Does the Chainlink course increase by 35%? Insights of whales and network health

- A $ 2 million purchase of whales signals confidence, with a potential outbreak of 35 %, but there is also resistance.

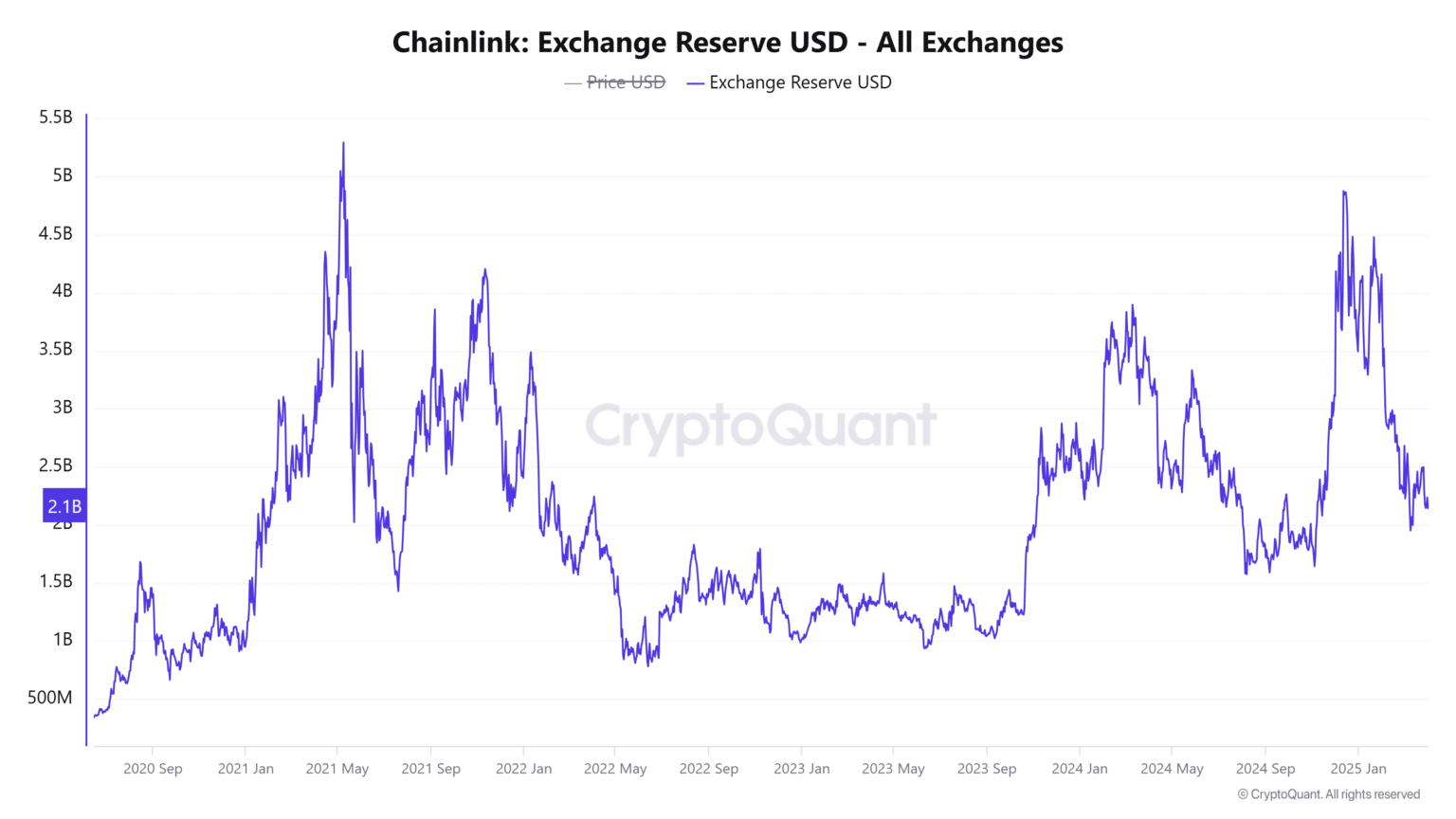

- Falling MVRV Z-Score and increasing number of active addresses indicate more accumulation, and reduced foreign exchange reserves also provide a positive view.

The Chainlink-Token shows strong signs of a price increase of 35 %, since whales buy more link and the price movement becomes narrower while the on-chain statistics improve. A primary whale purchase of $ 2 million link indicates optimistic market forecasts, since the token could increase over its critical resistance barriers.

The conditions for a potential upward movement of the link price are given because the stock market reserves remove and the network strength improves. Link’s ability to recover depends on the duration of price compression and its critical level of support.

Wal activity signals strong conviction

A Chainlink Wal-Investor returned to the market and bought $ 139,860 for $ 2 million, which increased its link stock to 147,553 tokens. This shows that link investors believe in the long-term success of the company, based on past profits of $ 161,000.

The market conditions for link are significant because the prices have leveled off in symmetrical triangles and descending wedges. The analysis of the price movement shows that this pattern traditionally triggers significant price shifts, which could lead to a possible increase to $ 18.18, based on the phase at $ 15.68.

The WAL entry point shows a strong resistance to Link, which makes it difficult for the bulls to overcome the current sales barriers. Link’s price movement will develop hostile if the level of support fails and the value falls below $ 12.57. Link’s future development will depend on whether the course will reach or exceed the existing level of support.

Onchain metrics indicate a positive mood

The analysis of various chain statistics makes the cost forecasts for Link more clearly. The MVRV Z-Score for Link stays at 3.09 and is well below the highest level, which was recorded at the end of 2024 during the time of the Link price distortion. Most link owners have decided not to keep their wallets beyond their acquisition value, which reduces sales pressure.

Although the figures are below the top values from the end of 2024, there are promising signs of increasing interest in the network. The network growth, which is due to the increasing commitment of users, indicates the change in the market value. The information on the stock market reserves shows a decline of 3.11 %, which indicates that link is deducted from the stock market platforms.

The decline in exchange reserves underlines the investor behavior, which indicates a growing tendency to hold assets in anticipation of a potential price increase. This trend in combination with significant whale purchases of link tokens and improving on-chain metrics strengthens the arguments for favorable price development.

Since the foreign exchange reserves continue to lose weight, the immediate sales pressure also drops. Together with the increasing accumulation of whales and the favorable mood in the network, this increases the likelihood that Link will soon experience a significant increase in price.

No Comments