- Japan may hoard Bitcoin without hanging it on the big bell. Behind it could be the intention of building crypto financial reserves.

- The BitcoIN course lasts well over $ 100,000 despite $ 1.2 billion.

Bitcoin fell three days in a row – in the middle of increasing geopolitical tensions at $ 104,818. There were $ 1.2 billion liquidations on the cryptoma markets. Meanwhile, analysts suspect that Japanese institutions position themselves for long-term Bitcoin engagement.

Geopolitical pressure triggers crypto sale

Bitcoin has withdrawn from his latest high of $ 110,417 and has fallen by 1.68% in the last 24 hours. The market reacts to the increased geopolitical risk after Israeli air strikes on Iranian military and nuclear systems have taken place. How CNF reportedescalate the tensions and the United States has started to withdraw staff from the region.

All of this triggered significant liquidations in the entire crypto sector. The data show that positions worth over $ 1.15 billion were destroyed, including $ 448 million from Bitcoin long positions. Ethereum also fell by 10% and was traded by $ 2,400.

Sea Kryptoanalyst Leshka Eth If this downturn shows the classic “risk-off” market behavior rather than a fundamental collapse of the crypto systems.

Bitcoin’s latest decline has brought him under important technical levels, including the 50-perioda ($ 106,783) and the 38.2%fibonacci retracement level ($ 107.640). The asset is now traded near the 23.6%FIB level of $ 104,872.

Analysts assume that a further decline could find support at $ 103,169 and $ 101,705. Resistance levels are still $ 105,948, $ 107,640 and $ 108,864.

Despite the short -term declining tendencies, the general prospects for BTC remain good if it lasts over $ 100,000. Technical analysts emphasize the spreading channel pattern on the daily chart and the 50-dayema at $ 102,655.

However, the MacD shows a bearish divergence, with an increasing red histogram and a recent crossover, which indicates a mixed short -term momentum.

Japan’s institutions could take discrete BTC Horten

Jeff Park, strategy manager at Bitwise Asset Managementbelieves that Japan is a big institutional buyer of Bitcoin. Park says that Japan Unique macroeconomic environment and the massive financial reserves would support a large bitcoin engagement.

Bitcoin’s Next Mega-Buyer? Watch Japan Closely, Says Bitwise Exec https://t.co/2DCysPxvNL

— Crypto Brothers (@LosKruptos) June 12, 2025

He points out that Japan’s currency reserves are over $ 1.1 trillion and over $ 8.7 trillion in pension and life insurance funds. Even a small replacement from these reserves in Bitcoin would be a big thing for liquidity and institutional demand.

The influence of Japan is also connected to the yen-carry trade and its integration with the global credit markets. Park says when both Japan and the USA start buying Bitcoin, this could change the way in which central banks withdraw from traditional Fiat currencies.

No official announcements were made, but analysts believe that Japanese banks and insurer behind the scenes Bitcoin accumulate, and in the long term.

Mood signals and market behavior indicate reverse potential

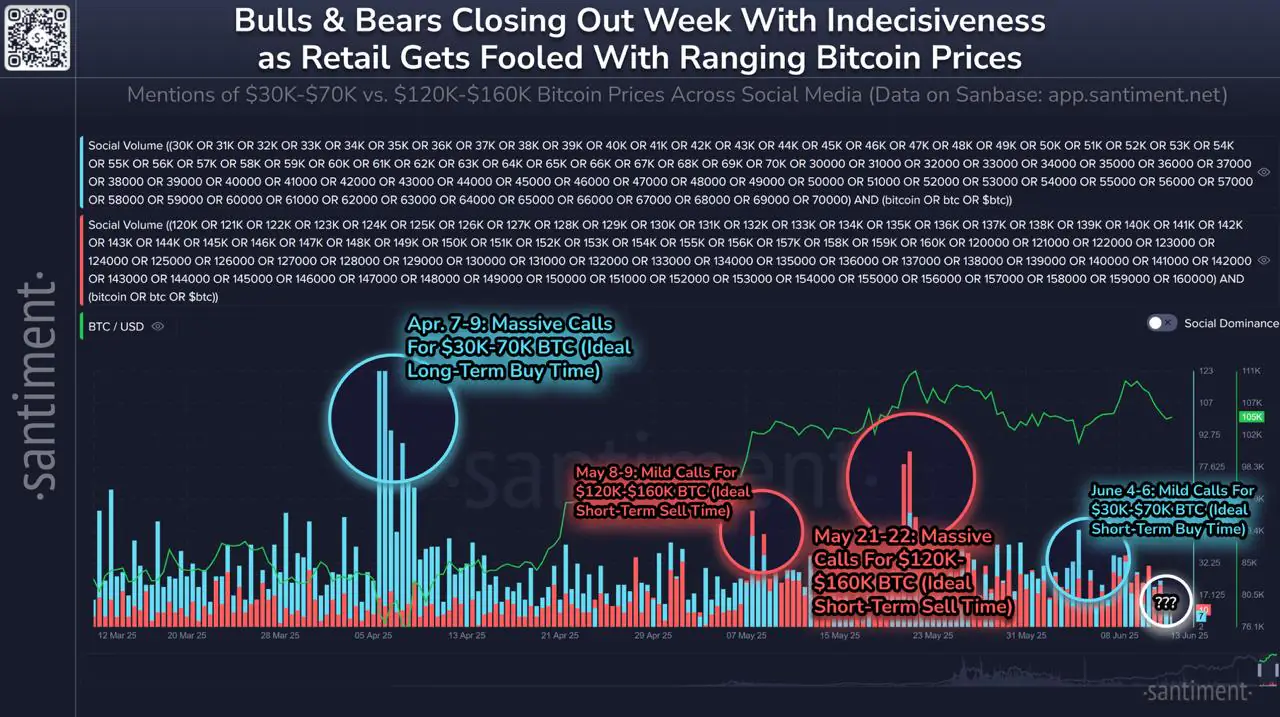

The crypto analysis company Singlent Has published new data that indicated that the mood in retail is still one of the strongest indicators of swing trading. The company pursued the Bitcoin price mention on the most important social media platforms, including X, Reddit, Telegram and Bitcoint talk.

The mood data was divided into two areas: blue for predictions between $ 30,000 and $ 70,000, and red for predictions between $ 120,000 and $ 160,000. Although Bitcoin In the past three months between $ 101,000 and $ 112,000, dealers often tend to emotionally extremes.

Santiment recorded a key event between June 4 and 6, when Bitcoin fell to $ 101,000. The atmosphere in retail was strongly turned into the negative and Wal-Wallets began to collect. The resulting upswing increased the pattern of contrary movements against the mainstream.

At the moment, the mood in retail seems to be mixed, with many investors waiting for a confirmation before they get back in. Santiment came to the conclusion that these hesitation phases often offer opportunities for larger market participants who pay attention to mood -related misalignments.

The BTC daily turnover has also dropped by more than 50% and is currently $ 2.08 trillion. The formation of an expanding sewer pattern on the daily chart indicates a possible soon.

No Comments