- Chainlink continues to grow: 18 projects on 15 blockchains adopt the Chainlink standard.

- LINK is trading near the critical support at $16 but is showing signs of stabilization.

Chain link builds its presence in the industry out of. Among others, Ethereum, Aptos, Arbitrum, BNB Chain, Hedera, Optimism and XDC took over Chainlink-Standard. Even the lesser-known projects ABDAO, ApeXdex, Bedrock DeFi, Etherlink and Memento joined and are bringing smart contract applications to additional platforms.

⬡ Chainlink Adoption Update ⬡

This week, there were 18 integrations of the Chainlink standard across 6 services and 15 different chains: AB Blockchain, Aptos, Arbitrum, Base, Bittensor, BNB Chain, Dusk, Ethereum, Etherlink, Hedera, Injective EVM, Mantle, Memento, Optimism, and… pic.twitter.com/scl6nEvRxf

— Chainlink (@chainlink) November 16, 2025

As more services integrate Chainlink, the demand for LINK tokens that keep the smart contracts running will increase, which in turn leads to more utility from the network.

Despite technical difficulties in pricing, metrics suggest the project has a strong foundation for future growth.

LINK under key support, selling pressure increasing

Chainlink’s price is currently trading at $13.52 and has fallen by 17% in the last seven days. It fell well below the $16 support on November 12, putting 53.87 million tokens under selling pressure.

The breakout of this zone turned a historically strong buying area into resistance, hurting short-term sentiment.

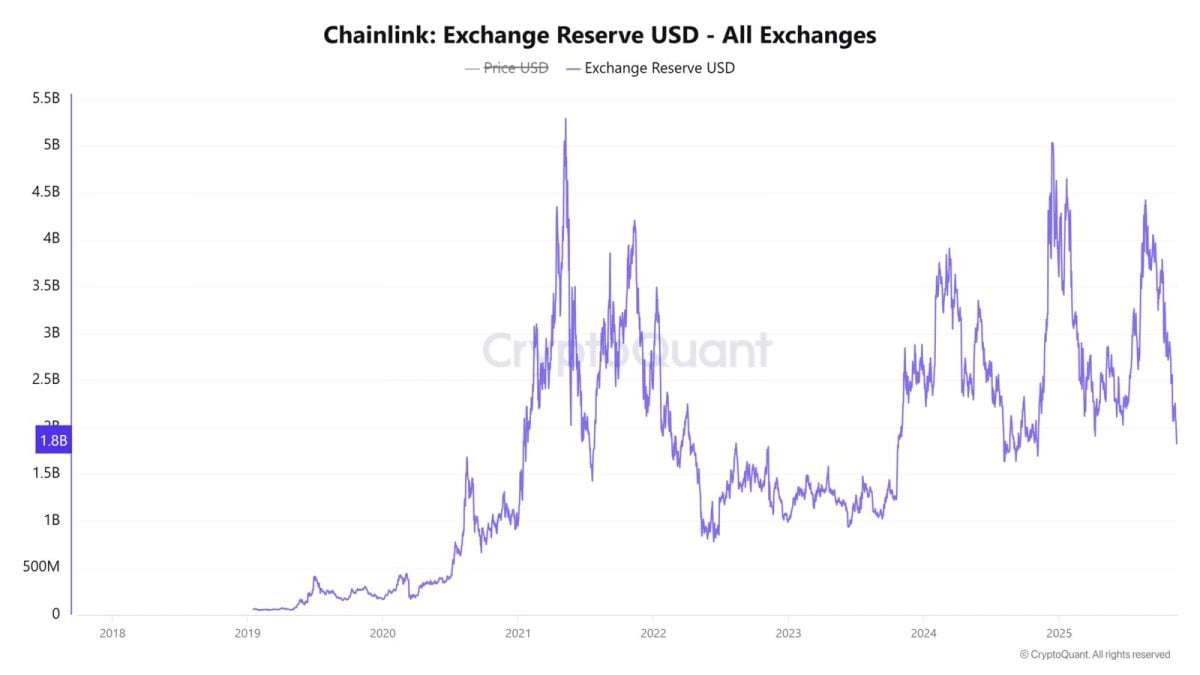

However, stock market reserves tell a different story. LINK holdings on exchanges continue to decline, falling 2.26% to 1.8 billion, suggesting that long-term holders are withdrawing tokens rather than selling.

Analysts note that shrinking reserves often precede stabilization and a possible rebound, as reduced sell-side liquidity can increase buying pressure once demand returns.

From a technical perspective, LINK price is moving within a descending channel, which it has been in since September. Price has recovered on the C wave of an Elliott Wave correction, suggesting that price is still defending support despite the overall corrective trend.

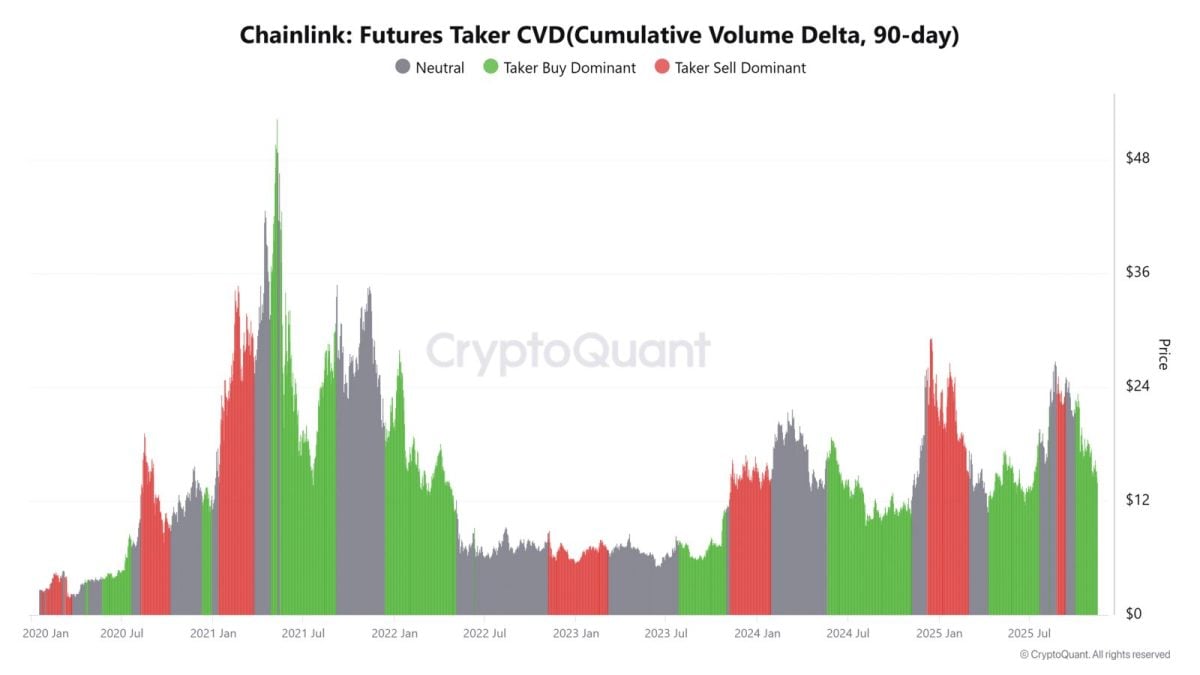

Chainlink futures purchases are increasing

The futures markets for Chainlink are showing significant participation from buyers. Taker Buy CVD is again dominating the markets, meaning there is aggressive buying even during the correction. On the Binance exchange, the positions of top traders are 74.32% on the long side and 25.68% on the short side.

Despite these trends, the overall outlook must remain cautious. A massive head and shoulders pattern can be seen on LINK’s weekly chart, with the neck line at the point of potential risk.

Technical analysis indicators RSI and MACD remain bearish. On the daily chart, LINK price failed to regain the $15 mark, confirming the breakdown and increasing the short-term downside risk.

Analysts assume that LINK price could come under downward pressure until the end of 2025 and even the beginning of 2026if the price does not recapture the $16.64 mark and rises above $27.87.

No Comments