- The core team of PI Network holds 82% of the entire PI coins, which causes serious doubts about decentralization and fair distribution of wealth.

- Limited transparency, AI-based KYC and decreasing public interest contribute to growing concerns about the trustworthiness of PI Network.

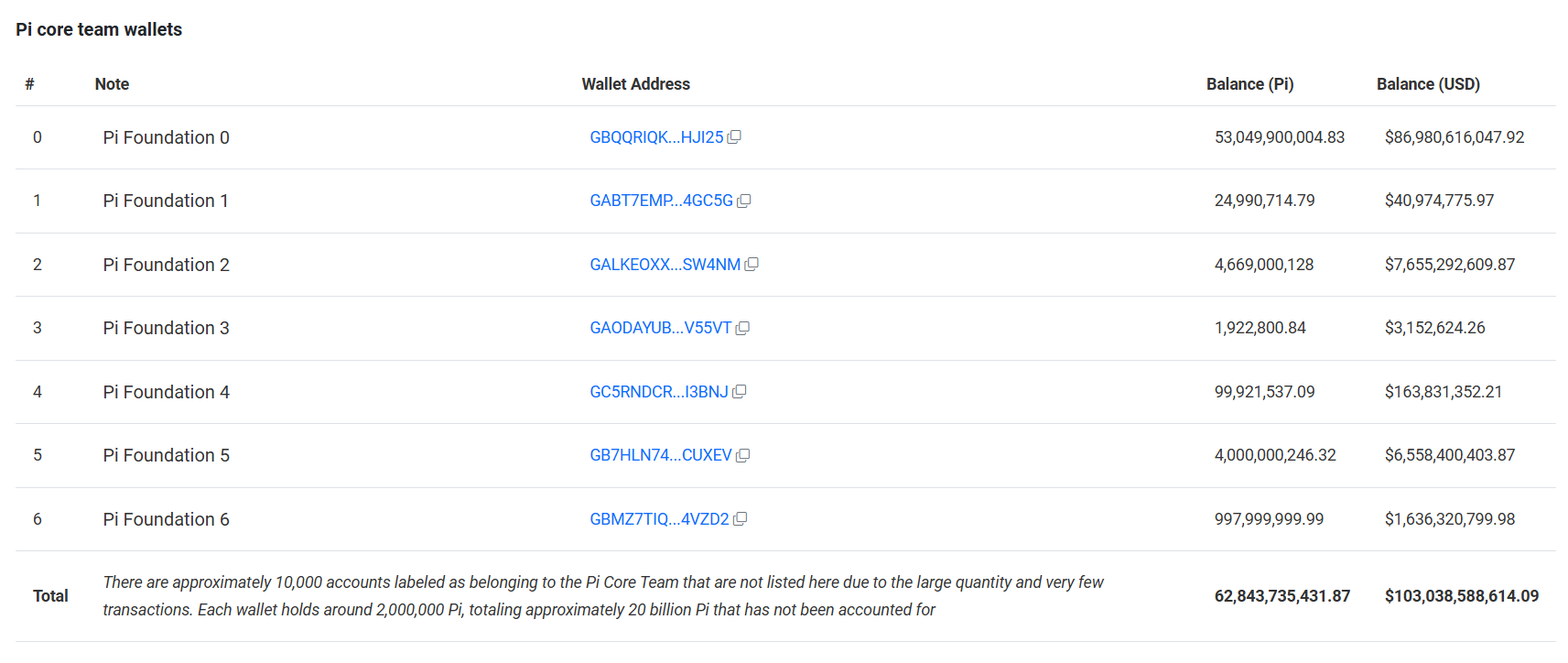

PI Network, a mobile-based cryptocurrency mining platform, sees increasing criticism exposed to its centralization. New data from PiScan Show that the core team has an overwhelming number of 82.8 billion PI coins, which makes 82 % of the total offer of 100 billion. Since there is such a large part of the wealth of the network in the hands of a few, the concerns about real decentralization grow.

The core of the problem is the concentration of these investments. The core team of the PI network controls 62.8 billion PI coins in six wallets. Another 20 billion PI are divided into 10,000 not listed wallets, which are also connected to the team. This means that almost the entire offer is under internal control, so that users ask themselves whether this system is really as decentralized as promised.

The problem does not stop when distributing the coins. PI Network is currently working with only 43 knots and three validists worldwide. Compared to giants such as Bitcoin with over 21,000 nodes or Ethereum with more than 6,600 nodes, the infrastructure of PI Network is disturbing. Solana is another example that with about 4,800 nodes stays far behind Pi Network.

The transparency of Pi Network is dubios

In addition to the concentration of the participations and control over the network, transparency is another central problem. Analysts found it difficult to examine the source code and the on-chain data of PI Network because the project remains largely closed. A contribution from Piscan to X makes it clear :

“The analysis of the source code and the on-chain data of PI Network is currently a challenge due to the incomplete openness of the project.”

Transparency is a cornerstone of every decentralized project, and without it, trust in the network remains shaky. The lack of openness in relation to his operations only fueled the debate.

In order to reinforce the discomfort, the PI Network in the quiet chatgpt has introduced his process for checking customer identity (KYC). This change was included in the data protection guideline updated in 2025, without it being mentioned in previous versions. In the updated document is it[called:

“We use Chatgpt as a trustworthy AI partner to automate the identity examination and improve the security measures. By using our KYC services, the users of the use of chatt and other AI providers who can later be implemented agree to as part of our KYC process. ”

The inclusion of artificial intelligence into the identity check raises questions about data protection and the participation of third parties. In view of increasing concerns about dealing with sensitive personal data by AI, many users wonder whether their information is really safe.

Frustration increases

The dissatisfaction within the PI Network community has grown. Many users have expressed their frustration about the long blocking times and technical difficulties during migration to the Mainnet. Since they cannot access their tokens freely, some even sold their accounts.

This frustration is reflected in the severe decline in the search interest to “Pi Network” against according to Google Trends, interest in the platform on February 20, the day of the Mainnet start, a maximum of 100. Since then it has dropped to only 12, which means a sharp decline in public enthusiasm.

While early supporters once believed in the vision of a decentralized, mobile -friendly cryptocurrency, recent revelations have given doubts about the orientation of the PI Networks. The majority of the offer is controlled by the core team, a small number of validers operate the network, and there is a lack of transparency in the administration.

No Comments