Global RWA tokenization: Chainlink and the $ 30 trillion-heavy financial alliance

- Chainlink, Swift, JP Morgan and 20 Other global finance market leaders cooperate with RWA tokenization-they manage above 30 billion dollars and bets.

- The alliance wants drive the token -based finance and Connect traditional banking networks with blockchain networks.

Chainlink has in the Allianz with Swift, JP Morgans Kinexys, Eureclear, Mastercard with a total of over 20 leading institutions took a big step into global RWA tokenization.

Together you manage assets of over 30 trillion dollars. This cooperation focuses on the development of blockchain applications and tokenized assets that meet the regulatory requirements and the existing infrastructure.

On the Sibos 2024 Chainlink co-founder Sergey Nazarov presented a new integration of a Swift bank message system with blockchain networks. Swift and Chainlink also carried out the first cross -chain handling of tokenized assets in which institutes such as Citi, BNY Mellon, BNP Paribas and Lloyds were involved.

⬡ Swift

8.4 billion messages across 11,500+ institutions⬡ Mastercard

Over 3.5 billion cardholders worldwide⬡ Euroclear

€40.7 trillion in assets under custody (AUC) across 1.7 million securities held⬡ J.P. Morgan

$3.9 trillion in AUM across 100+ countries— Chainlink (@chainlink) July 22, 2025

This product on the Cross-Chain Interoperability Protocol (CCIP)by chainlinkis based creates an on-chain bridge for old systems and new digital financial systems. It facilitates the output and handling of tokenized funds via standard Swift payment rails that are in operation between 200 countries.

Real-time assets and compliance with AI and Oracles

The network has developed beyond interoperability. In cooperation with Euroclear, Swift, UBS, Franklin Templeton UA, the network presented a corporate action initiative. It focuses on making fragmented financial data machine -readable by using AI and oracles.

The project enables a fast, uniform Business processing across Europe and eliminated Delays and inefficiencies in the coordination of Capital measures. In the second phase, ISO news standard and Swift protocol are in The architecture embeddedone a scalable framework for the future of financial system to accomplish.

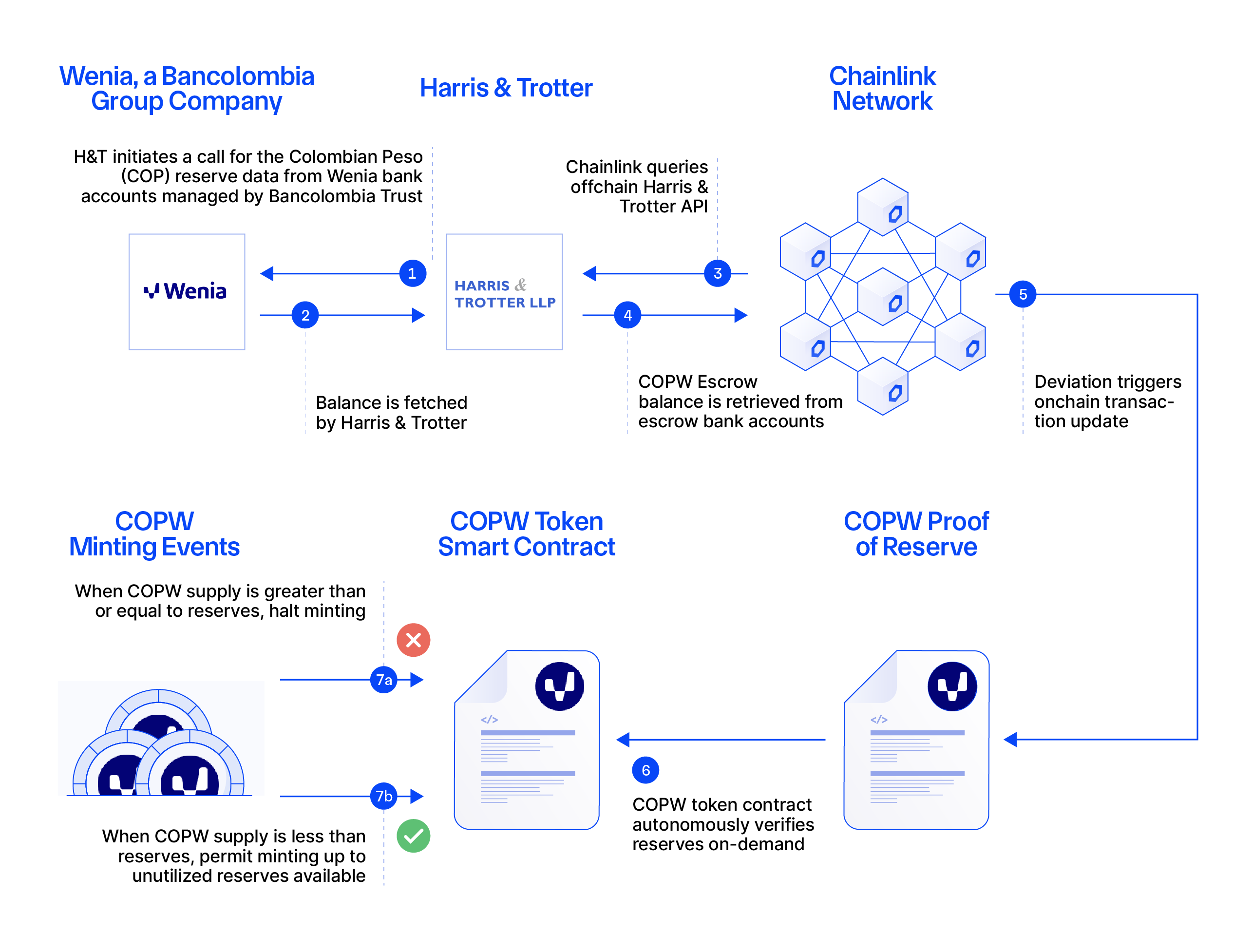

Also the Chainlink Proof of Reserve Technology delightedmore increasingly Popularity. Wenia, a company of Colombian Bancolombia group, has put the solution for transparency on its stablecoin COPW so that the Reservesdes Coins can be verifiable on the chain.

Mastercard, central banks and JP Morgan hug chainlink

On the consumer side, the network has entered into a partnership with MasterCardone die Swapper-App to present. It enables over 3 billion mastercard users to buy cryptocurrencies directly on the chain. It simplifies access to digital assets via card networks in conjunction with decentralized networks.

In the meantime it will network used by large projects. The Brazilian Central bank Works with Chainlink together, one the trade financing within the framework of the state CBDC program digitize.

The Reserve Bank of Australia is experimenting with DVP (Delivery vs. Payment) tokenized billing with Chainlink in the Acacia project.

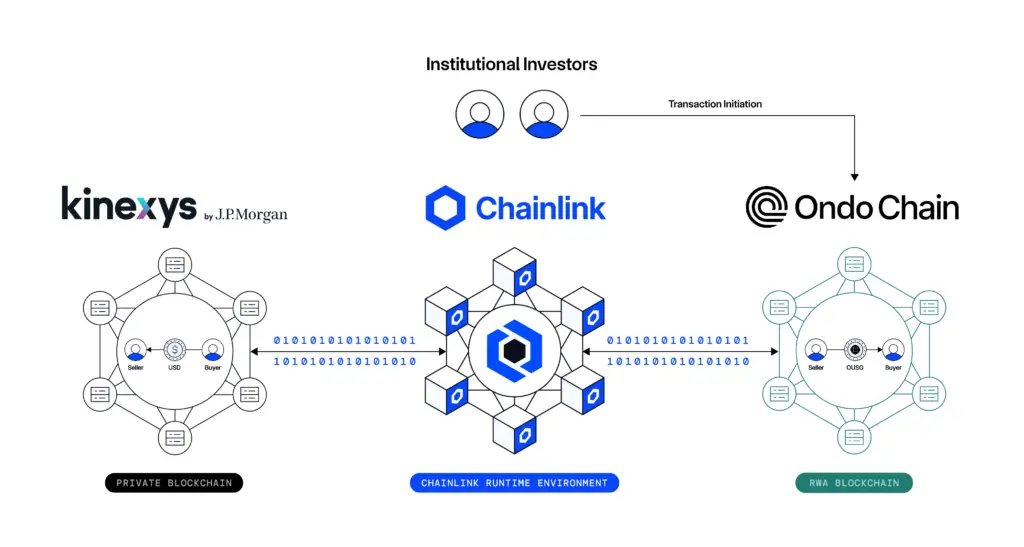

The Kinexys business area of JP Morgan also works with Chainlink and Ondo Financeto successfully complete a Crisschain DVP transaction. It was a significant case of integrating tokenized asset marketplaces with traditional payment rails.

These efforts show the growing participation of Chainlink in the redesign of the institutional financial system. The Chainlink network combines institutions with blockchain networks and thus lays the foundation stone For a joint onchain financial system.

No Comments