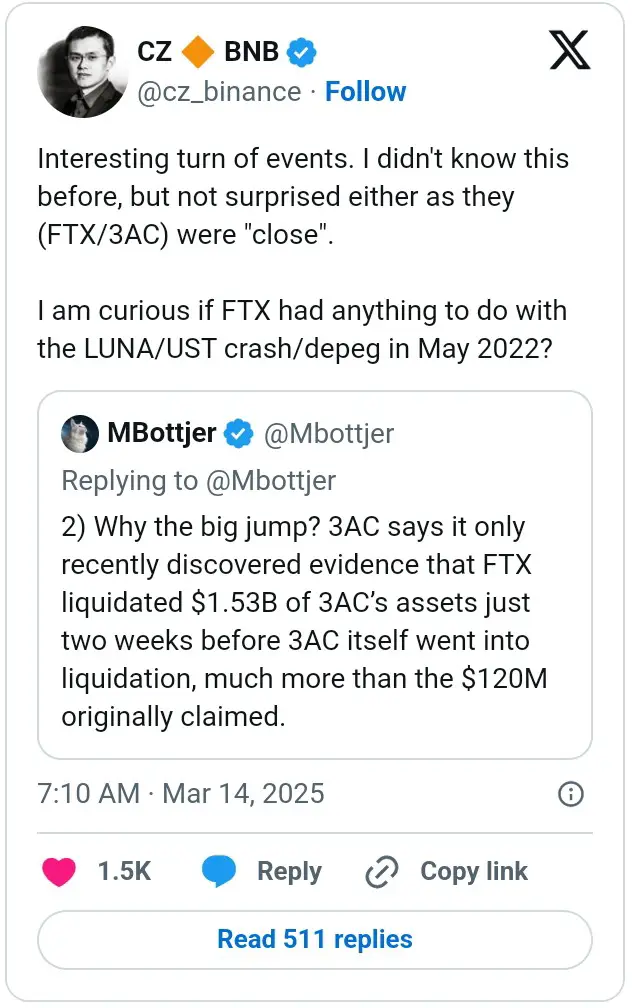

Earlier Binance CEO indicates possible involvement of FTX in luna crash

- The former Binance boss Changpeng Zhao raises questions about the possible participation of the FTX bankruptcy exchange in the Luna/Ust-Crash.

- ZHAO thus responds to the fact that the court granted the application from 3AC to increase its claim against FTX from $ 120 million to $ 1.53 billion.

The Linance founder Changpeng Zhao joined the FTX train because he questions that the insolvent stock exchange had something to do with the Luna/VAT crash in May 2022.

The legal dispute between 3AC and FTX

While the reasons for his suspicion have not been mentioned, CZ’s comments come to an update of the ongoing legal procedure between Three Arrows Capital (3AC) and FTX. Like “Mbottjer”, who pretends to be a co -founder of FTX Creditor, was communicated3ac recently applied for a bankruptcy court to increase its claim against FTX from USD $ 120 to USD 1.53 billion.

The reason for this increase lies in the discovery that FTX has liquidated an amount of $ 1.53 billion exactly two weeks before 3ac liquidation.

The information that the liquidators have received in the year since the submission of their original POC has led to the new conclusion that just two weeks before the start of the liquidation of 3AC, the $ 1.53 billion in assets that had 3AC on the FTX platform were liquidated in order to meet the liabilities compared to FTX in the amount of $ 1.3 billion.

3ac

Using why this was not taken into account in the original registration, 3ac said that FTX was also bankrupt and had access to important data. The efforts to receive enough details from them were in vain until the end of the official period. The delay also prevented the bankruptcy managers from understanding the scope of the transactions between 3AC and FTX.

FTX obtained an objection to this claim on the grounds that the registration was made too late and violated the bankruptcy proceedings. Interestingly, this objection was rejected by the court. The court documents show that the delay in submitting the change claim was largely due to the fact that FTX had not submitted the necessary documents. For this reason, the court granted 3AC’s application to change its original evidence.

“After weighing up all the evidence submitted, I came to the conclusion that the consideration in favor of the approval of the changed POC failed.”

Previously, 3AC had also filed a lawsuit of USD 1.3 billion against Terraform Labs and accused them of being responsible for the collapse of the company, as described in our last report.

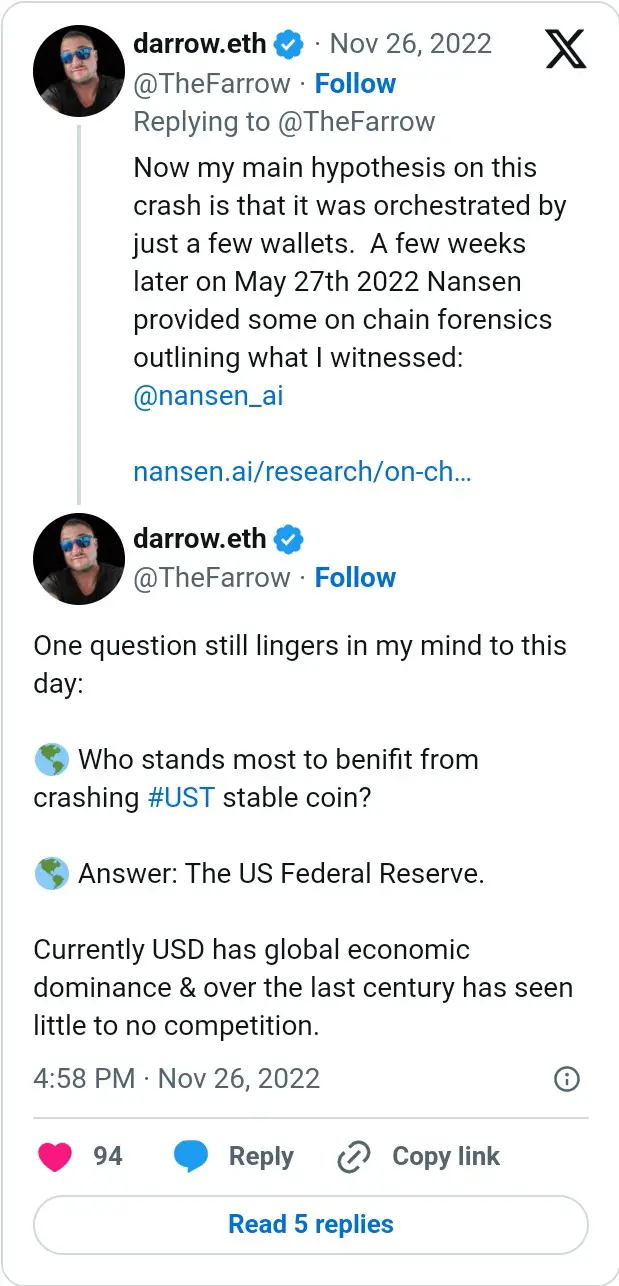

Who else could be involved in the VAT collapse?

In November 2022, a thread was published by a previously unknown person who identified himself as Darrow.eth, in which he tried to explain the crash of VAT. In his opinion, it would be interesting to find a connection to FTX. Until then, he believes that three large wallets of Luna immediately bought and sold with loss to deliberately pull the chart down. According to his understanding, it is strange that someone with a limited order buys at a spot price and then immediately sells the market with a bot.

In an accompanying picture, Darrow.eth explained that there were serious oppression on the purchase orders.

On May 12, 2022, the oppression pressed the course to zero, since they literally bought up all available shares, as the article states. While there are many questions whether FTX had his fingers in the game, Darrow.eth pointed out that the US Federal Reserve benefits most from the crash of the VAT. According to him, the plan was to attack the StableCoin market in order to maintain the global economic dominance of the USD.

Against this background, the hearing of the founder of Terraform Labs, Do Kwon, which was arrested in this context, was postponed from March 10 to April 6th after the authorities announced that they found four terabytes of additional evidence – CNF reported.

No Comments