- In Davos, Larry Fink described tokenization as a central capital market issue and called for a “common blockchain”.

- BlackRock’s research and products provide evidence that Ethereum is considered the preferred infrastructure for tokenization.

At the World Economic Forum in Davos, BlackRock CEO Larry Fink described tokenization as a central issue for capital markets and called for a “common blockchain” as a solution to inefficiency and corruption. Fink did not name a specific blockchain. However, BlackRock’s products and research point to Ethereum.

In Davos, Fink pointed to Brazil and India as pioneers:

“I believe the move towards tokenization is necessary. It is ironic that we see two emerging markets leading the world in tokenization and digitization of their currency – Brazil and India. I believe we need to move to this very quickly.”

Fink expects fees to fall and greater accessibility because capital can move more quickly between tokenized money market funds, stocks and bonds. For Fink, it depends on the architecture:

“If we had a common blockchain, we could reduce corruption. So I would argue: yes, we might have more dependencies on a blockchain, the downsides of which we could all talk about, but still all transactions would probably be processed and more secure than ever before.”

BlackRock CEO Larry Fink believes tokenization is inevitable and that one common blockchain is the future.

Context matters. BlackRock is the world’s largest asset manager and has been tasked with advising on Ukraine’s post-war state assets, underscoring the depth of its… pic.twitter.com/lY718X5BQ2

— Garrett (@GarrettBullish) January 22, 2026

Is Ethereum the solution for BlackRock?

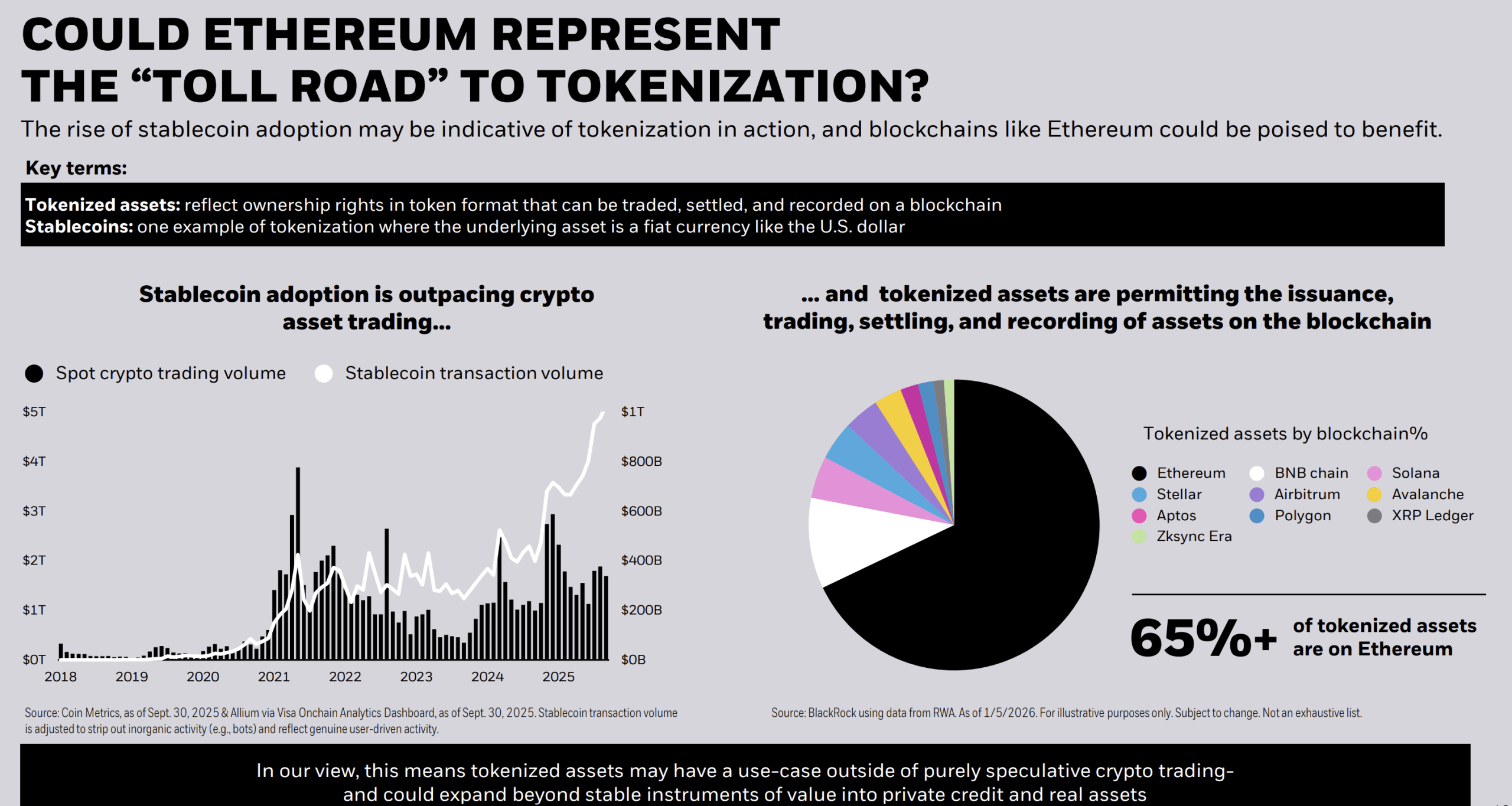

It is not entirely unreasonable that Larry Fink spoke about Ethereum during the WEF in Davos. BlackRock’s “2026 Thematic Outlook” specifically mentions Ethereum as the dominant blockchain for tokenization:

“Could Ethereum represent the ‘toll road’ to tokenization? The rise in stablecoin adoption could be an indication that tokenization is coming into practice – and blockchains like Ethereum could benefit from it.”

The PDF includes a chart showing that Ethereum has “65%+ of tokenized assets” in the entire market. This is followed by BNB Chain (9.73%), Solana (4.52%), Stellar (4.12%), Arbitrum (3.81%), Avalanche (2.97%), Aptos (1.92%), Polygon (1.65%), XRP Ledger (1.12%) and zkSync Era (1.09%). BlackRock emphasizes:

“Tokenized assets enable the issuance, trading, settlement and recording of assets on the blockchain. In our view, this means that tokenized assets could have a use case outside of purely speculative crypto trading – and could grow beyond stable value instruments into private credit and real assets.”

There is also further evidence that Ethereum could be Fink’s favorite among public blockchains: the asset manager launched its tokenized money market fund BUIDL directly on Ethereum (with other networks following).

Additionally, BlackRock only offers two crypto spot ETFs: Bitcoin (IBIT) and Ethereum (ETHA). Nevertheless, it remains speculation for now.

No Comments