- Cryptoma markets liquidated $ 737 million in externally financed positions, of which over 85% long trades were-sometimes great optimism.

- Bitcoin stays at $ 119,000, but old coins break in. BTC support at $ 116,000 should determine the direction of the next larger price movement.

The cryptom market has experienced a sharp setback in the last 24 hours and liquidated more than $ 737 million in lit shops. According to the data from Coinglass, more than 243,000 traders were liquidated, with long positions made up for 85.3 % of the total.

The data From Coinglass show that a total of 243,970 dealers have been liquidated in the last 24 hours, which destroyed positions worth $ 737.36 million. Of these, 85.3 % long positions were, which indicates an optimistic atmosphere shortly before the correction. The largest individual resolution was a BTCUSD long position on Binance worth $ 2.96 million.

1/ Over $700M in leveraged longs were liquidated in 24h

ETH and XRP were the main culpritsThe real reason though is $BTC.D closing up +1.57% after a 9-day downtrend

This spike shocked the market, triggering liquidations across alts

BTC held up well and this looks like a… pic.twitter.com/l9uSZ3e58M

— Aaron Dishner (@MooninPapa) July 24, 2025

Data von Coingecko According to Ethereum (ETH), Ripple (XRP) and Solana (Sol), according to the Ethereum, Ripple. Memoins like Dogecoin and Shiba Inu fell over eight percent. XRP fell 8.53, while Solana slipped by over five percent to $ 190. ADA, Doge and XLM also recorded losses of over 7 %in the same period.

Coinglass data shows that over $ 700 billion open positions were liquidated on the futures and option markets, which led to a decline in the derivative market by eleven percent.

Analysts According to the decline in profit from institutional investors and the payment of profits by retailers is due. The price development since June 22 – an increase of over 33% – has been almost without any significant reset.

Bitcoin consolidates at $ 120,000

Bitcoin remained stable compared to the old coins. He moved sideways in a tight span of $ 116,000 and $ 120,000 after he on July 14th A new all -time high from $ 123,218. On Wednesday, Bitcoin fell to 117,142 for a short time before it was easily recovered and was traded on Thursday at 119,200.

Technical charts show that Bitcoin moves within a symmetrical triangle, which is probably the fourth wave of a five -wave structure that started in June. If this wave count is correct, the next upward movement could have $ 127,150 to $ 127,760.

Market analysts see the 50-dayema (exponential moving average) at $ 111,399 as a potential downward trend if BTC closes under 116,000. However, a daily closing course over 120,000 could lead to a new test of the previous high and pave the way for the increase to $ 123,000.

Die BTC Estimated Leverage Ratio (ELR) auf CryptoQuant showed a moderate value of 0.263, which indicates a manageable level of leverage. Meanwhile, Bitcoin’s dominance increased, while old coins were sold more.

Institutional shifting and changing mood on the market

The market capitalization of cryptocurrencies sank Almost 5 % and is now $ 3.88 trillion. The trading volume fell by 13 %, which is due to the lower activity after the liquidations. Like CNF already reported Bitcoin’s dominance decreased by 5.4 % last month, but is 60.88 % this week and thus shows a certain stabilization.

Ethereum assets developed below average because validists got out from ETH operations. Left institutions Ethereum And last week recorded tributaries of USD $ 2.2 billion in Ethereum ETFs, while Bitcoin funds remained unchanged.

The Altcoin Season Index is 40 out of 100. Analysts expect that This index must increase over 75 so that the old coin season is confirmed.

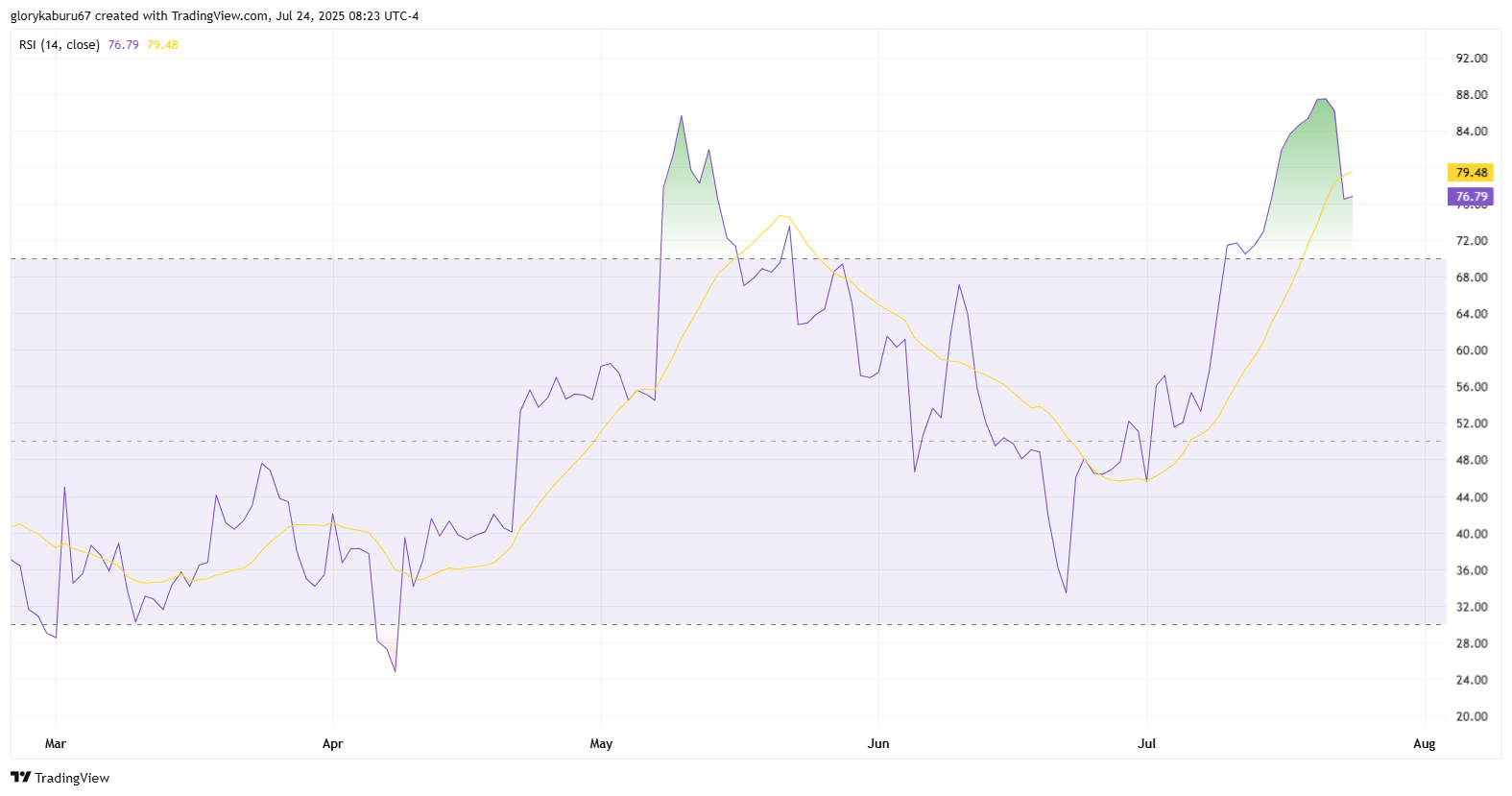

Despite the setback, Momentum indicators such as the relative strength index (RSI) do not signal a bearish divergence. The RSI recently fell under 30 during the sale, but quickly recovered, which signaled a reaction to oversized conditions.

Litecoin was the old coin with the best performance, crashed strongly from the latest lowstates and formed an interest bully engulfing candle. The upward trend is still intact and aims at $ 131.84 when the current dynamic continues.

Traders remain careful because they wait for the upcoming decisions of the Federal Reserve and changes in the policy of the US Ministry of Finance. Despite the recent decline, the general market mood is still optimistic. The Fear and Greed Index is 67, which indicates a still optimistic mood.

Strategists say that it is a healthy correction, not a complete reversal. You predict that Bitcoin by the end of 2025 to $ 137,000 and $ 160,000.

No Comments