- IOTA co-founder Schiener soberly comments on the October 10th crypto crash as a “sad truth”.

- The focus is on decoupling and deleveraging, while IOTA counters with TWIN/ADAPT/Salus and strong on-chain growth.

The crypto market experienced a hard break on October 10, 2025 and IOTA co-founder Dominik Schiener came to an unusually sober conclusion. Dominik Schiener responded on January 29 on X, saying: “Sad truth. But we must keep building – and our industry will only emerge stronger from this phase.”

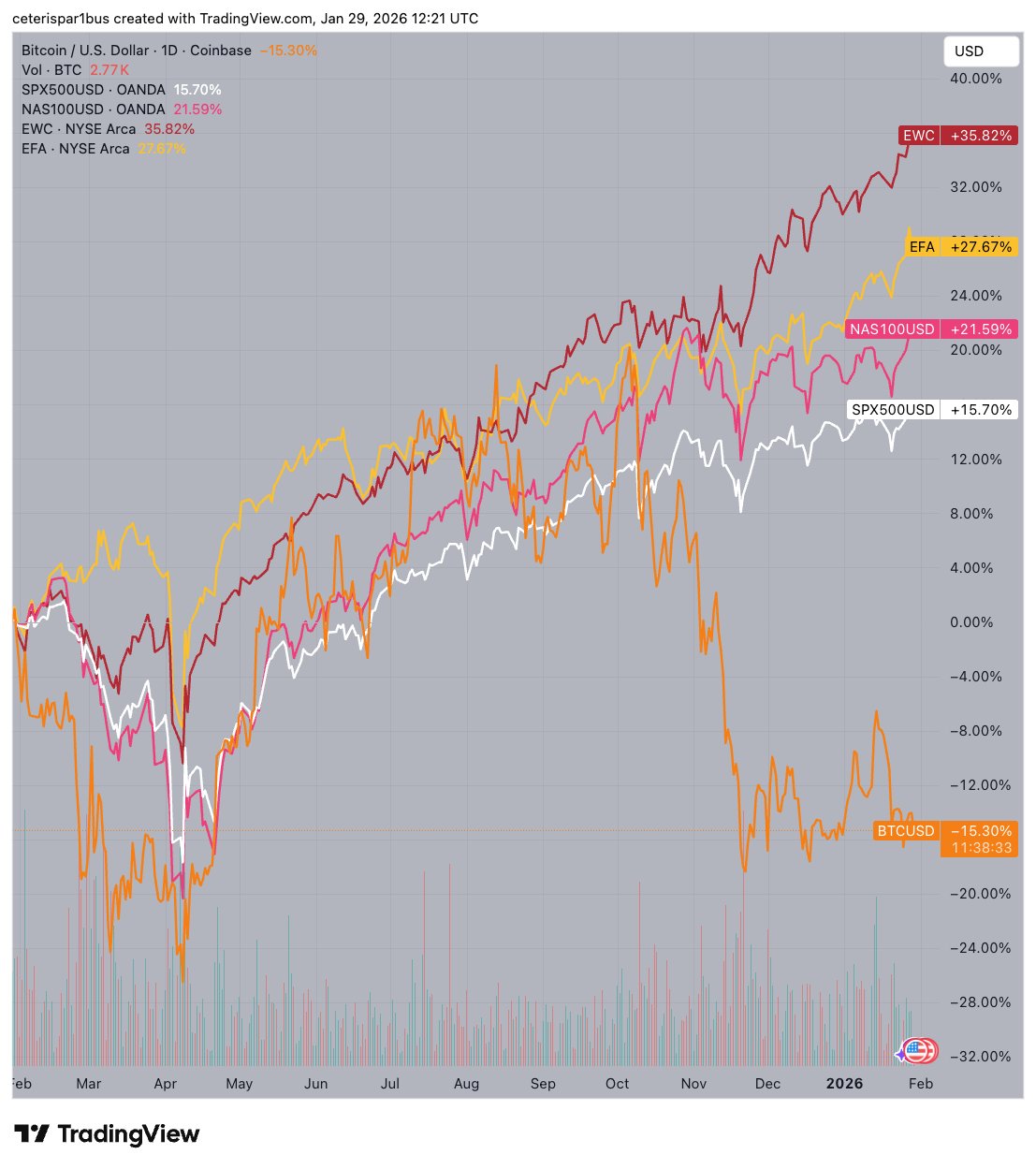

With his comment, Schiener referred to an X-Post by Ceteris Paribus, the Head of Research at Delphi Digital. Paribus shared a chart and wrote: “It’s really crazy how much the 10/10 has broken everything down.”

Instead of short-term price targets, the debate was primarily about responsibility and what the crash did to the market. The focus is on the striking decoupling: Bitcoin and the rest of the crypto market tipped over, while classic markets continued to rise.

The chart shows: Until the beginning of October, Bitcoin was roughly in step with other markets, after which there was a significant break. In the comparable period, Bitcoin is at -15.30% – while the S&P 500 (+15.70%), Nasdaq 100 (+21.59%), EFA (+27.67%) and EWC (+35.82%) are significantly up.

October 10th was a turning point for the crypto market. The trigger was a deleveraging spiral: around $19 billion in leveraged positions were liquidated in around 24 hours. Bitcoin crashed, altcoins even more violently.

A possible trigger is seen as a software error at Binance, which triggered de-pegging of individual assets. Official figures have not been published. However, Galaxy Digital CEO Mike Novogratz estimated the event wiped out around 30% of market makers.

Paribus interprets the crash as a possible structural reset: “I can appreciate the idea that 10/10 was the necessary final nail in the coffin of our old, broken market structure. At the same time, the correction went far too far over the target.”

IOTA relies on adaptation in the crisis

Schiener’s “sad truth” sounds more like a work order than a surrender: carry on, build, deliver. As CNF reported, Schiener recently released the “IOTA Manifesto.”

In the manifesto, IOTA describes itself as an infrastructure that wants to bring “the real world onchain” – with a focus on trustworthy, regulated and scalable applications rather than relying on crowded crypto niches.

Just yesterday the TWIN Foundation published the TWIN White Paper v1.0. TWIN is presented as a reference architecture and building block for interoperable digital trading solutions – modular, standards-based and intended as an interplay of software layers and services.

The 1.0 release of our Reference Architecture whitepaper cements TWIN as a neutral backbone for global trade.

By leveraging open standards and decentralized trust built on @IOTAit ensures transparency, data sovereignty, and seamless exchange across borders.

pic.twitter.com/0FMdcOwgHJ

— TWIN Foundation (@TWINGlobalOrg) January 29, 2026

In addition, ADAPT runs as an Africa initiative for digital trade infrastructure: By 2035, trade clearances in 55 African nations are expected to become significantly faster, costs will fall and trade volumes will grow. A first pilot test is already underway in Kenya. The initiative is supported by the Secretariat of the African Continental Free Trade Area (AfCFTA) in collaboration with the IOTA Foundation, the World Economic Forum and the Tony Blair Institute for Global Change (TBI).

At Salus, IOTA focuses on raw material supply chains: documents on the ownership and chain of origin of critical minerals are anchored as NFTs on the IOTA ledger.

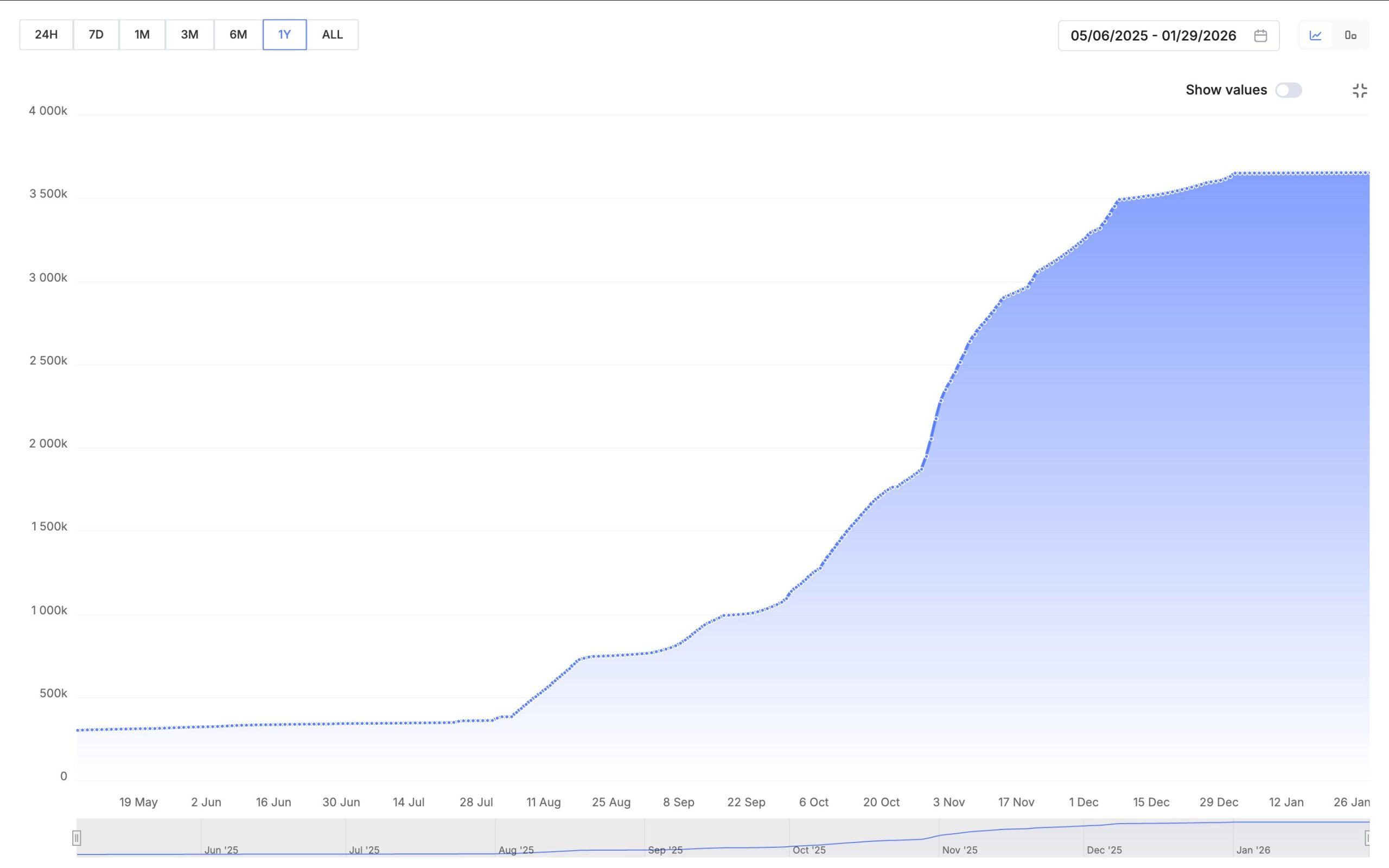

The on-chain data also provides a clear signal. Encapsulate HQ (@encapHQ) shared yesterday via X:

“The growth of the IOTA ecosystem is accelerating rapidly. The number of mainnet accounts increased from around 300,000 six months ago to over 3.65 million today. This corresponds to growth of more than 1200% within half a year for IOTA. The momentum is constantly increasing in the areas of staking, dApps and everyday acceptance.”

No Comments