- The strong dependence on small investors has led to Goge course fluctuations because institutions avoid supporting their operations.

- The long -term growth of Dogecoin is limited because it contains inflationary programming and no functions to support smart contracts.

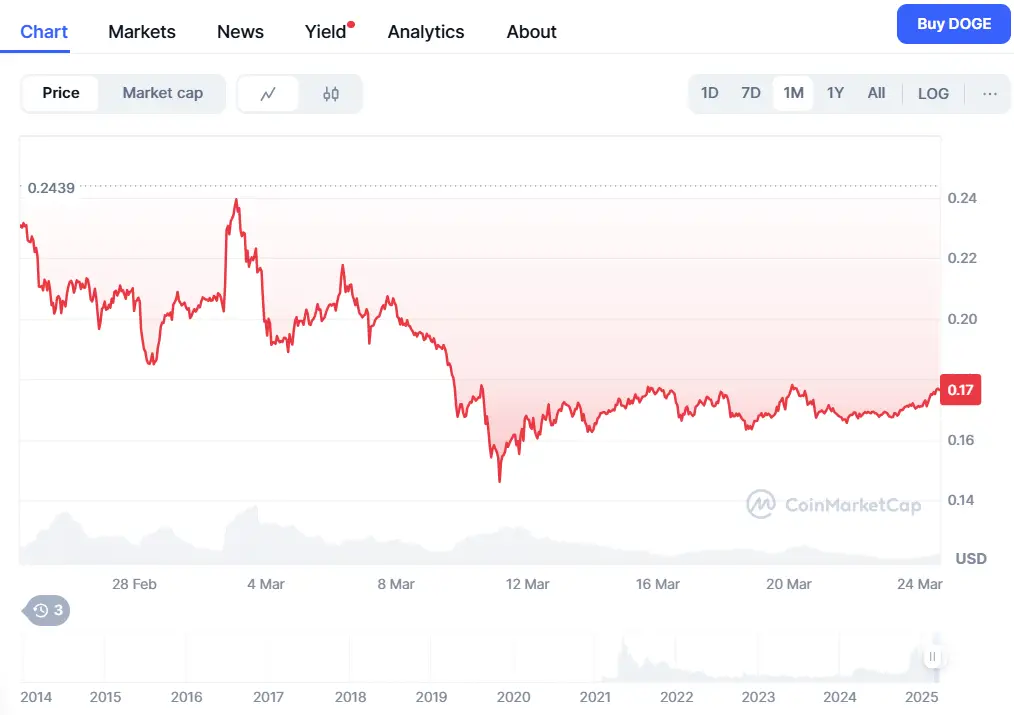

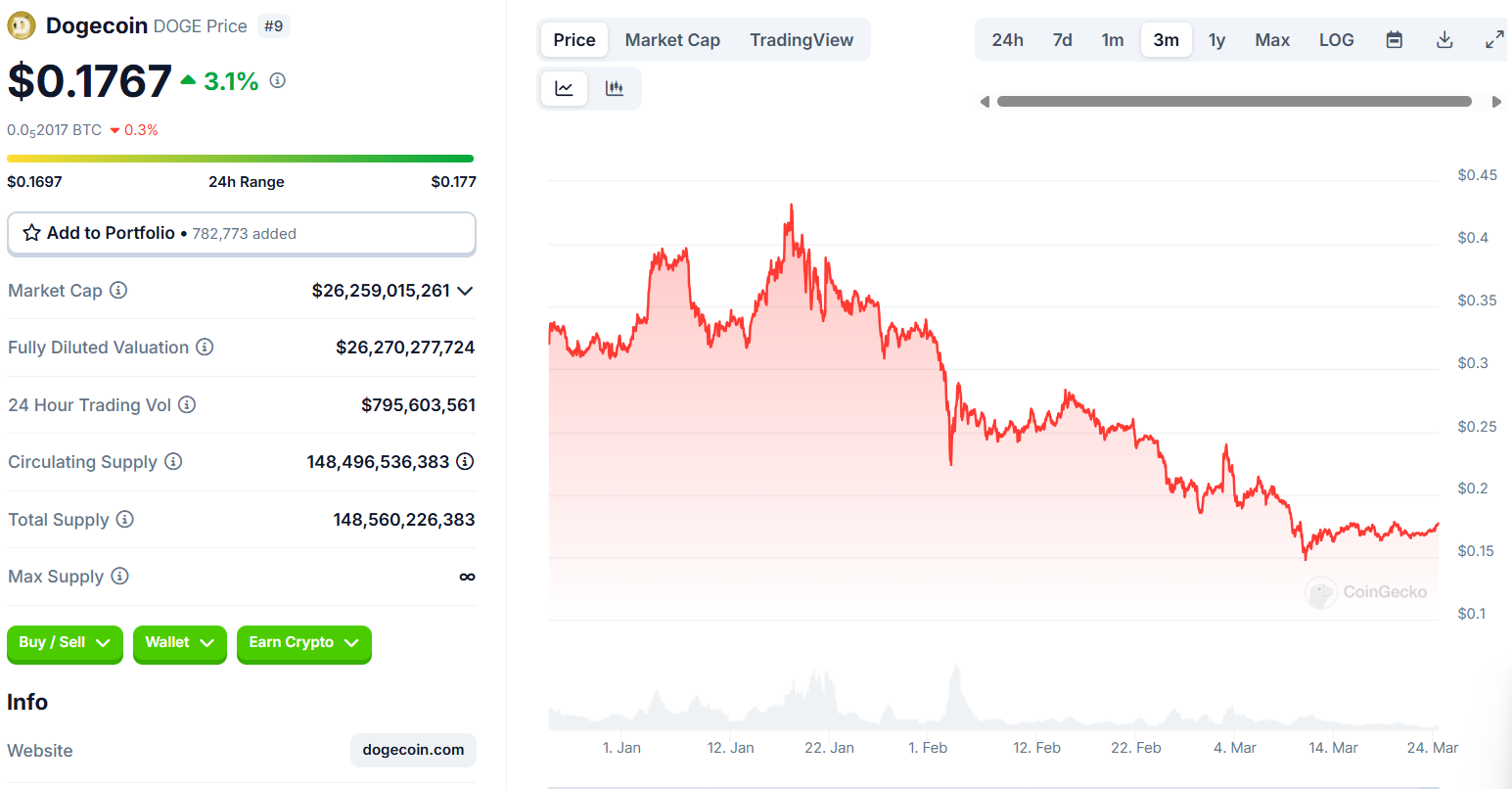

The market value of Dogecoin has fallen by 47 % since the beginning of this year. Dogecoin experienced impressive market profits through a development supported by Trump, but now he is rapid. Dogecoin has a stronger volatility than other cryptocurrencies on the market, like a Comparison recently carried out by CNF shows. The current investors face the dilemma whether this drop in price shows investment options or justifies a complete withdrawal.

Dogecoins volatility and institutional support

The Dogecoin prices have shown unpredictable movements because the market tends to react to broader trends. The financial support of institutional investors remains limited for Dogecoin because it depends primarily on inexperienced small investors.

The hype on social media has led to extreme price fluctuations in Dogecoin market history, which led to both flights of height and to deep stalls. The origins of the Dogecoin as a joke against industry have created an investor base that consists more of short -term speculators than long -term strategic owners

Tesla-CEO Elon Musk haton his social platforms regularlyInformation about the meme coin Dogecoin divided which has strongly influenced its market value.

The advocates of Musk triggered short market tips, but could not create a permanent market value. Based on the latest market behavior and the fact that institutional actors prefer secure cryptocurrencies towards Doco, the speculative investments.

The future of Dogecoin faces considerable hurdles, since institutions have not yet relied on the operation of the currency. Bit -traded funds (ETFs) is available for Bitcoin and Ethereum, but not for Dogecoin, which prevents cryptocurrency from gaining the same level of institutional legitimacy. The lack of investment support from pension funds and university foundations as well as through national governments makes Dogecoin susceptible to speculative market activities.

The long-term purchase and holding positions taken by institutional investors ensure wealth stability because they do not make their decisions on the basis of market movements. The current price volatility and the dependence on private investors discourage serious financial market participants.

The fluctuating prices during several household and baisse markets have meant that institutional investors hesitate to adopt Dogecoin, which further increases the hurdle for long-term acceptance. The future success of Dogecoin remains unclear because it needs significant developments to attract institutional participants.

Fundamental weaknesses and future prospects

During his growth, Dogecoin is faced with implementation problems that potentially represent obstacles to future expansion. Every year Dogecoin puts 5 billion units in circulation, while Bitcoin complies with exact limits for the creation of tokens. There is an inflation rate of 3.3 %because Dogecoin currently has 148.5 billion coins in circulation.

Despite the forecast changes over time over time, Dogecoin maintains inflation through other cryptocurrencies by using deflationary mechanisms. Dogecoin has a lower value for investors who prefer business because its offer is growing steadily.

Dogecoin’s transaction options are not going beyond basic payments because it only has minimal extended functions. The cryptocurrency network lacks the necessary functions for the execution of decentralized applications, which are supported by intelligent contracts in Ethereum and Solana networks.

A Dogecoin transaction is handled within one minute, but users have to wait longer as Solana users for immediate confirmation. The numerous technical inadequacies create numerous obstacles for Dogecoin to grow beyond its current scope, which limits its adoption potential.

The future development of Dogecoin depends on the market trends and the attention of private investors. A new housese on the cryptocurrency market could trigger another price increase for Memecoin.

The market trends indicate that the Dogecoin could continue to lose value in the coming months, since it is a speculative asset that is evaluated inflationarily and has only limited institutional support.

No Comments