Ethereum asked again: well over a million ETH were bought – course could increase over $ 1,800

- Apparently it is long -term investors who hoard ETH again, which suggests basic trust in Altcoin number one.

- However, the ETH course is about to resist $ 1,800, whereby the technical data makes everything possible, but no expert is determined how it goes on.

1.1 ETH tokens were sold between April 17 and 23, more than 1.1 million ETH, which indicates a new expectation among long-term owners. This development comes at a time when ETH meets with resistance around $ 1,800 brand, an important technical barrier that is reinforced by the 50-day SMA (simple moving average).

Although sellers briefly pressed the prices on Friday under $ 1,750, the growing trust of the buyers and the declining pressure of the empty sales indicate a change to the upward trend.

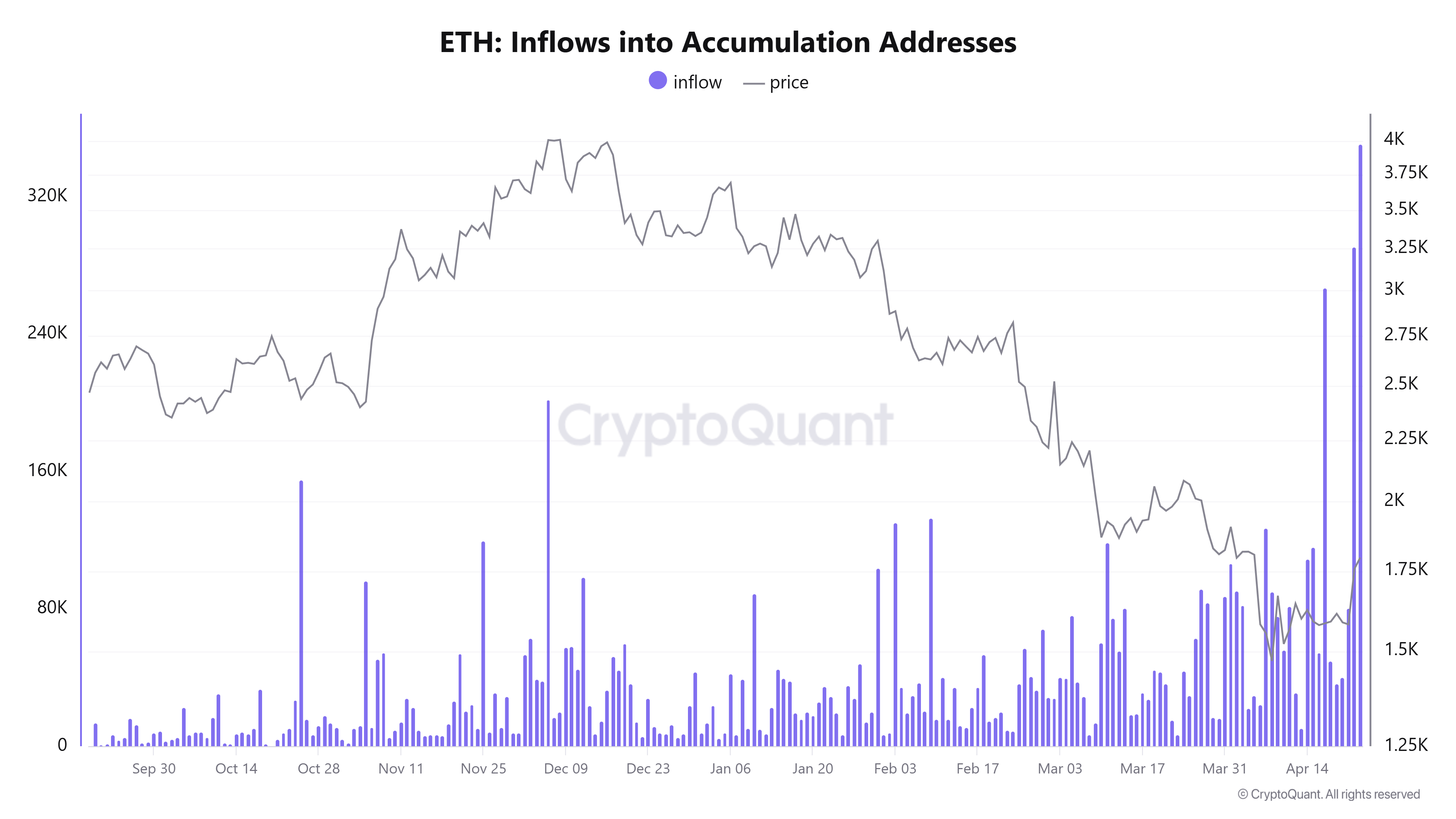

On-chain data show that pure purchase addresses, i.e. wallets that have never transferred ETH, recorded the highest weekly inflow of 2025. Almost half of these inflows took place after a price increase to the middle of the week, which indicates a strategic entry of long -term investors.

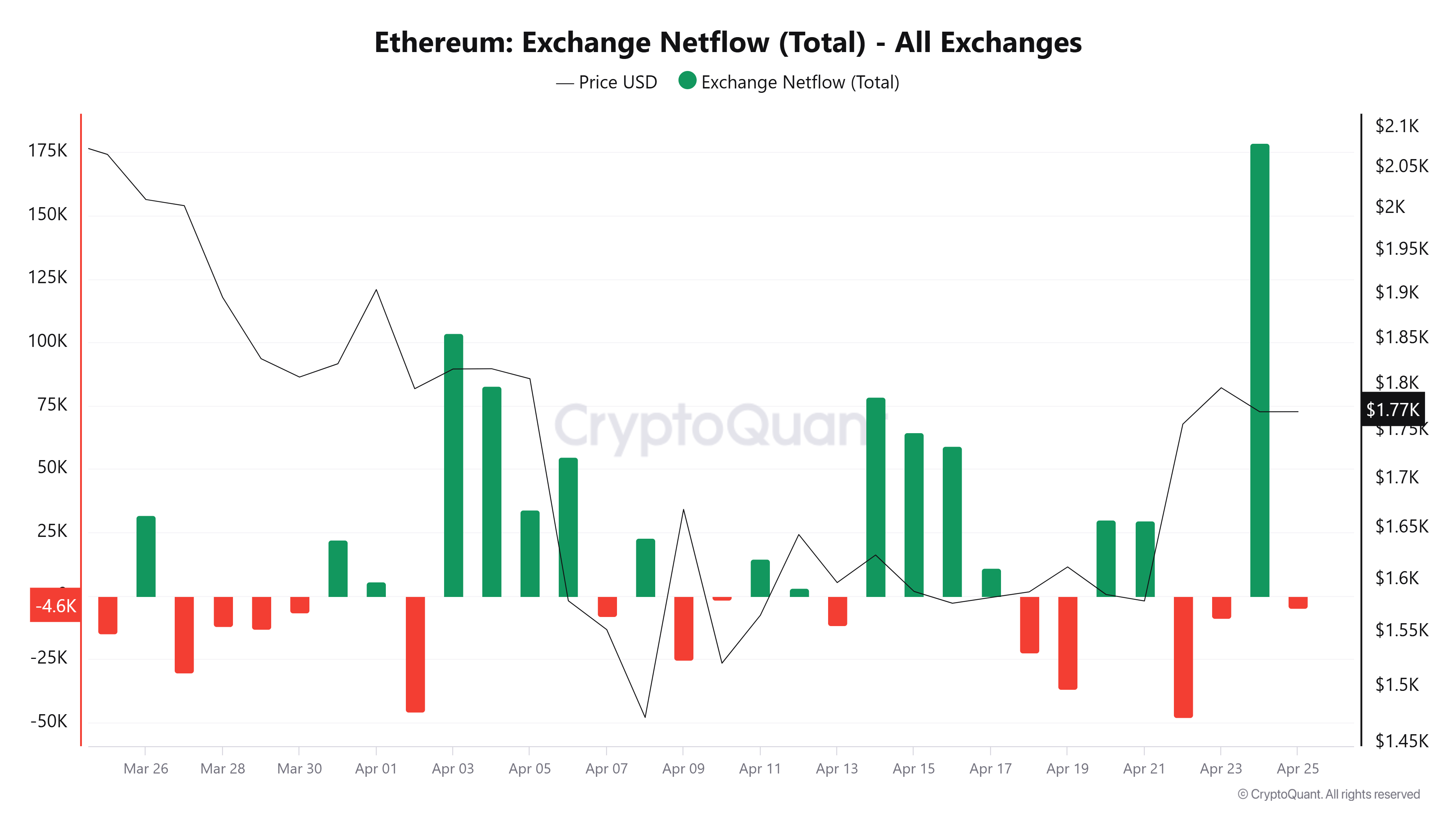

The buying behavior is in contrast to stock market activity, which can be closed on hesitation of speculative traders. On April 24, Ethereum recorded one of the largest stock exchange inflows on a single day this year: 178,900 ETH were transferred to central stock exchanges. This inflow, worth around $ 317 million, is a typical sign of profit treatment and a cautious positioning of investors who want to secure their profits.

These contradictory signals of buying wallets and stock market flows underline the current market splitting: Long-term investors stall, and at the same time the others remain careful after ETH has recovered from his low in April 11 at $ 1,473.

The exhaustion of the empty sellers is becoming increasingly clearer

The market mood for the Ethereum Future reported by CNF also begins to reflect on a declining bear dynamic. The net take-off volume, a key figure that shows the balance between purchase and sales activities at the futures markets, has decreased since January. This decline indicates that empty sellers lose their conviction, especially after ETH has not fallen further in the past few months despite persistent sales.

The latest liquidation data support this view. Last day Ethereum Futures worth $ 40.22 million were liquidated-$ 27.07 million of them were in long positions and $ 13.16 million in short positions. While the proportion of long positions is still high, the small number of liquidations of short positions indicate that the bears are no longer represented as strongly as before.

The technical indicators offer a mixed view. The stochastics oscillator has withdrawn from the overbought area, which indicates a temporary interruption of upward moment. The MACD remains in the positive area, and the relative strength index (RSI) is still over 50, which means that it is in the overbought area. Nevertheless, the AO remains in the negative histogram beams, but with a decreasing strength, which indicates that the downward pressure is still available, but could weaken itself.

Resistance at $ 1,800 remains an important hurdle

The Ethereum Prize is currently being traded near $ 1,760 and is in the middle of the purchase pressure and profit sales phase. Thus, $ 1,800 is the next critical resistance that can be supported by the 50-day SMA. An outbreak above this level could send the prices towards the $ 2,000 mark, with $ 2,100 to $ 2,200 as the next noteworthy resistance.

If it is not possible to break the $ 1,800 mark, the next important brand, which could be questioned, is $ 1,688. A breakthrough under this brand could throw the course back towards a descending trend line and extend the consolidation phase.

In another context, the Ethereum Foundation is planning an excursion for July 30th to celebrate the tenth anniversary of the blockchain.

No Comments