Ethereum is experiencing Smart-Contract boom-signs of course outbreak?

- The number of Ethereum Smart Contracts reaches new heights and signals a revival of network activity.

- The ETH purchases of whales also reach a record level and show long-term trust of investors.

As CNF reported, Ethereum is experiencing a significant revitalization of on-chain activities, since the Smart Contract inserts reach a level that was last recorded during the house in 2021. While the ETH course is further below its all-time high, the increasing commitment of the developers and institutional accumulation indicate growing market trust.

Technical indicators and historical trends indicate further upward movement. However, they could delay profit at short notice.

Smart-Contract Use reaches multi-year high

According to the Etherscan, the daily Smart Contract operations on Ethereum rose to the highest level in the first quarter of 2025 since an ETH course of over $ 4,800 in 2021. Analysts attribute the increase in on-chain activity to the expectation of the PECTRA upgrade. This increase in developer activity is seen as a sign that Ethereum gets going again. More use means a stronger demand for ETH, which strengthens its long -term value.

Nevertheless, the price development of ETH does not reflect the growth thrust at the smart contracts. After the course had fallen from $ 3,400 from $ $ 1,400 at the beginning of the year, ETH recovered to $ 2,500. The price lags behind the fundamental data, but many are still optimistic. An investor said that building activity was a clear sign that the dynamics return, and he believes that ETH can achieve $ 10,000 in this cycle.

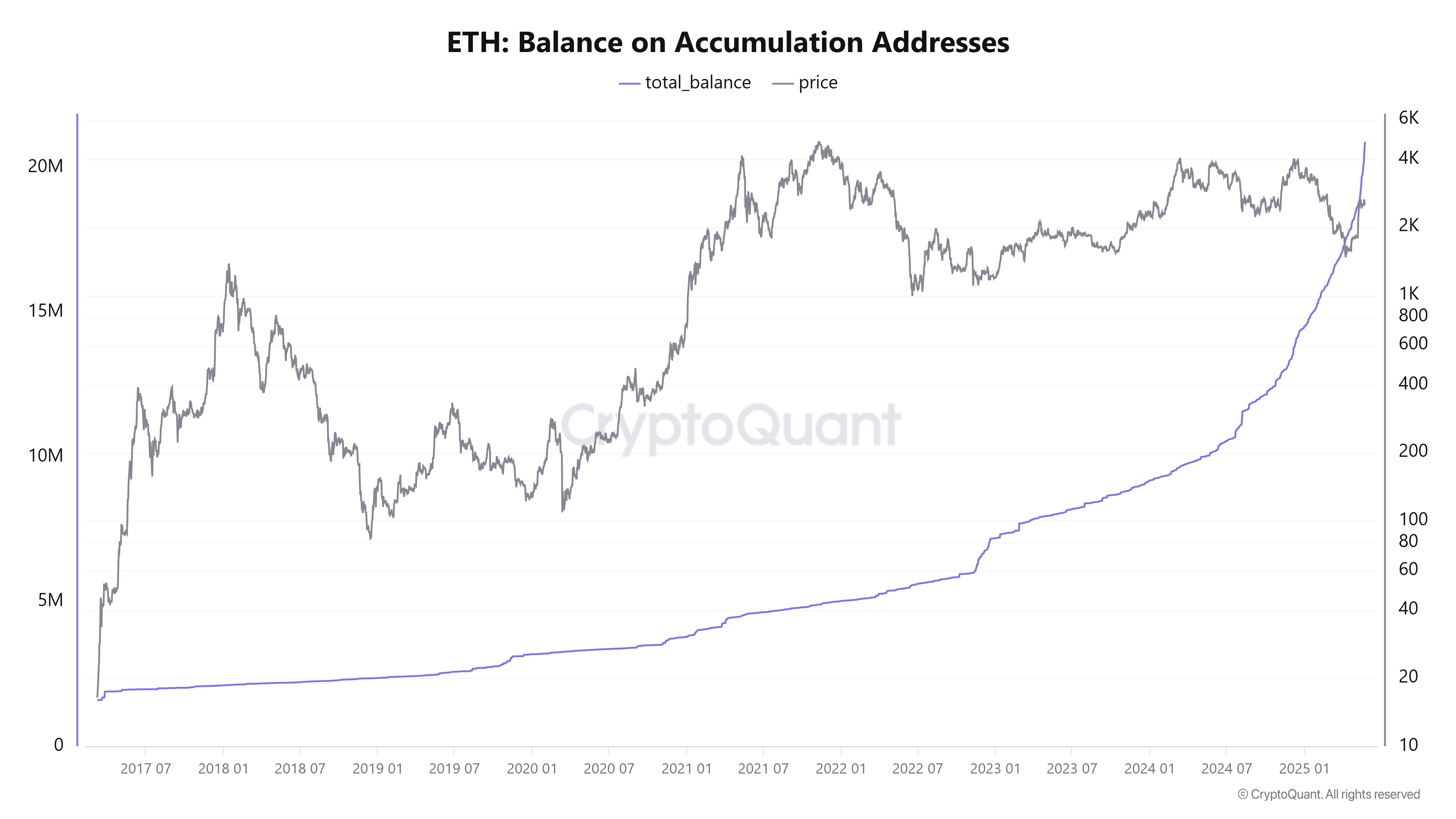

Cryptoquant data also show that accumulating wallets, which are often connected to institutional investors, now hold almost 21 million ETH, which is 17.5% of the total offer. This is a record high of Wallets and means a strong conviction of the long -term growth of Ethereum.

ETH stock on the accumulation address. Source: Cyptoquant.

Analysts see 4,000 dollars in the Bitcoin outperformance

Technical analysts indicate key indicators that support an interest bullic ETH outlook. Analyst Cas Abbe mentioned the two-week Gauss Canal and said Ethereum attempts to recapture this trend line. He mentioned similar movements in 2020 and 2024 when ETH rose strongly after breaking this line. Based on this pattern, ABBE believes that ETH could reach the $ 4,000 up to the 3rd quarter.

Ethereum price and 2-week-gauss channel. Source: Cas Abbé

ETH also developed better in the second quarter of 2025 than Bitcoin. Coinglass’s data show that ETH has increased by 40 %, while Bitcoin has increased by 33 %. Historically speaking, ETH tends to surpasses BTC with an average return of 64.22 % compared to 27.30 % for Bitcoin. This further fueled the optimistic mood among investors who pursue seasonal crypto trends.

However, recent analyzes show increasing caution. After the ETH course has increased by 80 % since the beginning of April, some investors take profits. This wave of profit treatment has increased the pressure and created a resistance to a further increase. Nevertheless, the growth of the smart contracts and the accumulation of whales are signs of a strong activity of the ecosystem. The price is below the highest level, but several on-chain and technical indicators indicate that ETH is preparing for a new cycle in 2025.

No Comments