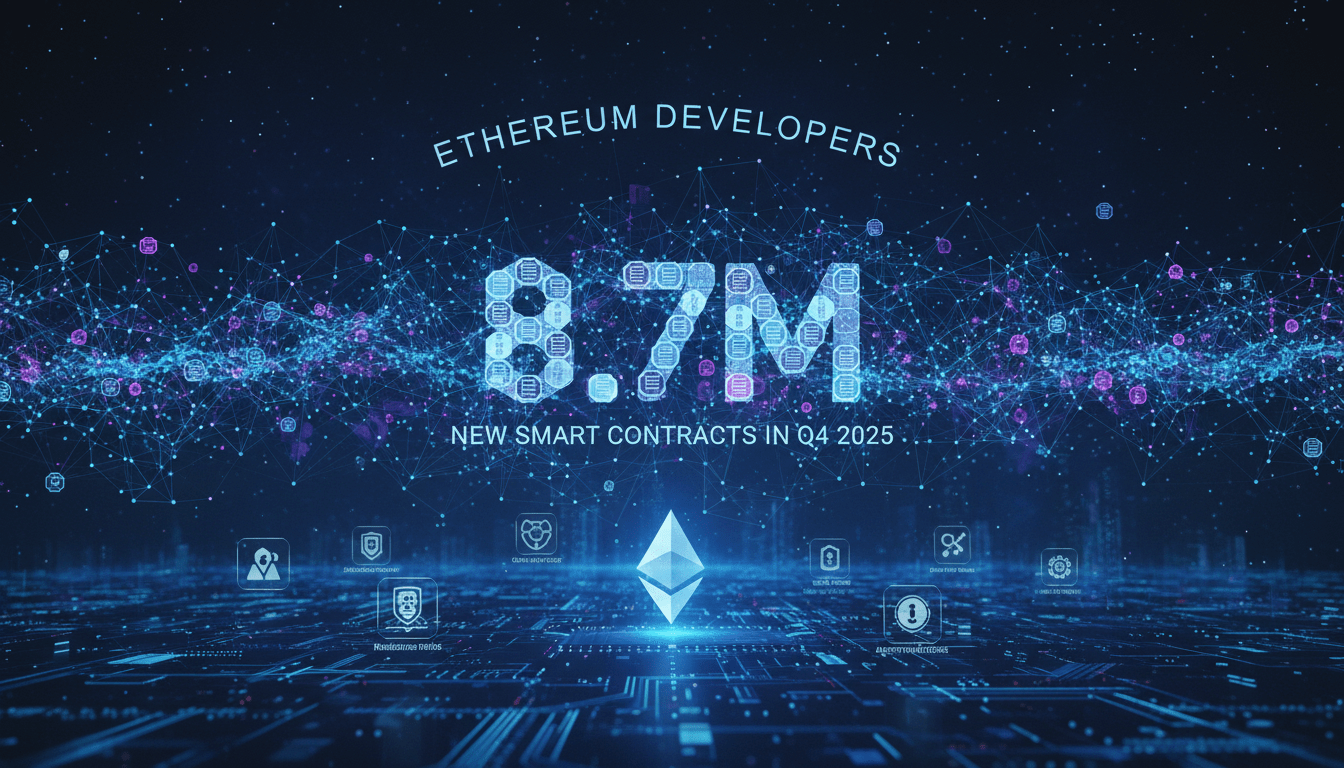

- Ethereum developers hit a new high with 8.7 million new smart contracts in 4Q25.

- Despite the new record, the ETH price remains undeterred near the $3,000 mark.

After two weak quarters, the renewed increase shows a significant return in developer activity. “Token Terminal” describes growth as organic and difficult to manipulate because contract deployments reflect the actual development work.

Record quarter with 8.7 million smart contracts

The 30-day average was 171,000 new contracts. The number per day is considered a precise indicator of future network activity because developers usually create the required infrastructure months before the expected user flows and the corresponding increase in fees.

Powered by RWA, stablecoins and L2 expansion

The picture is consistent: growth is not driven by speculation, but by organized structures, especially Layer 2 networks.

- RWA tokenization: Ethereum remains the quasi-industry standard of tokenization, backed by security, liquidity and proven infrastructure.

- Stablecoins: Over 50% of the $307 billion global stablecoin market is on Ethereum.

- Layer 2 networks: Base, Arbitrum and Optimism are reducing costs and accelerating their experiments, which is massively increasing the number of smart contracts.

- GameFi and Restaking: New financial and gaming protocols are driving demand for complex smart contract systems.

All of this solidifies Ethereum’s role as a global settlement layer.

Price development: Fundamental strength meets market volatility

Despite the record activity, the ETH price remained under pressure in the 4th quarter. After reaching an annual high near $5,000, ETH fell back to around $3,000 in the wake of the market collapse in October and remained there until the end of the year.

Onchain data also shows increased exchange inflows of over 400,000 ETH in December, suggesting distribution rather than accumulation. At the same time, the number of active addresses rose from 396,000 to over 610,000 – another sign of growing network usage.

Ethereum delivered its strongest fundamental values in years in Q4 25. The discrepancy between the record activity and the uninvolved ETH price is likely to resolve in 2026, when the results of increased developer activity lead to increasing user numbers and increasing fees.

No Comments