- Hedera lost almost 10%in March, but shows signs of course stability.

- The course rose by 4.71%in the last 24 hours with increasing sales.

Hedera (Hbar) showed signs of a possible recovery after he had suffered a severe decline since the beginning of March. While the token has lost around 10 % on his monkey type, the latest movements indicate stabilization. Investors have caused the current price activity of HBAR and the important level of support to observe a possible trend reversal.

Hedera finds support near the main demand zone

Hedera’s course has leveled off between $ 0.19 and $ 0.20 near a critical support area, a region that has proven to be stable in the past in the past. This level served as a buffer, which attracted further losses and buyers who were looking for cheap entry opportunities. Many dealers assume that the market could recover from this area in the course of consolidation.

#Hbar/USDT ANALYSIS

HBAR is consolidating within a descending triangle pattern, currently trading inside the horizontal demand zone. This level is providing support, preventing further downside for now.

The Ichimoku Cloud is acting as a resistance barrier above the pattern,… pic.twitter.com/E5bjuR0QEj

— The Crypto Express (@TheCryptoExpres) March 22, 2025

Although the recent losses pressed the mood, the price has started a slight upward movement, which is supported by an increasing volume. Hedera rose by 4.71% in the last 24 hours and reached $ 0.19469 in the middle of a wider old coin recreation. This increase reflects a relocation of the dynamics, but remains in the context of short -term consolidation.

The descending triangle pattern on the daily chart illustrates the continued pressure because the prices reach lower maximum and test a flat base. However, the maintenance of the stability above this zone could signal an accumulation and lead to interest bullies. If it is not possible to keep this level, this could open the door to further losses.

Technical indicators ensure careful optimism

The Ichimoku cloud indicates a strong resistance, whereby the red cloud indicates a persistent sales interest that the bulls have to overcome. A persistent movement above this cloud could confirm a trend reversal and arouse new buying interest. Until then, the declining mood could remain predominant because the sellers test the resistance of the support.

The Bollinger bands (20 SMA) show that the prices of the center line approach, the upper and lower band at $ 0.26158 or $ 0.16937. This formation signals increasing volatility, and every strong movement could determine the next important course direction. Hbar remains below its simple, sliding 20-day average, which is currently $ 0.21547, which indicates continued pressure.

However, the Awesome Oscillator (AO) has started to print green bars, although it is in the negative area with -0.02335. This development could be a sign that an early momentum builds up when the purchase pressure continues in the upcoming meetings. The combined signals indicate a decisive phase for Hbar, in which a break or breakthrough seems to be right.

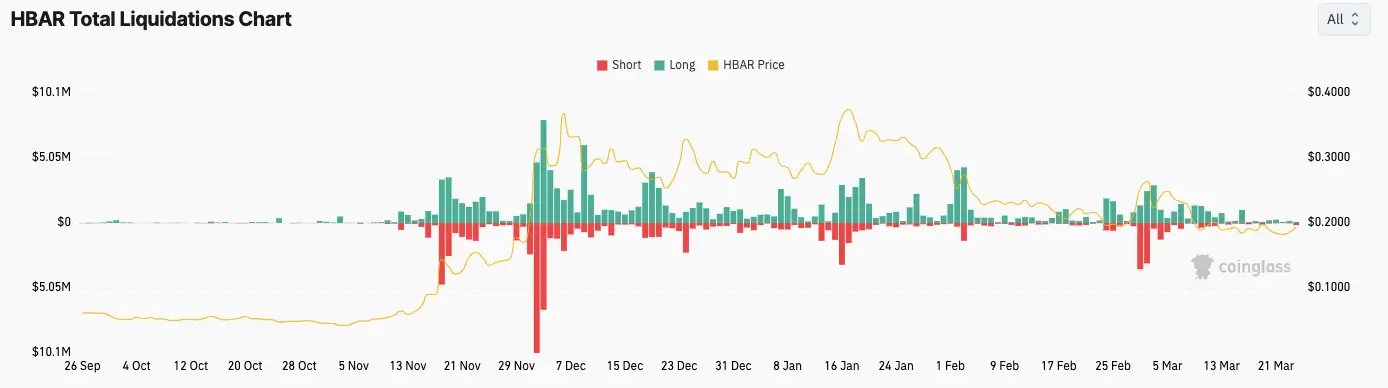

Reduced liquidations indicate market maturity

During the entire month of March 2025, Hbar recorded a significant drop in liquidation activities, which indicates a less foreign trade and a careful approach. Coinglass’s data confirm the reduced long and short liquidations, which have been below $ 2 million a day since mid-February. This is in contrast to the top values from the end of 2024, in which the daily liquidations exceeded $ 10 million.

The decline in liquidation is in accordance with the stable price development of Hedera and the closer trading range of the past few weeks. In the previous months, extreme volatility led to massive liquidations, especially during relaxation and subsequent corrections. Now the dealers seem to wait for clearer trends before taking courageous steps.

Lower leverage and slower liquidations could create a more balanced environment for the next phase of the system. If price stability continues, long -term investors could begin to accumulate at the current level.

No Comments