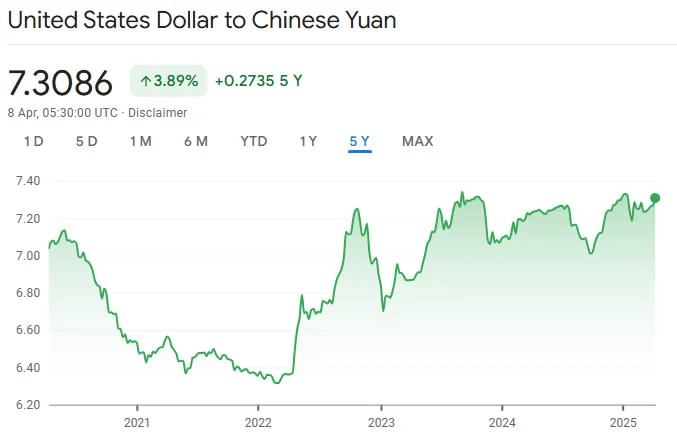

- Arthur Hayes predicts an increase in Bitcoin demand when the Chinese Yuan becomes weaker and is reminiscent of 2013 and 2015.

- Capital escape from China and the devaluation of the Chinese currency would make interest in Bitcoin stronger.

Bitmex founder Arthur Hayes predicts that a weak Chinese Yuan would lead to an increase in Bitcoin demand. Hayes pointed out that this dynamic in the past had already shown itself in the devaluing in 2013 and 2015.

He suspects that Bitcoin could become a preferred alternative if Chinese capital is looking for a refuge. Arthur Haye’s view coincides with a wider pattern in which financial instability in China has correlated with rising Bitcoin prices in the past.

The Yuan devaluation has historical role models

Hayes says that if the Chinese central bank devalues the Yuan, capital will flow into Bitcoin. Hayes referred to the devaluations in 2013 and 2015, in which the Bitcoin course scored.

If not the Fed then the PBOC will give us the yachtzee ingredients.

CNY deval = narrative that Chinese capital flight will flow into $BTC.

It worked in 2013 , 2015, and can work in 2025.

Ignore China at your own peril. pic.twitter.com/LAOeQZEjZt

— Arthur Hayes (@CryptoHayes) April 8, 2025

In the same year China loosened up capital controls and thus became a fertile soil for the development of Bitcoin. The activity on the BTC China stock exchange increased and Bitcoin rose from 13 to over $ 1,000 by December of the same year; The central bank evaluated the Yuan and again there was a high demand for Bitcoin.

For a long time, Chinese investors were looking for an opportunity to protect themselves from the effects of the falling currency, which led to an increase in the BitcoIN course. As Hayes says, the same process could repeat itself in 2025, and again Chinese capital would buy due to the devaluation of the Yuan Bitcoin.

Capital escape from China is great

The Chinese Yuan has been under pressure, especially in the recent past, among other things because of tariffs that were raised by the United States. As already mentioned, Arthur Hayes warned that Chinese capital could migrate in search of a safer country if the central bank should further devalue the Yuan.

The capital controls are still high today, and in view of this great influence, Bitcoin offers a way through which Chinese investors can invest their money outside the reach of the state institutions.

Also Bybit CEO Ben Zhou explainedIf the Yuan trap, capital go to Bitcoin. He noted that Bitcoin, as soon as the Yuan had fallen to the dollar in 2019, had a price increase of 20% within a few days.

As Zhou mentioned, comparable economic factors could trigger a further round of Bitcoin demand among the Chinese who try to secure their money.

However, Bitcoin has recovered to $ 83,000 and at a time when the entire US market is in great difficulty because it will lose an estimated two trillion dollars, due to the emerging trade war with China and the rest of the world.

Hurdles through regulation and the effects

So there can be a new Bitcoin house, but the Chinese dealers are currently confronted with the problems described. It is noticeablethat China is currently still the strictest crypto regulation in the world.

A new law of 2024 states that Chinese commercial banks have to report all international transactions, in particular high sums in cryptocurrency. This could be unfavorable for the ability of local retailers to easily transfer capital into Bitcoin, which is a global asset.

As Markus Thielen, founder of 10x Research, emphasizes in relation to the future of Bitcoin and a possible future fleeing capital, the Chinese position is an important factor.

The keeping of the Supreme People’s Court on cryptocurrencies, especially in connection with money laundering, has made it more difficult for individuals to use Bitcoin to flee capital. Nevertheless, historical trends indicate that Chinese investors could continue to turn to Bitcoin in large numbers if the devaluation of the Yuan accelerates.

As CNF reported, however, Arthur Hayes recently found that any measures in the United States to found a state-supported Bitcoin fund could lead to Bitcoin becoming a political power instrument and small innovative companies are left out. He explained that this could be a new threat to cryptocurrency if the Bitcoin market is closely linked to politics.

No Comments