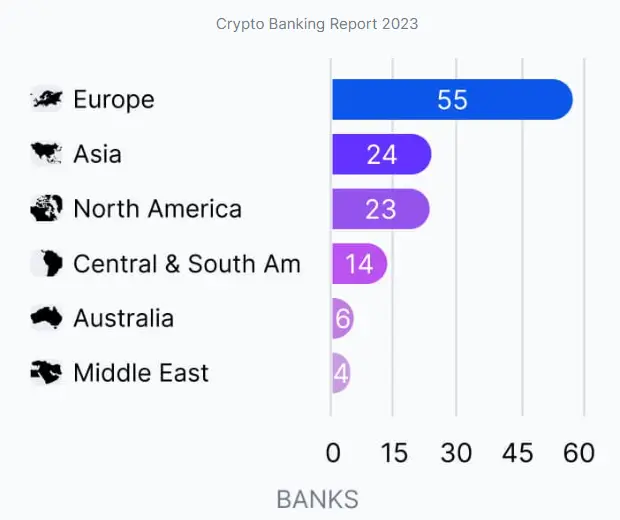

Europe dominates crypto banking: 55 banks offer custody and trading-in different forms what distinguishes it

- The EU is a leader in crypto banking. 55 banks offer crypto custody, trade and exchange and thus exceed Asia and North America.

- The Mica Ordinance promotes the acceptance of crypto in Europe by ensuring clarity, security and scalability and moving large global stock exchanges into the region.

Europe has taken the global leadership in crypto banking, with 55 banks that now offer services such as crypto custody, trade and exchange in Fiat. These institutes in Germany, Switzerland, Great Britain and beyond have opted faster than their counterparts in Asia or North America for digital assets.

One Coincub study emphasizes that six banks are actively active in the field of cryptocurrency services in Germany alone, while there are five in Great Britain. The leading names in this area include Seba Bank in Switzerland, Revolut in Great Britain and Bankera in Lithuania. These banks offer services such as safe crypto custody, staking and asset tokenization.

The upswing is largely due to the Mica Ordinance (Markets in Crypto-Assets), which creates a clear legal framework for crypto services. The regulation promotes transparency, security and scalability for crypto business and encourages banks to integrate digital assets into their portfolios.

Regulation brings Europe forward

Mica fundamentally changed the European financial sector. The regulation, which is to be fully implemented by December 2024, offers structured guidelines for banks and crypto companies that reduce uncertainty and promote acceptance. The regulation aims to create a safer environment for investors and to rationalize the integration of blockchain into the financial system. In the recent reason 6 of the Mica is it[called:

“A clear framework is intended to enable the providers of crypto-assets to expand their business across borders and to facilitate their access to banking services so that they can run their activities smoothly.”

While the USA lagging behind, the OCC (Office of the Compotroller) of the Currency has recently given the banks to provide permission to provide services in connection with cryptocurrencies. This hesitation in connection with regulatory uncertainty led to the American banks behind their European competitors.

Despite its advantages, the European crypto banking sector is not without challenges. Price volatility, fraud and strict anti-money laundering (AML) and Know-your-customer (KYC) requirements represent hurdles for financial institutions who want to expand their crypto offer.

Global crypto exchanges go into the EU

The regulatory security of the Mica has brought large global crypto exchanges to Europe and consolidated its position as a first-class goal for companies in the field of digital assets.

Okx and Crypto.com both received a mica license in Malta in January 2025, which underlines trust in the transparent EU regulations. Bitpanda, a stock exchange based in Austria, received the approval of the German supervisory authorities, which further strengthens the status of Europe as a crypto -friendly center.

In the meantime, other regions continue to pursue different approaches to regulating cryptocurrencies. In the United Kingdom, for example, the approval of the regulatory authorities was slow: only four out of 29 applications were approved by the Financial Conduct Authority in 2024. This hesitant reaction gives rise to concern about the combination of the United Kingdom in this sector.

In contrast, US President Donald Trump promised to make the United States the “Crypto capital of the planet”. While the mood indicates a change in American politics, the regulatory uncertainty continues to keep many institutions on the sidelines.

No Comments