- The crypto market experienced one of the largest liquidations in a single day as $1.7 billion in leveraged trades were wiped out.

- Despite the panic selling, they are Long-term fundamentals are good and institutional commitment remains strong.

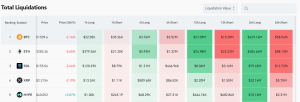

The crypto market experienced panic selling with liquidations totaling $1.73 billion in 24 hours, as data from CoinGlass shows. Of that, 1.32 billion were long positions, suggesting that traders who had bet on a price rally were unprepared.

Bitcoin led the decline, briefly slipping below $100,000 for the first time since May before recovering slightly to $101,558.22. $429.16 million in BTC was liquidated in long positions and $58.54 million in short positions.

The worldwide one Market capitalization of cryptocurrenciessank one more 2.61% and lies now at $3.38 trillion. Over the last month, digital assets have lost a total of nearly $840 billion in value.

Ethereum was also under heavy pressure, falling 5% to $3,000 before recovering to $3,306.38. The coin recorded $484.66 million in long liquidations and $88.15 million in short liquidations, illustrating how quickly leveraged bets were cleared.

The domino effect of liquidations marks one of the biggest shocks of the year, similar to previous market corrections in early 2024 when Bitcoin experienced a 33% pullback.

Trader Tardigrade notedthis pattern closely matches past bull market declines, suggesting the current downturn still in a broader upward cycleto fitcould.

$BTC/weekly

Since 2024, #Bitcoin has experienced several healthy pullbacks ranging from 21% to 33%.

The recent pullback measured only 21.62%, which is very close to the one in early 2024.#Crypto bull market is still going onpic.twitter.com/RmJR1P7S8Q

— Trader Tardigrade (@TATrader_Alan) November 5, 2025

Bitcoin and ETH ETFs lose for the 5th day in a row

Institutional sentiment also followed market fluctuations. Bitcoin-Spot-ETFs recorded on November 4, a net cash outflow of $578 million and with it it fifth day in a row drains.

This was followed by a net outflow of $219 million from Ethereum ETFs, marking five consecutive days drains meant.Solana was an exceptionthe recorded a net inflow of USD 14.83 million and thusrecorded outflows for the sixth day in a row.

This emerging trend at Solana contradicts the general trend of withdrawal from digital assets, as it is selective and provides a certain level of trust in high-performing ecosystems.

Business as usual in the form of greater volatility or reset?

Crypto expert Shanaka Anslem Perera described the event as a staggered liquidation cycle rather than a true market crash.

He estimates that more than $1.2 trillion has evaporated in eight weeks, with the total market cap falling from $4.6 trillion to $3.4 trillion. On October 10th alone achievedthe margin calls 19 billion dollars because of the leverage except control got into trouble .

THE $1.2 TRILLION LIQUIDATION NO ONE SAW COMING

Crypto didn’t crash. It was executed.

Eight weeks. $1.2 trillion vaporized. Market cap fell from $4.6 trillion to $3.4 trillion while every fundamental metric hit all-time highs. This wasn’t fear … it was forced liquidation at… pic.twitter.com/TIkD293BXp

— Shanaka Anslem Perera

(@shanaka86) November 5, 2025

Although open interest fell sharply by 43% from 217 billion, overall fundamentals remained fluid. The number of global crypto users rose to 560 million compared to 520 million at the beginning of the year, while stablecoins approximately 30% of all transactions turn off .

Institutional investor participation increased as BlackRock and Strategy increased its purchases while in the USACrypto-friendly regulations have been enacted .

Even if the gap between the lower prices and the increased number of users is widening, this is more of a sign of a possible market reset than for market failure.

If it is true that lessons can be learned from historical events, this cycle will also be followed by a new rally after the inevitable normalization of leverage and the restoration of liquidity.

No Comments