Chainlink-News: Thanks to the after-school whale, the link course has a good chance of the $ 25 Run

- Chainlink rises by $ $ 16.45 and, thanks to WAL purchases and promising course patterns, can start with Bullische Matter $ 25.

- Despite the strong whale activity, sales pressure at $ 15.50 could hinder the recovery of Chainlink.

CHAINLINK (Link) today rose by 2 % to $ 16.45 because the wider cryptoma market is optimistic. Whale activity and a potential outbreak pattern indicate $ 25, but the sale on important resistors could stop the movement.

On-chain data show that whales have also belonged around 25 million Link tokens since February. However, the latest network activities and sales trends are an obstacle to continuation of the trend.

Wal-accumulation confirms chain links positive outlook

Whales that hold 100,000 to 10 million link tokens have increased their credit from 350 million to 375 million since February, such as Intotheblock data show. This increase of 25 million tokens shows the strong trust of the large investors. The trend coincides with the course increase of chainlink via the 200-dayema at $ 16.01.

Large transactions worth more than $ 100,000 also increased by leaps, by 135% from 97 to 228 since May 17th. Such increases indicate institutional or WAL activities, since small investors rarely move such capital. This growing presence of large investors supports the potential of Chainlink to break out of its current price zone.

Technical patterns indicate a target of $ 25

The course course of Chainlink indicates a reverse head-shoulder pattern, a positive signal for a rally. Link is traded at $ 16.45 and strives towards the $ 18 $ 8-day supply zone. As CNF reported, a sustainable increase over $ 15.5 strengthens the chances of further price gains.

A decline under the 50-dayema at $ 15 could destroy this pattern and possibly press the link to $ 13.20, an earlier upward trend low. The range of $ 10.93 to $ 18 remains volatile, with the resistance of $ 18 a significant hurdle. The dealers pay close attention to an outbreak to confirm the $ 25 goal.

As explained in our last analysis, Chainlink’s development activity is ahead of the competition in the long term. In the short term, however, price development will depend on whether the resistance is broken at $ 18.0 and the momentum is preserved. In the next few weeks it will be shown whether Link can continue his upward trend.

Network data let doubts about the positive trend

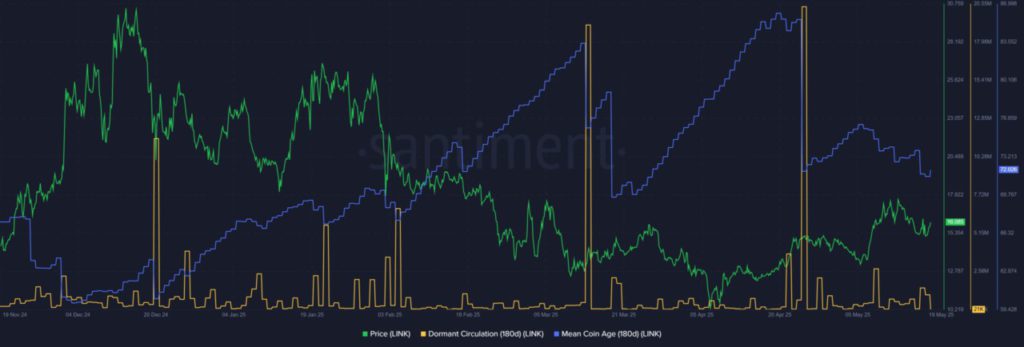

On April 25, the diagram of the dormant circulation of Chainlink increased, which means that network activity increases. That fell with a decline in the middle coin age together , Since the owner sold Link when it approached the former level of resistance of $ 15.5. This sales pressure shows that investors lose their conviction at important price points.

There are currently 76 % of link owners at a profit, compared to 65 % and 56 % during sales in March and April. Although chainlink in 30-day development activity Singlent There are 50% of Ethereum, there are challenges. Sales pressure and lack of market trust will make it difficult to stay over $ 15.5.

The partnerships of Chainlink and the progress of the oracle protocol are still a hot topic on the cryptom market. Link rose to a high of $ 17.89 last month, although the market was unsure overall. Now the people are wondering whether Link can reach $ 20 soon.

The level of support of $ 15.5, which was a resistance zone, is critical. If Link can keep above this level, an increase is possible to $ 18 and beyond. If he cannot keep this level, Link will test the strength of the interest bully orientation.

Chainlink also becomes an important player in the tokenization of Real-World assets (RWAS), which gains traction throughout the crypto area. As CNF reported, according to Lunarcrush, CHAINLINK was with 10,520 mentions of the leaders in the social engagement charts for RWA projects.

The increased interest is due to the fact that Chainlink forms the bridge between blockchain networks and real data, which is a prerequisite for the tokenization of assets. This additional visibility and positioning could give the link even more buoyancy.

No Comments