- Spot XRP and spot Bitcoin ETFs see inflows as Fed minutes signal timely rate cuts in 2026 are less likely.

- In the crypto sector, market shares (Perps-DEX race) are shifting as companies continue to aggressively accumulate BTC/ETH.

Even at the end of the year, the crypto market does not stand still. Below are the 12 most important news stories from the last 24 hours.

1) Spot XRP ETFs: 29 days of inflows in a row

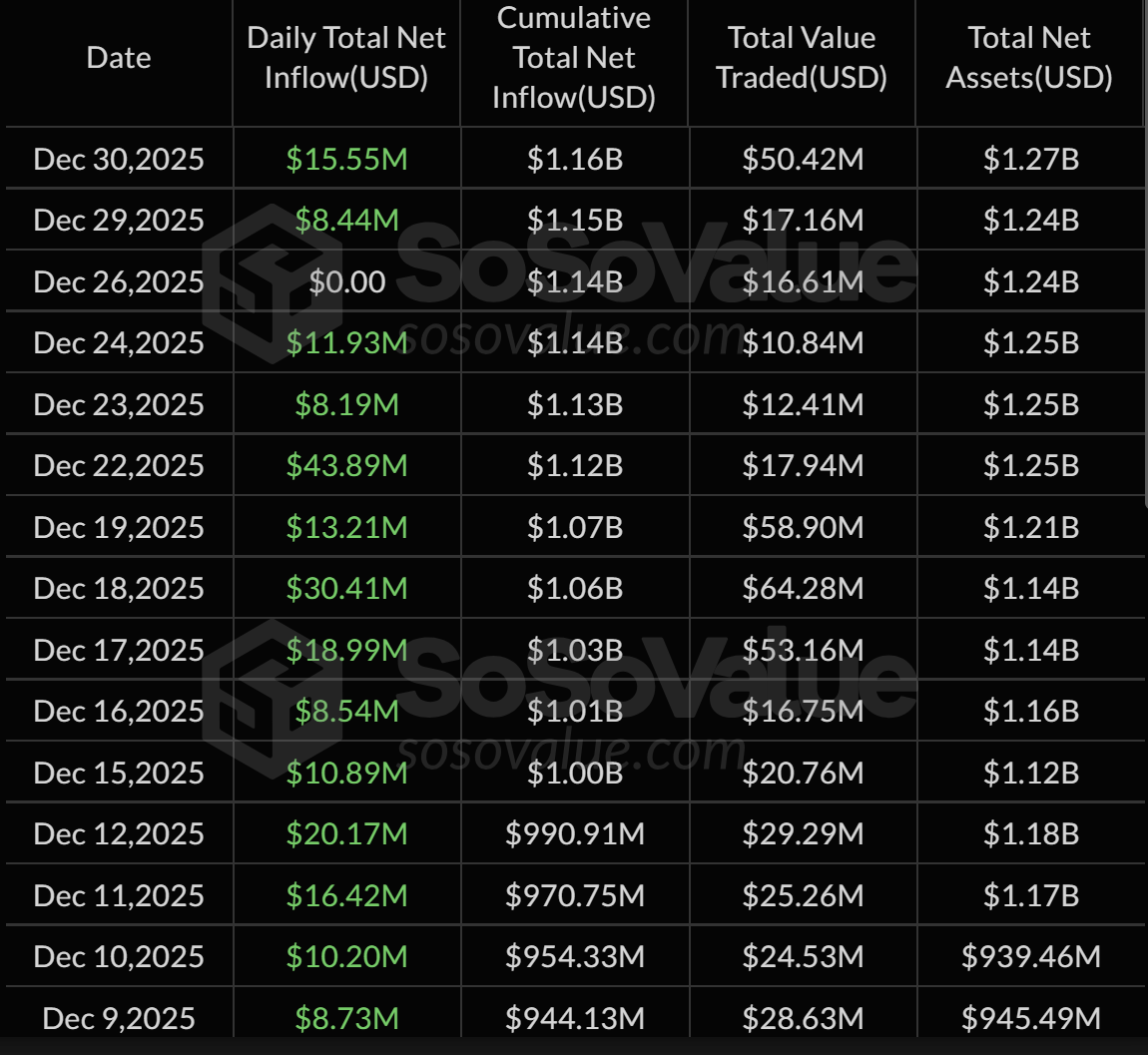

The American spot XRP ETFs continue their inflow streak to 29 days, even though sentiment in the crypto market is currently in the basement. According to SoSoValueData The cumulative net inflows since launch are around $1.15 billion and the net assets are around $1.24 billion.

Yesterday, Tuesday, the XRP ETFs attracted $15.55 million in capital, and on Monday it was $8.44 million. Even on December 24th it was $11.93 million. The data suggests a steady but not euphoric allocation.

2) Fed Minutes: 25 basis points in 9-3 vote

The December Fed Minutes paint a picture of heightened internal tensions: the 25 basis point move came in a 9-3 vote on 9/10. December through.

Not only inflation versus the labor market was discussed, but also the question of how close policy is to neutral interest rates. Several participants described the decision as a “close call,” which increases sensitivity to new data. The internals of the protocol are relevant for the crypto market in that the hurdles for the next interest rate cut have increased.

3) Don’t rush for more cuts

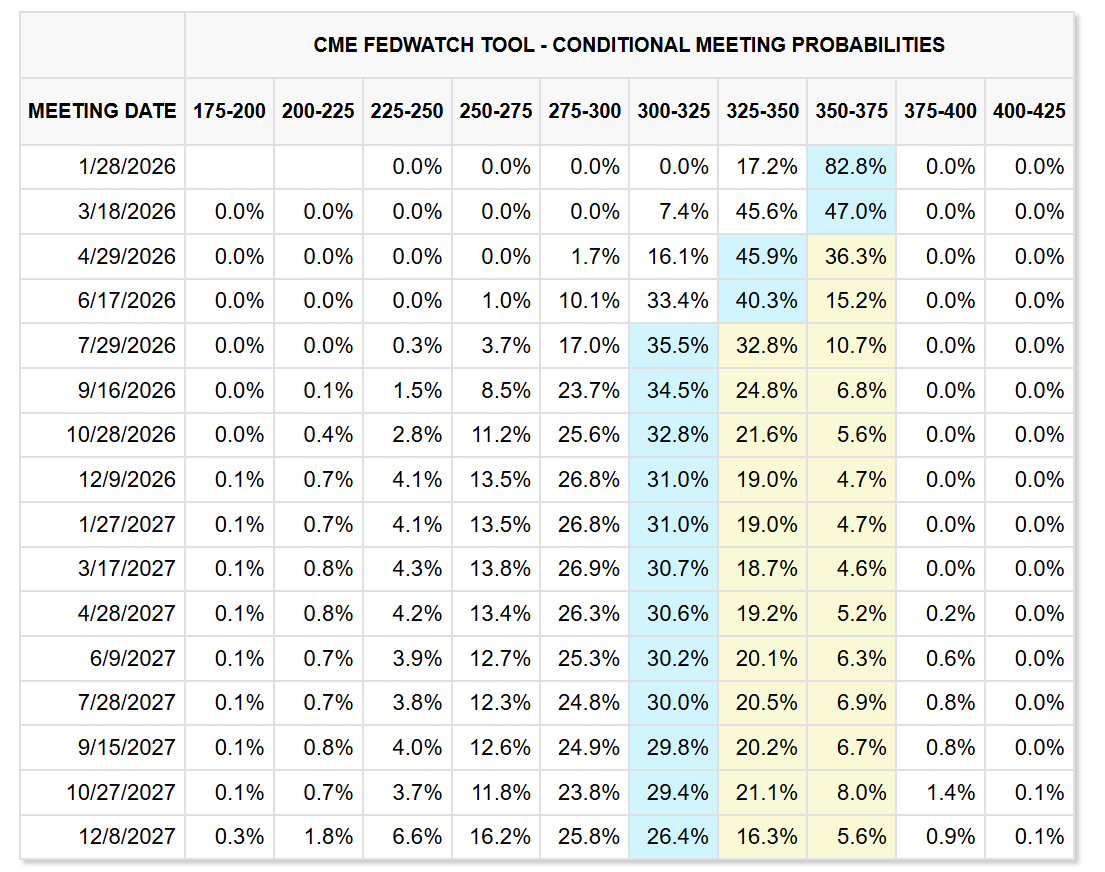

The tenor repeatedly appears in the Minutes that interest rates could remain unchanged “for some time” while we wait to see the effect of the steps taken so far. Accordingly, the chances of an early cut in 2026 fell after publication.

CME FedWatch Ocean Tool The majority does not expect the first interest rate cut in 2026 until April. For the first meeting at the end of January, the chances are around 82% that the Fed will leave interest rates at 3.5-3.75%. There is around a 46% chance of a 25 basis point cut at the end of March meeting.

4) Perps-DEX race: Lighter passes Hyperliquid

The DEX “Lighter” reported around $200 billion in 30-day volume, overtaking competitors such as Hyperliquid. According to DefiLlama data, Aster and Hyperliquid were in the same window below.

The jump coincided with the launch of the LIT token, an indication that incentives and launch dynamics can quickly redirect volumes. What will be crucial is whether Lighter can stabilize this level without acute token incentives.

5) BitMine buys 32,938 ETH

BitMine Immersion Technologies continues its buying spree. According to data from Nansen, the Tom Lee-led company purchased an additional 32,938 ETH for around $97.6 million. The company’s total ETH holdings are approximately 4.07 million ETH.

6) Tom Lee (CNBC): S&P -10 to -15% in Q1 2026, then recovery in Q3

In a CNBC interview, Lee explained that US stocks could see a 10-15% decline in the first quarter of 2026. At the same time, he expects the markets to “come back” later in the year, with a noticeable recovery towards Q3.

This is particularly relevant for crypto because beta assets often correlate more strongly in phases of stress, but also react disproportionately in phases of recovery. The call is therefore less crypto-specific than a macro framework for risk-on/risk-off.

TOM LEE ON CNBC: 2026 SETUP

2026 could mirror 2025 volatility.

Q1:

• S&P may drop 10–15%

• Delayed Fed cuts

• Policy uncertainty

• Tariff conflicts

• AI skepticism

Q3:

• Strong recovery

• Year-end markets likely higherTakeaway for crypto:

Volatility creates… pic.twitter.com/0EmUFSsvfI— Crypto Tice (@CryptoTice_) December 30, 2025

7) Metaplanet buys Bitcoin again

Metaplanet upped the ante at the end of the year and purchased 4,279 BTC at a cost of around $451 million. This reportedly brought the total holdings to 35,102 BTC, in the region of around $3 billion in market value.

8) Trump Media: Five Truth Social ETFs launch on the NYSE

Trump Media & Technology Group joined Yorkville in bringing five America-First/Made in America ETFs to the NYSE. The range includes, among other things, products for Defense/Security, Frontier Tech, “Icons”, Energy and REIT Focus, each under Truth Social branding. Further ETFs, including crypto products, have been announced for 2026.

9) Spot Bitcoin ETFs are seeing inflows

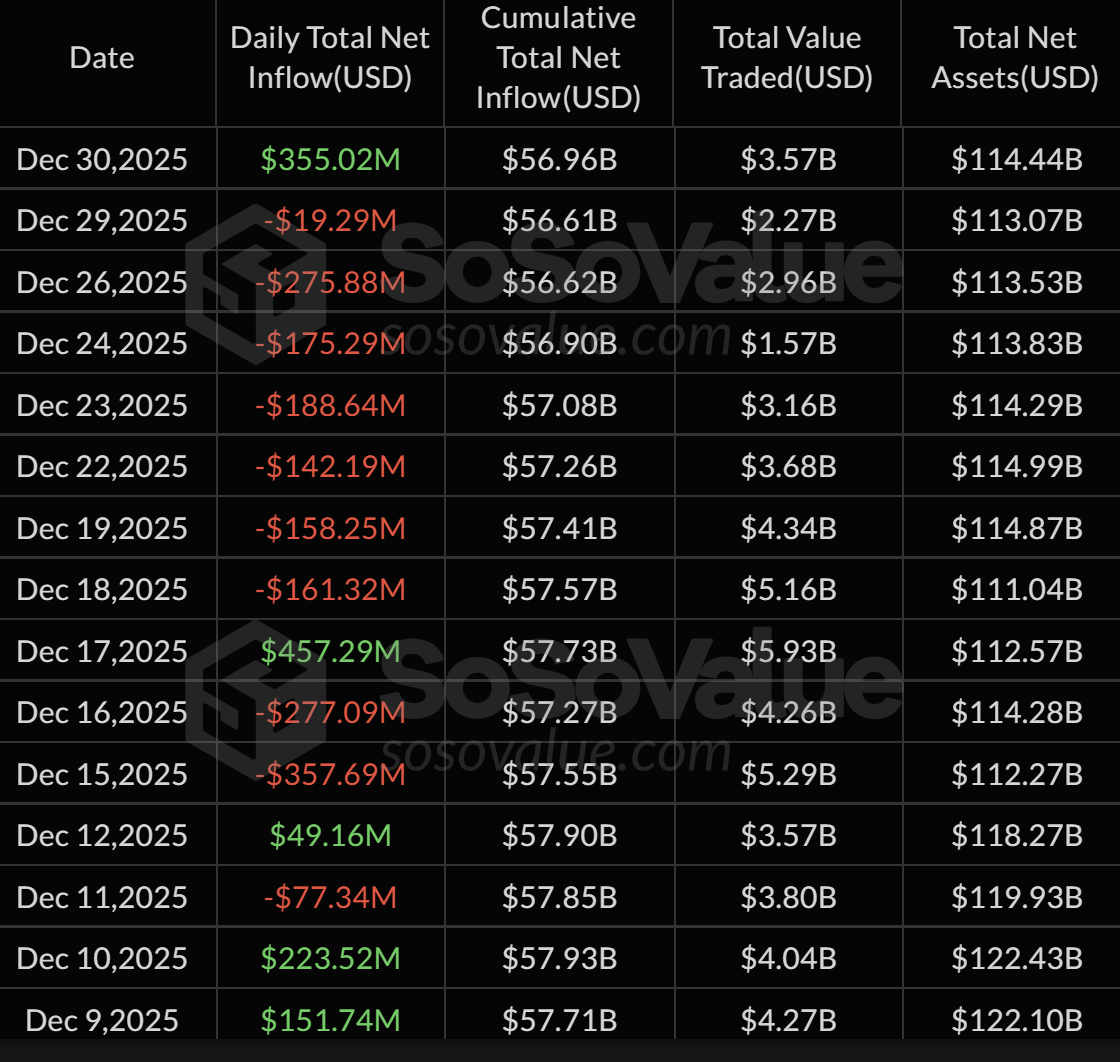

On December 30, US spot Bitcoin ETFs turned positive again after seven consecutive days of net outflows points SoSoValue +$355.1 million. Drivers included BlackRock (US$143.75 million) and Ark/21Shares (US$109.56 million), each with high positive daily values.

10) South Korea postpones crypto law – dispute over stablecoins

South Korea’s “Digital Asset Basic Act” stalls; the submission is now expected in 2026. According to reports, the core of the conflict is who is allowed to issue won-linked stablecoins and which authority has supervisory authority: Financial Services Commission versus Bank of Korea. The period of regulatory uncertainty is extended for the local market.

11) Grayscale files S-1 for Bittensor product

Grayscale filed a Form S-1 with the SEC on Dec. 30 that seeks to enable a U.S.-listed product with TAO exposure. In the filing, the “Grayscale Bittensor Trust (TAO)” is described as a Delaware trust whose shares are intended to track the TAO price.

12) Russia: Justice Ministry wants prison sentences for illegal mining

Russia’s Ministry of Justice presented a draft that would address unauthorized or unregistered crypto and Bitcoin mining in a tougher criminal law. Fines of up to millions of rubles as well as forced labor are mentioned; According to reports, in more serious cases, prison sentences of several years are envisaged. The move follows the trend of tolerating mining as an industry, but strictly binding it to registration and reporting obligations.

No Comments