Chainlink reaches $322 billion in the RWA market – high-profile partners expand onchain integration

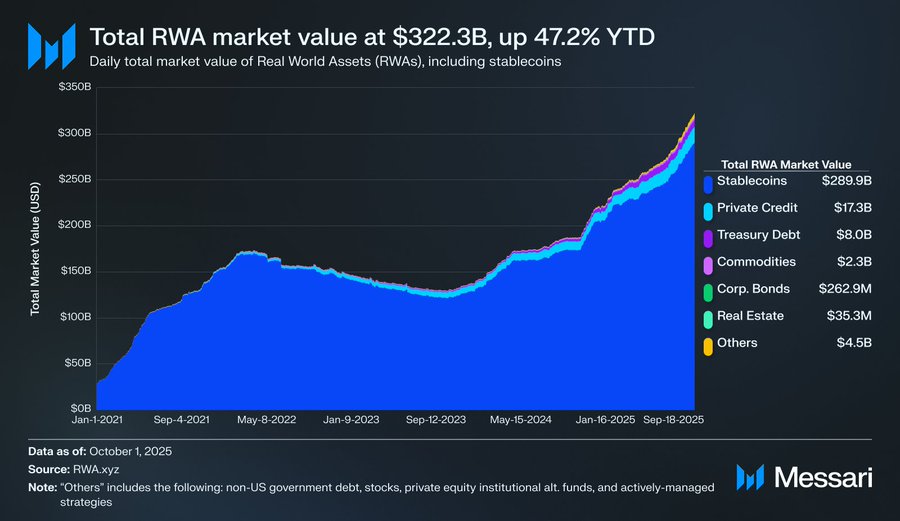

- Chainlink’s RWA tokenization segment has surpassed $322 billion, driven by institutional customers.

- Partnerships with JP Morgan, Fidelity, UBS, Swift and Deutsche Börse make Chainlink a comprehensive institutional infrastructure.

Chainlink launched in 2017 as a simple oracle networkbut the project is now into another phase kicked. A recent report from Messari shows that Chainlink secures over $100 billion using more than 450 protocols and processes over $26 trillion in transaction value.

His stake in the Oracle sector becomes 70% appreciated. This scale shows why the network $322 billion in tokenized RWAhas exceededwhat a significant increase of institutional blockchain activities represents.

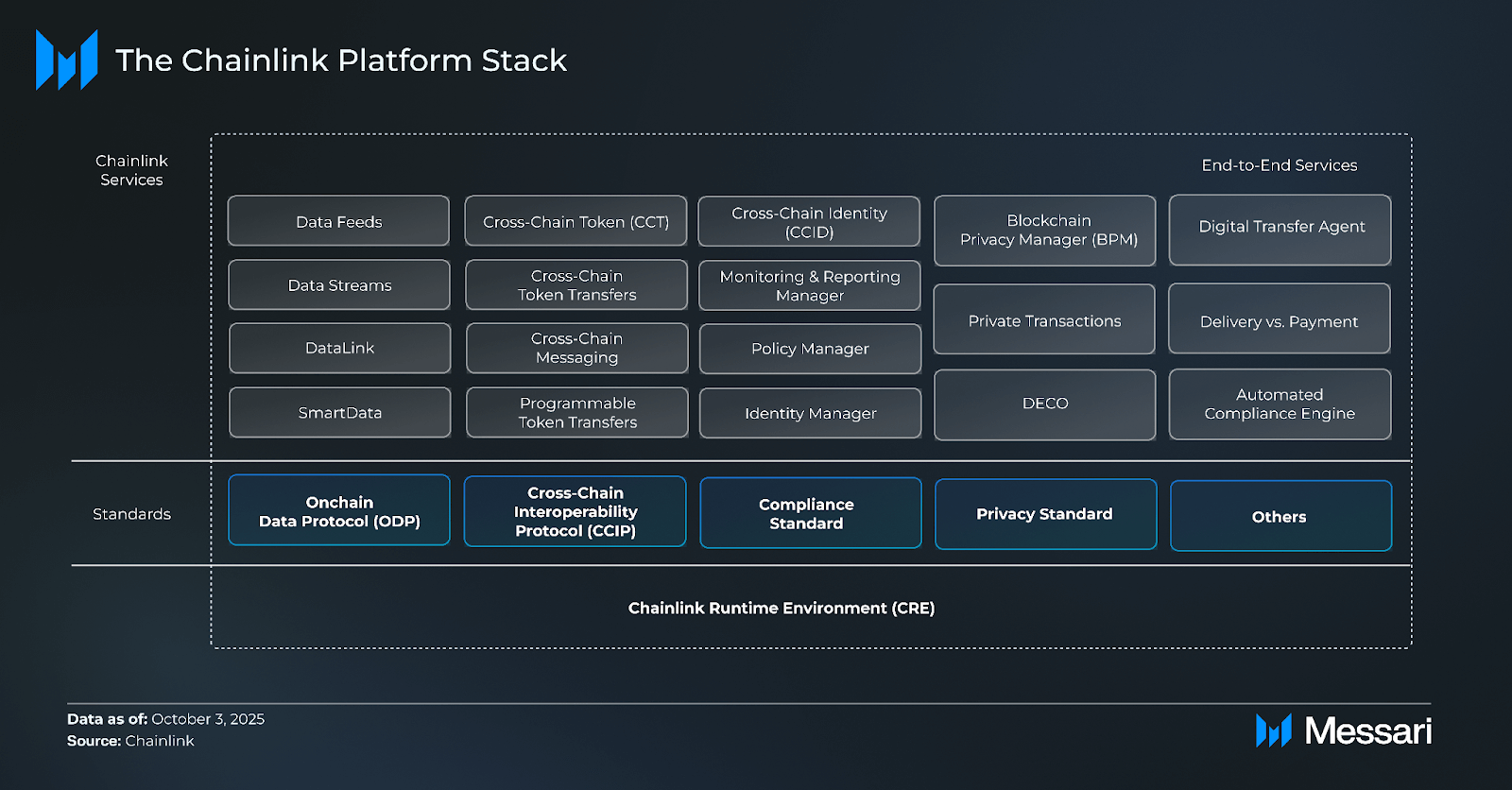

Chainlink is becoming a full-fledged institutional stack

The latest report from Messari explains how Chainlink is expanding beyond price feeds to a full-stack service for DeFi and traditional markets.

The report points points out that financial institutions unified systems and no separate providers for data, compliance, data protection and crosschain execution prefer.

Chainlink’s answer is a comprehensive infrastructure, the from Data transport up to automatic compliance and data protection functions are enough.

In addition, the technology package now includes Data Feeds, Data Streams, SmartData, cross-chain interaction through CCIP, Automated Compliance Engine (ACE), private computation platforms and the Chainlink Runtime Environment (CRE).

CRE is already on the market and allows programmers to complete Workflowsto develop which can be used to link both on-chain and off-chain processes. The same framework will enable tokenization and settlement of funds, bonds, stocks and cash on automated networks

Institutional acceptance in all major markets

The list of companies working on the Chainlink platform is constantly expanding. JP Morgan’s Kinexys relies on Chainlink for cross-chain settlement of tokenized US Treasury assets.

Fidelity International published the real-time NAV value of its $6.9 billion Institutional Liquidity Fund on the blockchain via Chainlink.

UBS schloss a live tokenization of a fund on the platform aband Swift and Chainlink developed a system that it every global bankenabledto connect to any blockchain by using their messaging standards.

Deutsche Börse, which hosts Eurex and Xetra, controlled via the DataLink framework from ChainlinkOn-chain market data . On-Chain-Initiativen were too from Euroclear, DTCC, ANZ, Apex Group, SBI Group and WisdomTree through the of Chain linkinfrastructure offeredintensified.

These steps showthat the project now plays a central role in the tokenization of companies and is not just another blockchain data provider.

LINK’s role grows with fees, rewards and reserve program

The Chainlink platform’s LINL token will also for usefulness usedthen is to collect fees for the Chainlink Reserve is usedwhich launched in August 2025. The LINK Reserve already contains more than $9.4 million in LINK and is expected to with increasing acceptance even more is stored.

The 11th Chainlink Reserve $LINK inflow is here

The Reserve now totals 523,159 $LINK (~$9.4M), with an average cost basis of $21.98 per $LINK

59,968 $LINK (~$1.1M) was acquired today, with ~90% coming from $USDC swapped into $LINK via Uniswap and ~10% from user fees already… pic.twitter.com/8HtiWuTVFe

— Zach Rynes | CLG (@ChainLinkGod) October 16, 2025

The blockchain platform also introduced reward programs through which early projects were enabledto reward token holders who staked LINK tokens. The Build and Scale initiatives are further forms of support for other blockchain platforms that want to join the Chainlink network.

The demand for standardized data, cross-chain functionality, and regulation will likely only increase as token markets grow.

At this point in timewith early adoption, standardized security and high-profile collaborations, appears It is likely that Chainlink will remain the essential infrastructure within institutional on-chain financing.

No Comments