Daring forecast: 25% of the S&P 500 companies will have Bitcoin systems by 2030

- Treasury managers feel under pressure to take over Bitcoin because they fear job risks if they ignore the potential profits.

- The role of Bitcoin as a treasury asset for companies is growing, but its long-term effectiveness remains unpleasant.

According to Elliot Chun, a partner at Architect Partners, it is expected that a growing number of S&P 500 companies Bitcoin will include in their balance sheets by 2030, as Treasury managers fear to miss potential profits. Chun predicted that at least a quarter of the companies listed in the index will invest in Bitcoin, driven by the pressure to research digital assets.

He suspects that the trend is motivated by the risk of professional consequences for those who ignore the potential of Bitcoin. Since only Tesla and Block Bitcoin currently hold among the S&P 500 companies, there should be a significant shift in order to fulfill Chun’s forecast.

Treasury strategies shift towards Bitcoin

Chun explained that companies from companies are increasingly interested in Bitcoin as a long -term investment. He noted that these financial managers feel obliged to at least test Bitcoin in their portfolios. He wrote:

„If you tried it and it worked, you are a genius. If you tried it and it didn’t work, at least you tried it. But if you don’t try it and have no good reason, your job can be in danger.“

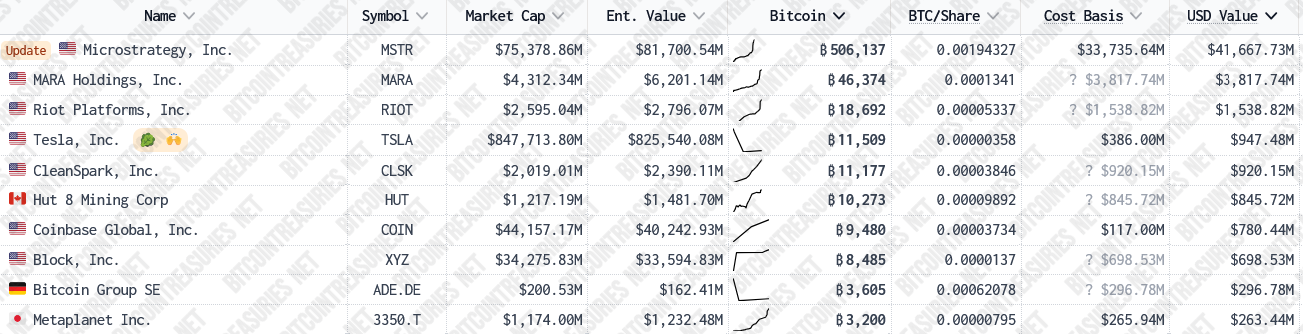

Microstrategy (MSTR) has most Bitcoin among the listed companies and thus far exceeds other companies that use Bitcoin. According to BitcoinTreasuries.net, 89 public companies have Bitcoin in their balance sheets. As CNF reported, Gamestop could soon be one after it has announced a change in the value of $ 1.3 billion on March 26, which wants to use it for Bitcoin purchases.

Chun emphasized the difference between companies that add Bitcoin to diversify and those who like Microstrategy restructure their entire business model around Bitcoin. He warned that companies that try to repeat the performance of MSTR could have unrealistic expectations.

The Microstrategy share has increased by over 2,000 % since the first Bitcoin investment in August 2020 and has thus exceeded Bitcoin and the wider S&P 500 Index. However, he attributed this to the unique role of the company, which enabled US assets administrators an early commitment to Bitcoin before Bitcoin ETFs were approved in January 2024.

Institutional acceptance and effects on the market

Analysts such as Cathie Wood, CEO of Ark Invest, and Mike Novogratz, CEO from Galaxy Digital, believe that Bitcoin could achieve a value between $ 500,000 and $ 1,000,000 by 2030. This view further fueled the interest of institutional investors who want to protect themselves against inflation and diversify their treasury stocks.

Chun pointed out that Bitcoin as a financial investment remained an “unproven strategy”. He admitted that companies see Bitcoin as a potential protection against the inflation of the US dollar, but the long-term effectiveness of such a step is still uncertain. However, he argued that Bitcoin offers advantages over traditional assets such as gold due to its digital character, its simple transfer and its liquidity. In contrast to gold that entails and logistics problems, Bitcoin is recognized as tangible, fungal asset according to the GAAP calculation standards.

The institutional turn to Bitcoin is also reflected in the introduction of investment instruments such as the Bitwise Bitcoin Standard Corporations ETF. The ETF, which was introduced by Bitwise at the beginning of the month, depicts companies that keep at least 1,000 bitcoin in their company treasure. Since more and more companies are exploring Bitcoin, the market could experience a broader shift in strategies for treasury management in the coming years.

No Comments