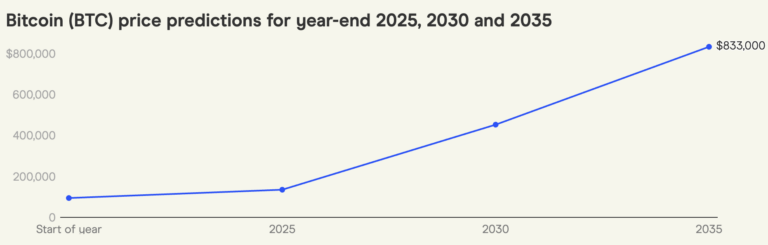

- With good institutional demand in 2035, the BitcoIN course can be over $ 800,000, also by the half -length effect, which is often overlooked because it only happens every 4 years.

- Experts still see a course of $ 135,000 in 2025, with high inflows and a shortage of the offer bringing the course up.

Bitcoin has climbed over $ 94,000. The market experienced its first positive movement after many months of stagnation due to macroeconomic triggers.

According to industry forecasts, Bitcoin 2035 will reach a course of over $ 800,000. Large investors like ARK Invest see an even greater potential.

Bitcoin becomes stronger after overcoming resistance

The Bitcoin course has overcome the resistances on the sliding daily average of 50 and 200 at $ 84,501 and $ 88,857. He experienced his strongest price increase in early 2025, after he had reached a continuous increase in $ 87,077 on the sixth day, and then increased to $ 93,952 and then $ 94,499.

When writing this article, Bitcoin is $ 94,266, and it has increased by 1.88%in the last 24 hours. In the past week, the increase was 11%. At $ 1.54 billion, the Spot Bitcoin ETF recorded one of the greatest tributaries during this time. Currently The course is slightly below the important level of resistance of $ 95,500, which in the opinion of analysts is the next level of support if the course increases higher.

New long -term goals

Twenty -five crypto experts who are in the framework The Finder’s study Last year, predicted that BTC will reach the course of $ 135,000 by the end of 2025. This is less than the value given in January 25 on 161.105. But here, too, the experts precede a further increase to over $ 450,000 by 2030 and over 830,000 to 2035.

The same survey showed that the majority, namely 68 % of those surveyed, believe that the right time for an investment at the current price is now recommended to keep the stock. Only 7 % rates for sale. This assessment gives the experts in the industry more confidence in long -term price development.

Second, the report “Big Ideas 2025” also contains a more specific goal for the course level in addition to the Finder panel. In the previous article in which the company’s estimates were presented, Ark Invest assumed a best-case scenario of $ 1.5 million per BTC by 2030.

The strategies you have discussed focus on increasing the number of institutions that accept Bitcoin, and talking about how Bitcoin can be used as a value preservation means in developing countries. As CNF stated, US banks can now participate in crypto-related activities without having to notify their primary supervisory point at the Federal Reserve because the central bank has withdrawn previous supervisory letters.

This step also includes the withdrawal of the joint explanation of the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC) and the Office of the Compotroller of the Currency (OCC) from 2023 on activities with digital assets.

Institutional demand and ensures optimism

Jack Mallers, CEO von Strike, underpinned The optimistic expectations and predicted that BTC could achieve a value between $ 250,000 and $ 1 million. Mallers named the persistent instability within the traditional financial systems as a decisive driver for the upward trend of Bitcoin.

As reported by CNF, the estimates of ARK Invest are based on the growing global demand for alternative value residues, especially in inconsistent economies. In view of the massive tributaries in the US Bitcoin ETFs and the rally of the shares In addition to the cryptocurrencies, the financial landscape seems to be increasingly favorable for the further rise of bitcoins.

The current discount of 40 % on the inner value of Bitcoin, that of Analyst Edwards was determinedoffers additional upward potential. In the shortage of the offer after the fourth halving, analysts see another important catalyst for future price increases.

The performance of Bitcoin after halving has led to significant household phases in the past. The current market situation in connection with the increasing acceptance and the lower offer will offer BTC the potential for large price gains in the coming years.

No Comments