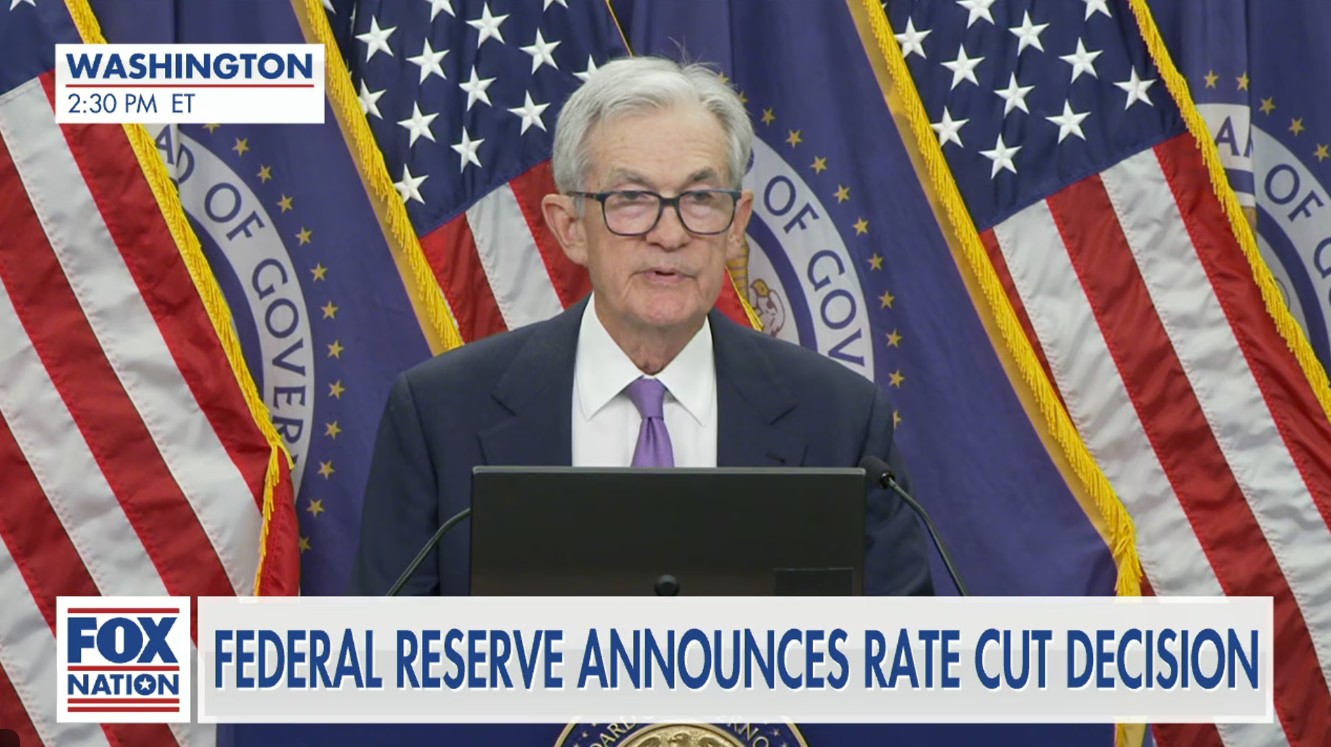

Fed cuts interest rates again – Bitcoin reacts nervously, rally postponed?

- The US Federal Reserve cut the key interest rate by 0.25 points on December 10th, for the third time this year.

- Bitcoin jumped briefly after the decision and then turned away again, but analysts are still talking about a possible lag according to the usual pattern.

A brief moment of shock, then BTC rises again. Bitcoin reacts to the Fed interest rate cut like a market that had already priced everything in and still remains nervous.

The Fed has cut by 25 basis points, the target range is now 3.50 to 3.75 percent. Three cuts in a row over the fall, a total of 0.75 percentage points, that was pretty much expected. And yet it doesn’t seem like relief, more like another data point that raises new questions.

Bitcoin initially jumped above the $94,000 mark, but only briefly, and then fell back towards 90,000. At the time of writing, the BTC price is close 92.600 USD and recorded an increase of in the last 24 hours 2,34%.

At the same time, a rather cautious tone was heard from the Fed, projections, a look to 2026, and risk turned off again. It’s not entirely clear how much of this is actually due to the Fed and how much is purely positioning.

Interest rate cut number three brings a moderate price increase

Some analysts are focusing less on the rate cut itself than on the underlying signal. Powell speaks of a neutral zone, and there are corresponding projections. At this point the market is rapidly losing its euphoria. This is particularly noticeable in the crypto sector, as reactions depend heavily on how clearly and reliably expectations of the next monetary policy steps can be classified.

The following morning, broad corrections began again, and not just for Bitcoin. The short-term bounce was there, but was quickly sold off. Futures positions and risk exposure have been pared back, a pattern that often emerges after highly anticipated calendar events.

Analysts rely on time-delayed effects

In parallel, an alternative interpretation exists. In the past, interest rate cuts were often followed by the actual market movement with a delay of 3 months, after the event had been processed and the positioning had been reorganized.

Some analysts therefore expect a rally to start later. It remains to be seen whether this pattern will work this time, especially since the Federal Reserve is currently sending more dampening than stimulating signals.

Added to this is the increasing background noise from the technology sector. Movements in AI and tech stocks, such as Oracle, as well as the general mood in the major US indices are now having a noticeable impact on the crypto market. Bitcoin is currently reacting nervously to this, regardless of its own narrative.

There is currently little to suggest a clear trend. The market seems headline-driven, reacts at short notice and rejects impulses just as quickly. If the upcoming labor market or inflation data deviate again, the focus is likely to shift accordingly. Bitcoin therefore remains in a phase of uncertainty, between hopes for interest rates and signs of fatigue.

No Comments