Chainlink offers great added value to all industries-and its link token unlimited opportunities

- Chainlink becomes a central infrastructure for global finance and its banks.

- Link combines data, chains and compliance and drives the next generation financial system.

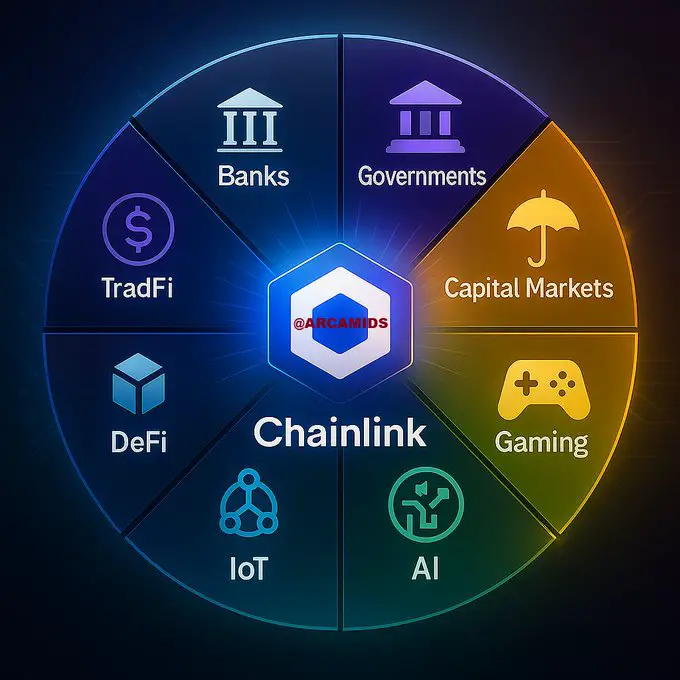

Chainlink enis thrown into the hidden infrastructure of a cross -sector digital economy. While the usual platforms are designed for certain applications in certain industries, Chainlink is used by banks, insurance, governments, gaming networks, AI systems and defi protocols.

According to the researcher Arca Do not even cover more markets than Chainlink. Although AWS claims the cloud for itself and works visa in global payment transactions, Link has a cross-sector range, including data feed-in, proof-of reserve, crossschain messages and compliance systems up to the RWA tokenization.

Link is neither tied to a blockchain nor to an app. Rather, it is the universal translator that enables systems to communicate in the same language.

1/

Chainlink’s addressable market isn’t just massive, it’s borderless.No product or platform in history has had a TAM (Total Addressable Market) this global, this deep, and this cross-industry.

Here’s how $LINK compares, and why its ceiling might not exist.

— Arca (@arcamids) June 11, 2025

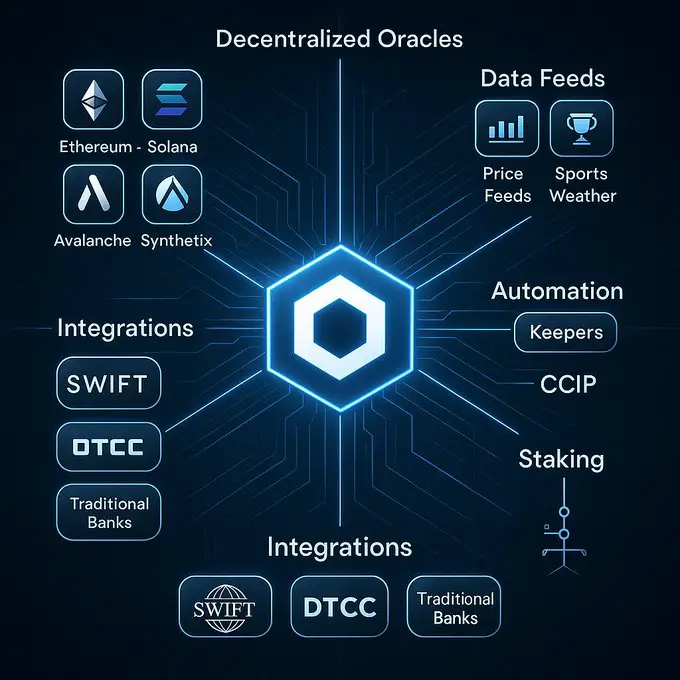

Whether it is the evaluation of derivatives that Implementation of Kyc checks or the integration of private chains deals with public networks, Chainlink provides the rails ready die the operation Let it run smoothly and continuously.

Chainlink is relevant for banks

Chainlink offers the financial sector better benefits, and becomes through this For the needs the Banks are always more relevant.

The Anz Bank and Fidelity International have a transaction process on Chainlink within the official Framework of the HKMA in Hong Kong, causing the ability to carry out chain links to execution more complex and multi -jurisdictional Smart Contracts was proven .

A visa report explains that chainlink the solution for Central PRoble can be with which institutions are confronted – above all in the case of data integrity, crisschain operations and compliance with regulations.

With its Cross-Chain Interoperability Protocol (CCIP)-a cash COW for the company for a long time-Chainlink is already at SWIFT and DTCC established. In the future it will Basis for other banks be.

This trend takes place at the same time with more legal and political openness in the United States, such as the introduction des GENIUS Act makes clear.

The law, if it is assumed, prescribes the regulatory peculiarities of stable coins and thus opens public blockchains for the inclusion of conventional capital markets.

1/

The GENIUS Act is the most important piece of crypto legislation in U.S. history.It doesn’t just regulate stablecoins, it creates the legal foundation for legacy capital to move on-chain.

This is mega bullish for crypto.

Especially for $LINK.

— Arca (@arcamids) June 5, 2025

In this case, Link would become the decisive bridge that one verifiable compliance and operational trust for institutional financing secure.

Link could become the TCP/IP equivalent of the financial sector

What distinguishes Link is that it becomes a central “confidence -building measure” for more profit through programmable finances.

Since the number of link tokens is only one billion and currently already approximately 657 million tokens are in circulation the offer Due to the need the emerging sectors, Ki, IoT, derivatives and depin, the more token needlimited.

Link is created by a gradual, well -structured approach that is on the Elimination the actual problems concentrated, With that die The industry are confronted.

After current status Things could quietly become a central pillar for finance as the TCP/IP protocol of the Internet, there es the basic layer represents – A basic layer that does not belong to anyone, but everyone has to use.

No Comments