Ethereum Onchain data compact to the purchase signal-ETH/BTC ratio rose 38%

- The ETH/BTC ratio has increased by 38 % of a 5-year low and signals a possible shift in the Altcoin market.

- Institutional ETH accumulations and decreasing sales pressure indicate a renaissance of Ethereum among the old coins.

Ethereum could be about to recapture second place to Bitcoin, as new Onchain metrics show a shift in market dynamics. Cryptoquant data show that Ethereum may have passed the valley sole after a strong recovery of the ETH/BTC ratio. The market signals indicate growing ETH demand, decreasing sales pressure and increasing institutional accumulation. Analysts say that this could be the beginning of an old coin season that is driven by Ethereum’s comeback.

ETH/BTC ratio recovers from historical low

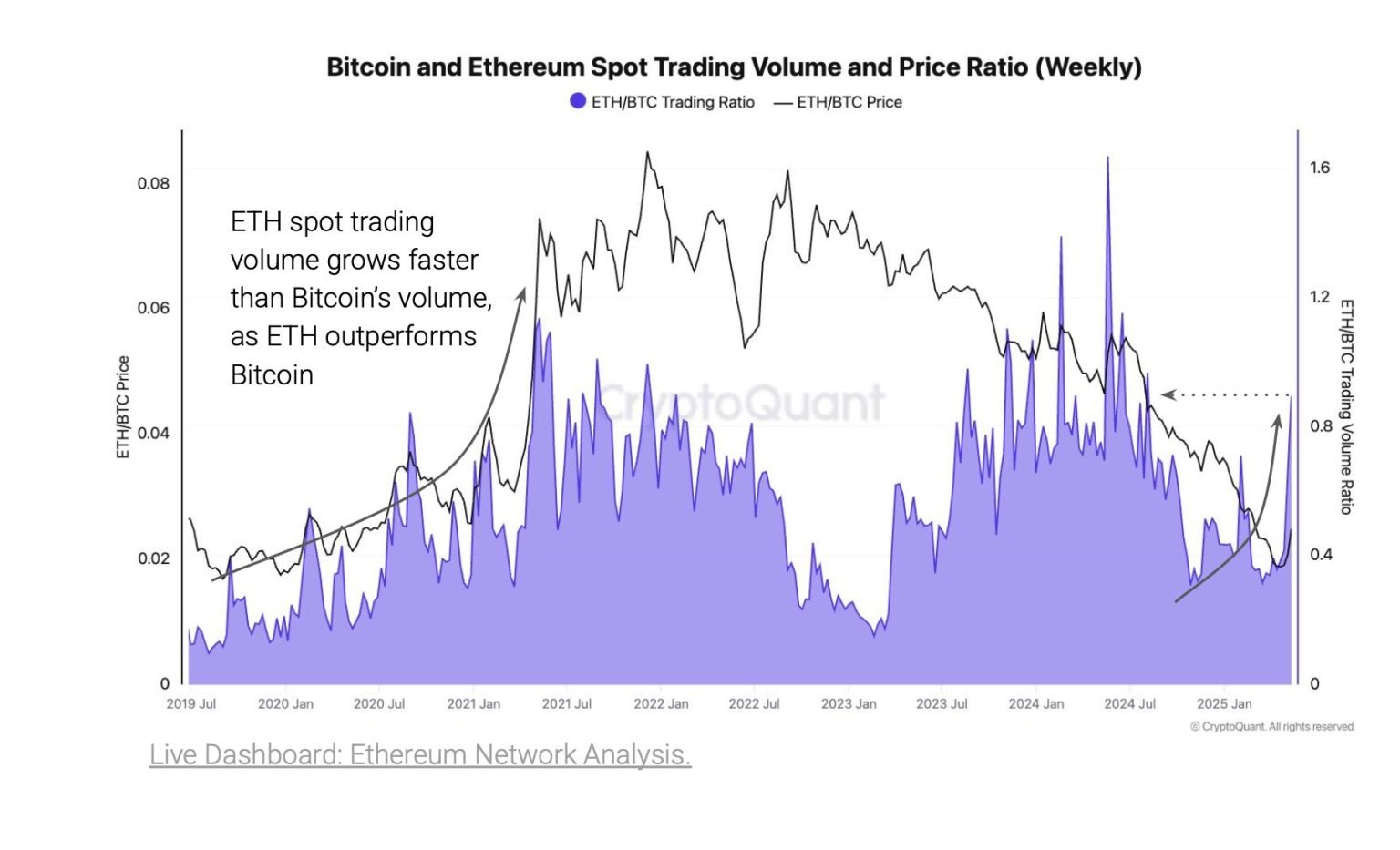

CryptoQuant reportedthat the price ratio from Ethereum to Bitcoin has risen by 38 % last week after it has reached the lowest level since January 2020. This increase follows at a multi -year low, which, according to Cryptoquant, is historically associated with market lows for ETH. According to her analysis, Ethereum has now entered a zone of extreme undervaluation compared to Bitcoin, as the ETH/BTC-MVRV indicator shows, which was last observed in 2019.

In past cycles – especially 2017, 2018 and 2019 – similar conditions were preceded by strong recovery from ETH to BTC. The recent development of the ETH/BTC price ratio awakens expectations for a possible repetition of these historical trends.

The relationship between the ETH and the BTC cassauna volume has also risen to 0.89 and thus to the highest level since August 2024. Cryptoquant states that this reflects a new trade interest in Ethereum that reflects a pattern that occurs from 2019 to 2021 as an ETH significantly better than BTC.

Institutional demand increases – sales leave after

Institutional inflows reinforce the housesee. Cryptoquant has found a strong increase in the relationship between ETF stocks from Ethereum to Bitcoin since the end of April. This means that fund managers turn their capital in ETH, possibly in the run-up to the latest scaling upgrades from Ethereum or a cheaper macroeconomic environment.

This is supported by the data on the stock exchange inflows that show a lower sales pressure on Ethereum CNF. The ETH/BTC stock exchange inflow has dropped to the lowest level since 2020, which means that fewer ETH owners send their coins on stock exchanges. Bitcoin lists more activities on the sales page.

Cryptoquant analysts say that this is part of a broader change in behavior on the market. They say that investors aggressively accumulate Ethereum because the price and mood reach historical levels. Since the question of investors increased, the stock exchange inflows decreased and institutional accumulation is present, the situation is ripe for a reversal. When the story is repeated, Ethereum will soon outperform Bitcoin and lead the Altcoin market.

When writing this article, Ethereum is traded at $ 2,482.77, which corresponds to a decline of around 3.93% in the last 24 hours. The token has a resistance of $ 2,603.86, and the support is currently $ 2,449.07

No Comments