Chainlink: Rewards program creates new investor interest in LINK tokens

- LINK rebounds near $15.35, whale accumulation increases, and social media presence is highest since 2022.

- Bonuses and participation in build projects ensure increasing optimism and keep dealers’ interest alive.

Chainlink (LINK) price held steady at $15.35 on Wednesday after recovering from a weekly low. Investors are regaining confidence in the token. The Chainlink Rewards Season 1 Program sparked new buying interest and attracted more people to the community.

LINK rose 11% since November 5 before falling 6.6% on Tuesday. Traders remained positive as the price remained above its support. The recent rally shows strong demand fueled by staking and improving on-chain metrics, boosting confidence and signaling that the opportunity remains strong in the market.

The Chainlink Rewards Season 1 initiative officially began on Tuesday. It allows eligible participants to earn Cube Rewards Points by participating in nine build projects: Dolomite, Space and Time, XSwap, Brickken, Folks Finance, Mind Network, Suku, Truf Network by Truflation, and bitsCrunch. These rewards encourage more people to participate in the network.

Staking program expands Chainlink commitment

Participants can assign cubes between November 11th and December 9th and claim rewards via a 90-day linear unlock plan starting December 16th. This setup helps users stay active in the Build ecosystem, encourages long-term commitment, and maintains token demand with staking rewards that incentivize regular participation.

These developments show a positive future for LINK. Higher staking rewards and greater user participation help LINK’s ecosystem grow, increasing liquidity and making the tokens more useful. More interaction encourages steady buying and forms a strong base for LINK price in the coming trading sessions.

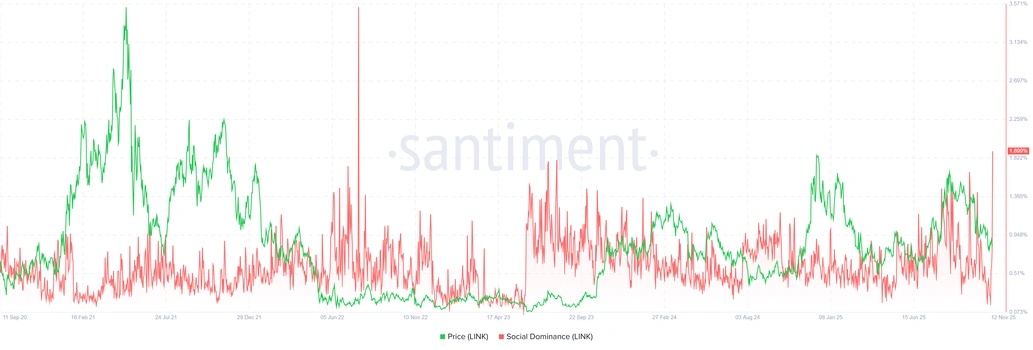

The Santiment data further reinforces optimism as Chainlink’s social dominance metric surges. It jumped from 0.15% on Saturday to 1.89% on Wednesday, reaching its highest level since July 2022. The increase shows growing commitment and renewed discussions about the project’s latest program.

Chainlink faces $18 resistance – bullish momentum building

At the time of writing, LINK is trading at $16.05. The price fell by 0.79% in the last 24 hours. The market cap is $11.18 billion, and traders exchanged $723.71 million worth of LINK, which is about 6.21% of its value. There are 696.84 million of LINK in circulation.

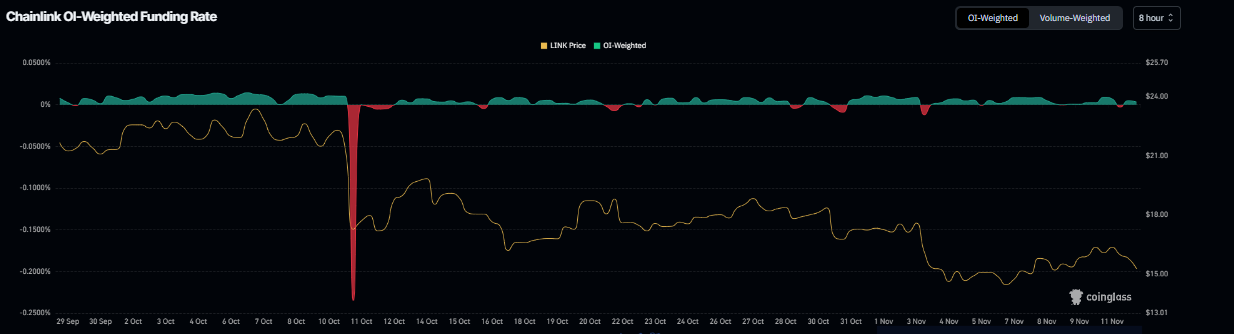

Data from CryptoQuant suggests consistent whale accumulation in both spot and futures markets. Large buy orders show that investors trust the medium-term trend of the token. Coinglass reported that the OI-weighted funding rate rose to 0.0032% on Wednesday, meaning traders with long positions are now outperforming those betting on a further decline.

LINK’s technical outlook remains constructive as the price trades near the lower trendline of a falling wedge pattern. If the price holds this level, it could reach the 50-day exponential moving average at $18.12. According to analysts, this area could serve as a resistance point before the next upward move.

The Relative Strength Index is currently at 40, close to neutral 50, showing that bearish pressure is easing. If it rises above 50, it could indicate stronger bullish momentum. At the same time, the MACD has shown a bullish crossover since Monday, further supporting hopes of a recovery.

Should sales return, the next visible support is $12.59. Even with small corrections, traders are optimistic as the staking program remains active, whales are trading more, and strong community signals increase confidence in Chainlink’s market prospects for December.

No Comments