- The decline in the stock market offer from Ethereum and increasing customer activity signal new trust of the owner with less volatility.

- ETH continues to move in a bandwidth because the resistance stops at $ 1,805, whereby the cooling spot turnover probably initiates market consolidation.

Ethereum [ETH] shows the first signs of a quiet comeback. Its market activity reflects a lower volatility and a stronger long -term stop pattern. After a correction phase, ETH has settled in the area of $ 1,804 and tests an important resistance at $ 1,805.

While the upward dynamics of the financial value remains limited, the underlying data indicates a change in mood. A lower offer on the stock exchange and a constant increase in networking management indicate that the owners will again become trust, even if the speculative activities are deceptive.

One of the most remarkable trends that supports the price stability of Ethereum is the continued decline in the range of central stock exchanges. The latest data show that the stock exchange stocks have dropped to 8.05 million ETH, which represents a significant decline and continues a wider trend since the beginning of the year.

The decline in the tokens held on the stock exchanges is interpreted as a signal that the owners keep their assets themselves and thus reduce the immediate risk of a large -scale sale.

This consistent pattern of drains with limited tributaries in between reflects the behavior of long -term participants, who choose to wait for the decline in price. In contrast to speculative dealers who react to short -term fluctuations, these owners seem to be geared towards long -term profits. The lower range of stock exchanges also limits the effects of sudden market shocks and creates a more stable trading environment.

Increasing commitment of the users despite stagnating courses

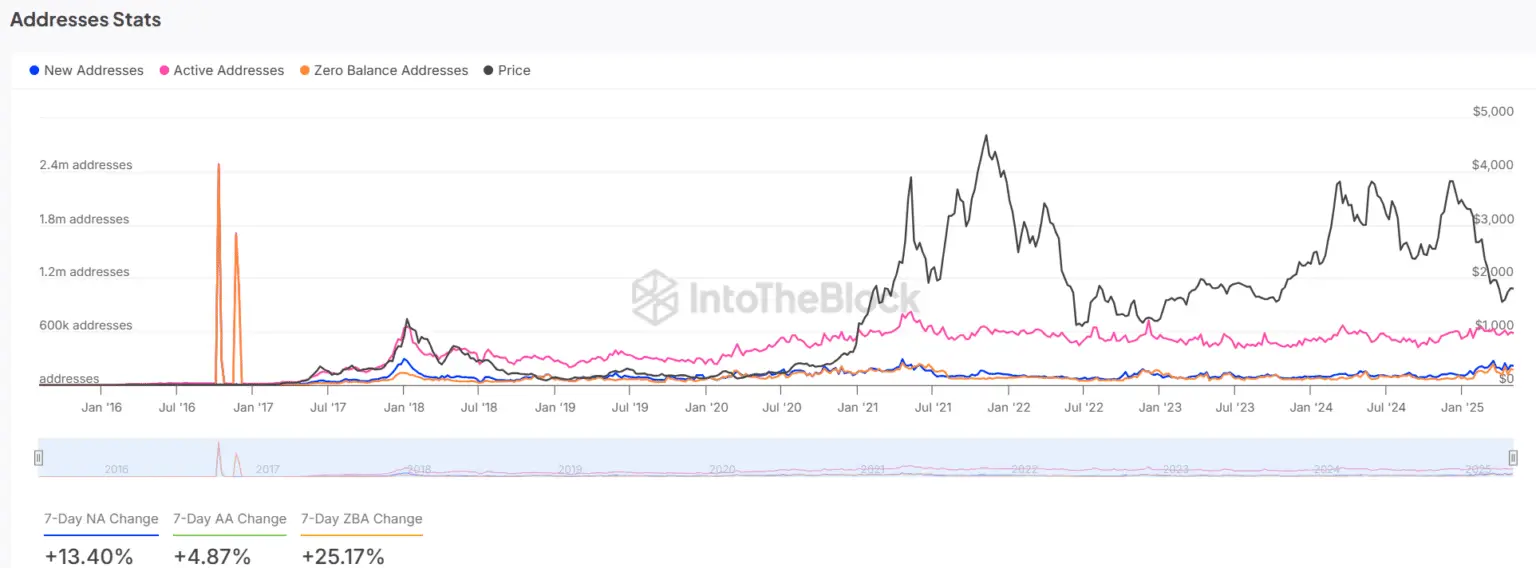

Even if the price movement remains limited, the on-chain metrics indicate a new activity in the Ethereum network. The number of addresses active daily has increased to 431,200, which indicates a small but steady increase in network participation. In the past seven days, the number of newly created addresses has increased by 13.4 %, while the number of zero-balance addresses increase by more than 25 %-a sign for the reactivation of wallets and a higher user interaction.

This growth is recorded, although ETH has not managed to cross the $ 1,805 mark, an important technical barrier that matches the 0.236 Fibonacci retracement level. The asset was traded in a descending channel until it broke out recently, but so far no upward trend pattern has developed. The relative strength index (RSI) is still above the center line, this time at 53.80, which indicates a persistent accumulation with weak purchasing power.

Spot turnover decreases significantly-speculation too

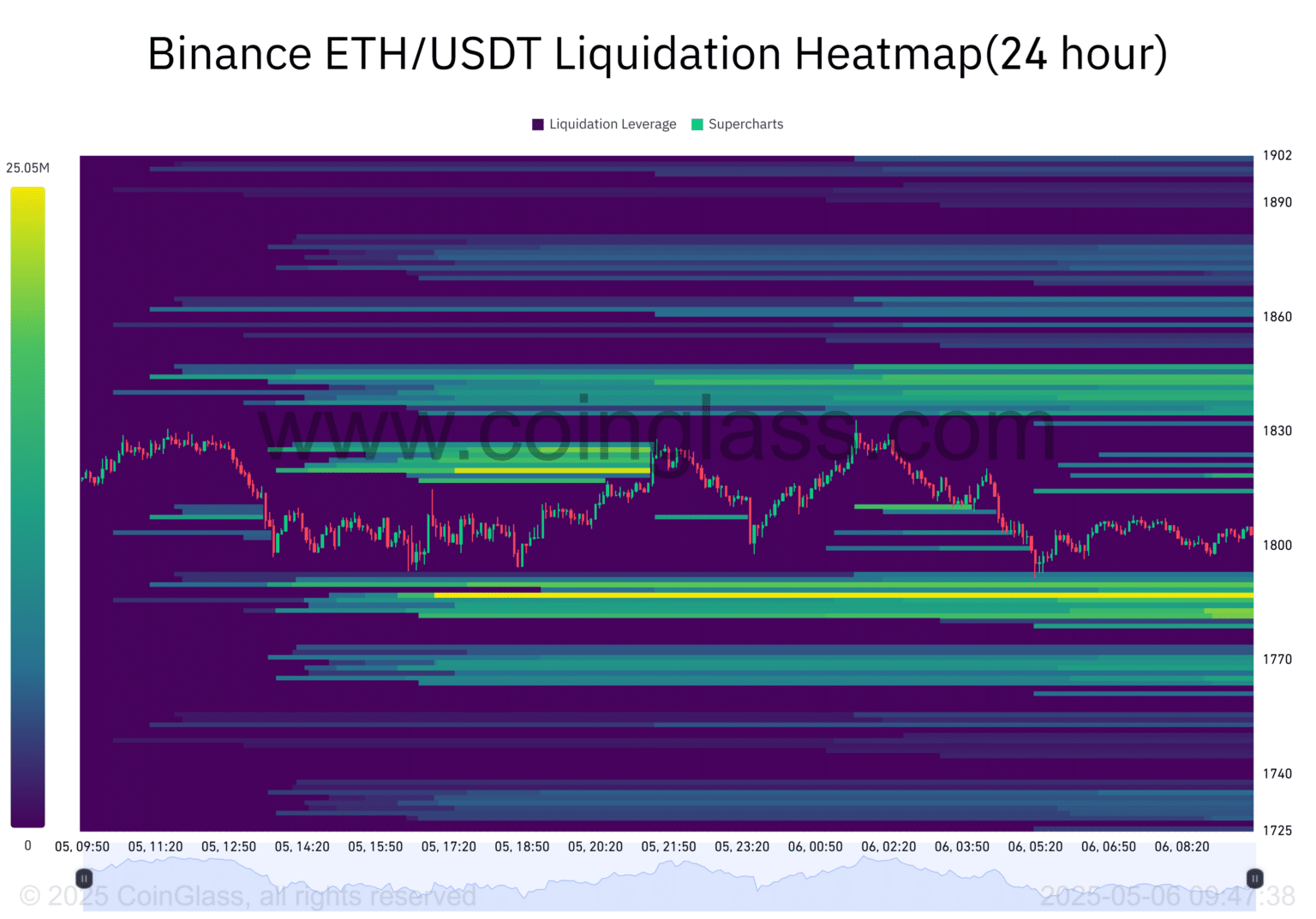

ETH’s spot volume has also cooled down considerably in the last sessions. The volume heat maps show smaller, neutral clusters that indicate a reduced speculative trade. In the past, such periods with a small volume were more associated with stabilization phases than with strong updating or downward movements. Although this is not a confirmation of a market, the extreme volatility could decrease.

This shift in trade behavior reflects other indicators that can be observed in the available data of the stock exchange and blockchain. After entering the period of the limited large-scale transactions and the evenly divided stochastic purchase and sales movement, the market mentioned is centralized, which could pave the way for a centimetrical recovery if the market conditions in the outside world are stable.

However, this is almost overcome for Ethereum due to the significant resistance in the area of $ 1,775- $ 1,830. This zone appears as a competitive area through repeated long and short liquidation on the liquidation heat map of Binance.

No Comments