Chainlink presents complete infrastructure for institutional stablecoins

- Chainlink presents an integrated infrastructure that supports stablecoin issuers with reserve creation, documentation and global distribution.

- It combines existing Chainlink modules such as Proof of Reserve, CCIP and Confidential Compute into an end-to-end solution for regulated stablecoins.

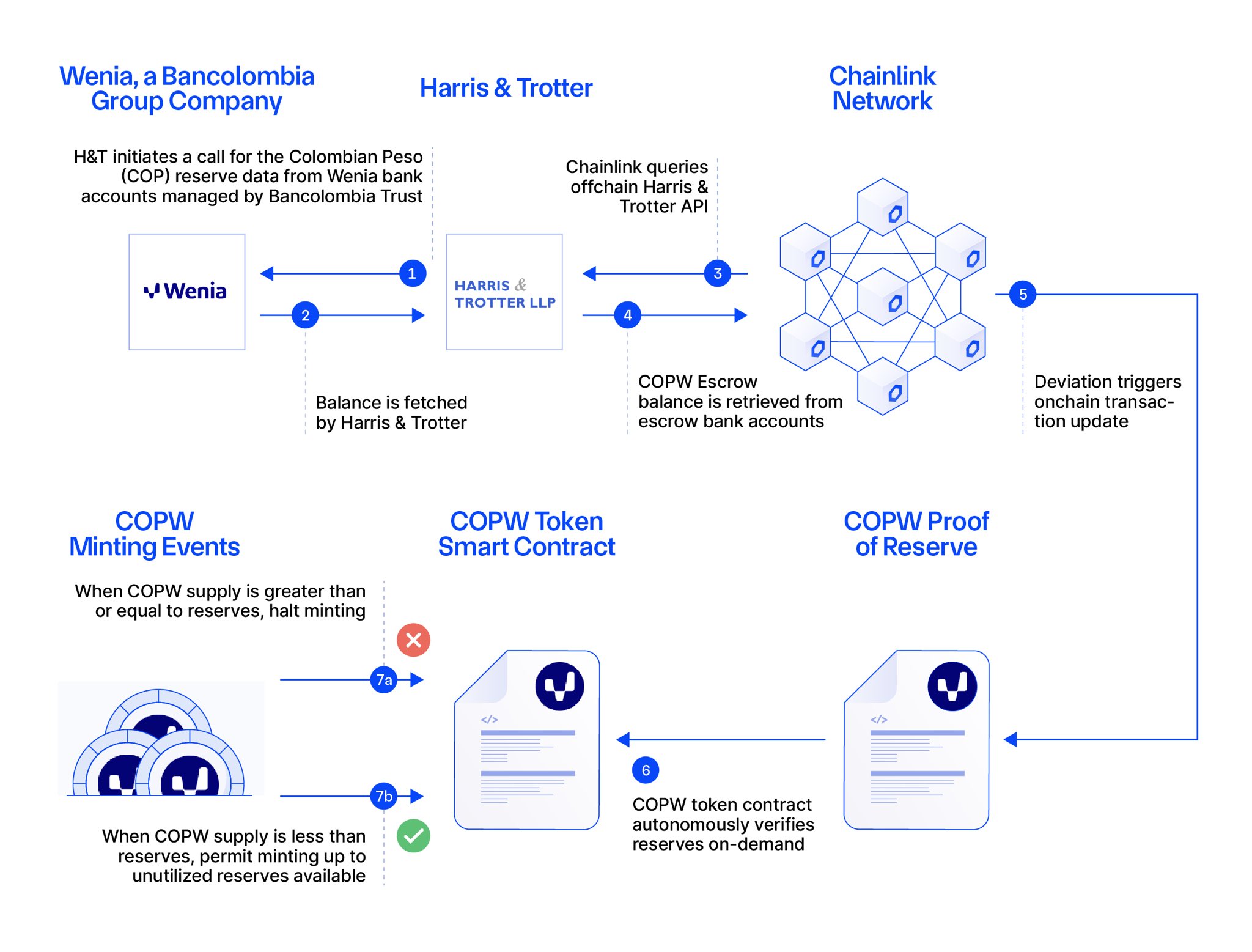

With Proof of Reserve and Secure Mint, Chainlink links the issuance of new stablecoins directly to verified off-chain reserves. The Wenia (Bancolombia) and OpenEden USDO projects already use these mechanisms. The Standard & Poors Global Rating additionally provides risk analyzes via Chainlink’s DataLink.

What: Chainlink

Automated compliance and interoperability

The Automated Compliance Engine (ACE) enables the mapping of KYC/AML rules, jurisdiction boundaries and counterparty filters at the smart contract level. Confidential Compute allows confidential calculations without disclosing sensitive data. The Bermuda Monetary Authority relies on a Chainlink-based framework for stablecoin regulation.

Cross-chain liquidity without fragmentation

Stablecoins can be operated synchronously across multiple blockchains using the Cross‑Chain Interoperability Protocol (CCIP) and the CCT standard. Financial institutions such as ANZ, Falcon Finance (USDf), World Liberty Financial (USD1) and Aave (GHO) use CCIP for interoperable stablecoin models.

Connection to existing financial systems

The Chainlink Runtime Environment CRE connects off-chain systems such as treasury software or compliance workflows with on-chain processes. A cross‑chain DvP transaction between JP Morgan Kinexys and Ondo Finance has already been orchestrated via CRE.

Access to global distribution channels

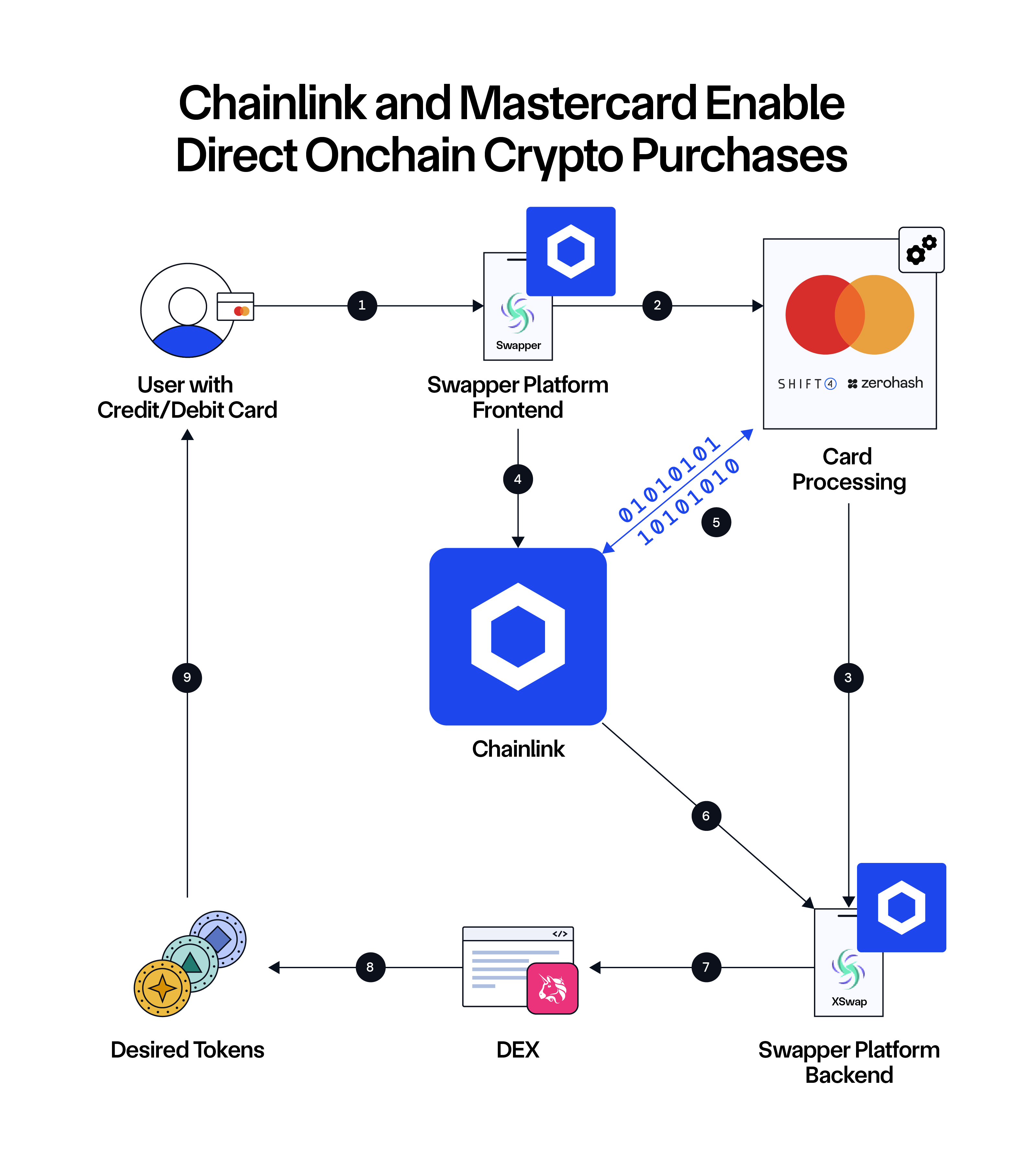

A new stablecoin enablement program with GSR aims to support issuers entering the market. In addition, a cooperation with Mastercard enables on-chain purchases via Mastercard cards via Swapper Finance.

No Comments