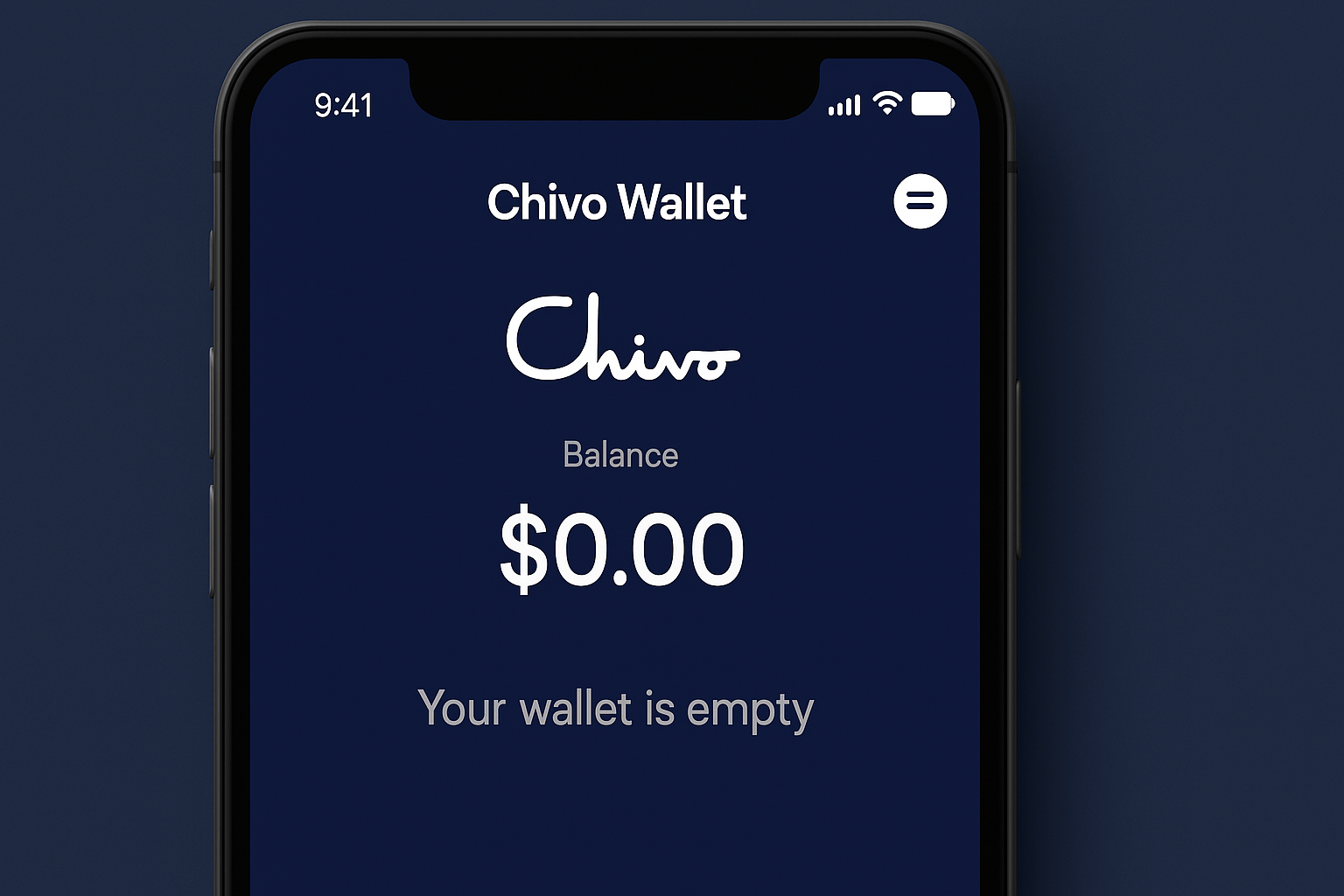

- El Salvador’s negotiations over the sale of the state-owned Bitcoin wallet “Chivo” are nearing completion, according to the IMF.

- The wallet was launched nationwide in 2021 when El Salvador declared Bitcoin legal tender.

The IMF confirmed that the sale was part of the terms of a larger $1.4 billion loan. In May, the IMF released a first tranche of $120 million, subject to clear conditions.

El Salvador must limit government control of Bitcoin. The use of Bitcoin in the private sector must remain voluntary and government involvement in the Chivo wallet must be reduced.

The sale is therefore a central condition of the IMF credit release in order to reduce fiscal risks.

Dispute over state influence

But the political situation is complicated: Based on its own data, the IMF assumes that El Salvador has not bought any Bitcoins since December 2024. Salvador’s government contradicts this. She claims there have been and continue to be regular purchases, including 1090 BTC for around $100 million in November alone.

President Nayib Bukele publicly stated that daily Bitcoin purchases would not stop – a clear violation of IMF loan conditions.

The Chivo wallet has been controversial since its launch. Users report technical problems, frequent identity theft and low overall usage.

Most Salvadorans only used the app once: to withdraw the $30 government start-up bonus. Since then, they have continued to use cash and their regular bank accounts.

For the IMF, the Chivo wallet is therefore a resoundingly failed experiment, but still a financial risk that could affect the stability of the national budget.

Chivo wallet: empty forever?

Their sale would ease the burden on the state budget and repair notoriously poor relations with the IMF. El Salvador’s Prime Minister Bukele could officially continue his Bitcoin strategy politically.

He could save face, but without any future influence on the wallet’s operations. However, potential buyers are currently unknown and there is no official information.

Nevertheless, the decision to sell alone is a caesura for the state Bitcoin experiment. After the successful passive resistance of its own population, El Salvador is moving closer to international customs.

However, the future of the world’s first “Bitcoin State” remains open.

No Comments