 19th.”

From this, Darkfost derives a change in investor behavior, away from the HODL strategy since October towards profit-taking on older positions as well as capitulation and loss-selling with newer market participants. As long as these increased inflows continue or continue to increase, it will be “difficult for XRP to form a real accumulation phase” and the correction could not only be extended in time but also deepen further.

The immediate implication for traders is clear: if exchange inflows remain elevated, any bullish squeeze narrative will compete with visible, short-term activated liquidity. An XRP price rally currently seems impossible under these circumstances.

At the time of writing, XRP was trading at $1.85.

No Comments