Central banks see Riples XRP system as a Swift alternative-integration in sight?

- Central banks examined the Ripple network in addition to Swift in studies on cross-border payments.

- XRP Ledger extends its functionality to support institutional tokenization.

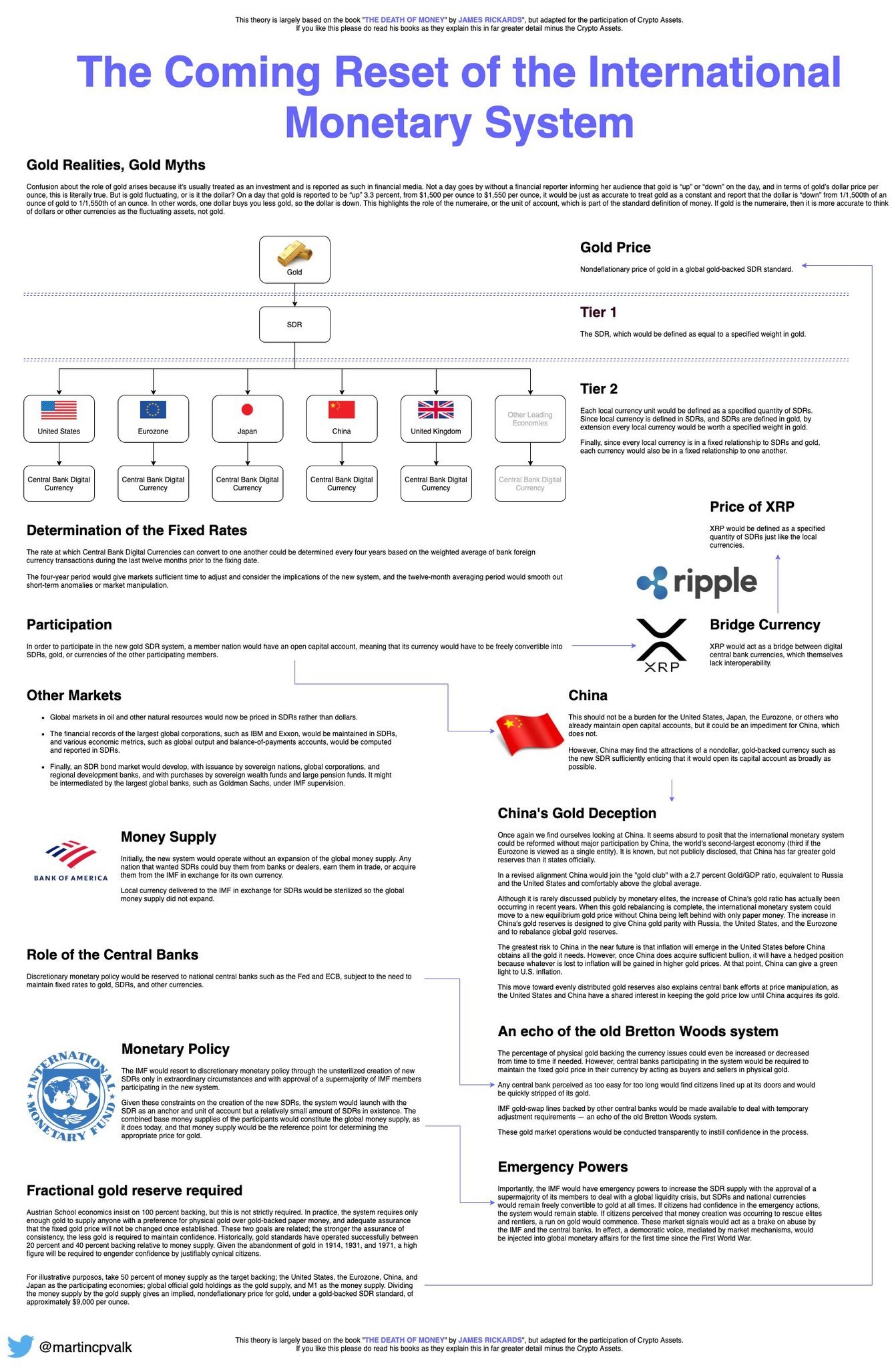

A Current X-Post From “Finance Bull” that has potential From Ripple emphasizedto optimize cross -border payments. In the article, Stella was emphasized that a joint project by the Bank of Japan and the European Central Bank, the DLT (Distributed-Ledger-Technology) were examined as possible improvements for cross-border systems.

The network From Ripple became next to SWIFT tested What shows how seriously the central banks take private innovations.

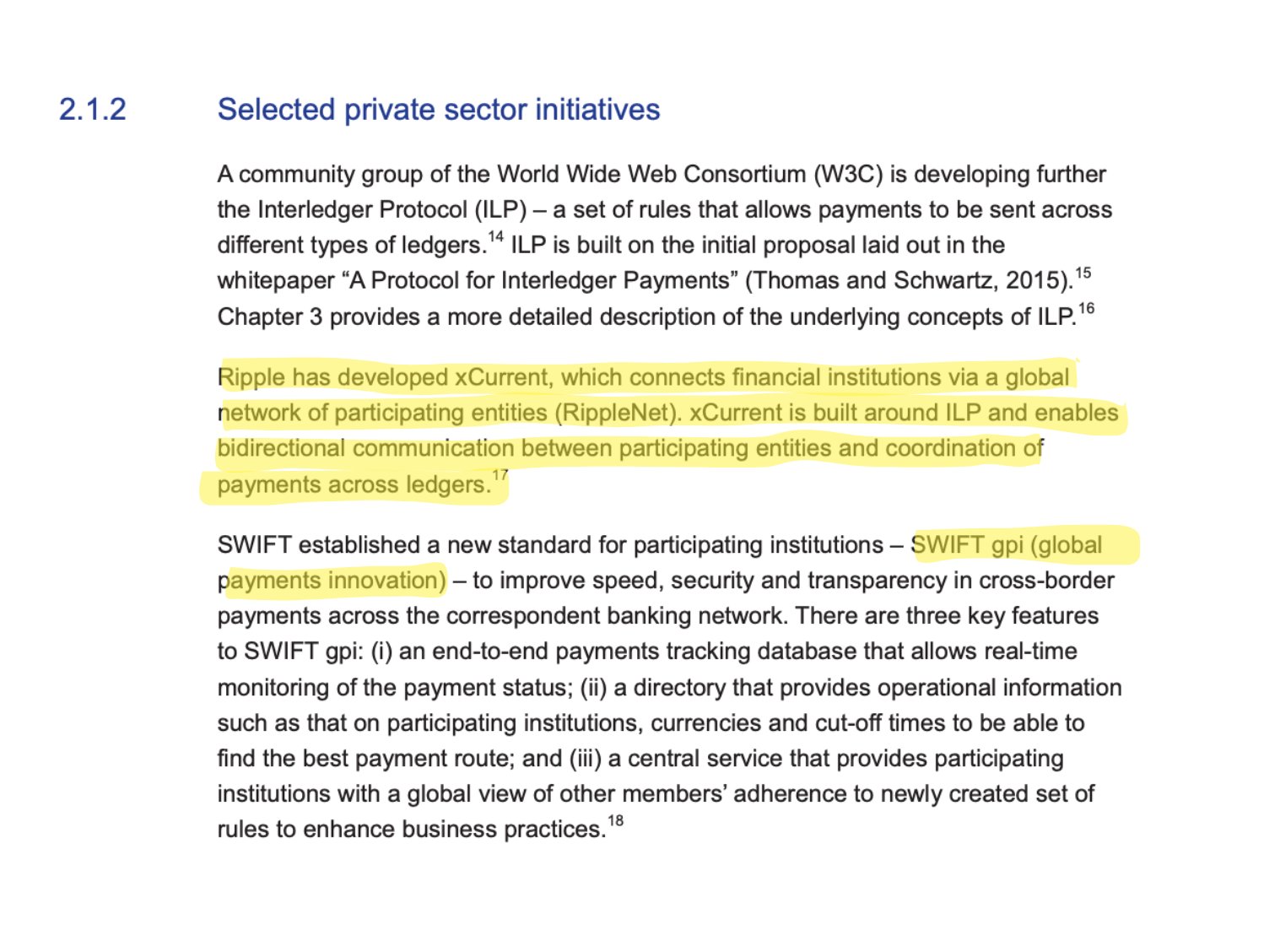

In the report, the Interledger Protocol (ILP) is also called xCurrent From Ripple based. ILP combines various payment systems and enables you to communicate with other financial systems via the Ripplenet.

In this comparison the architecture From Ripple Directly with the Improvement of international payment innovation (GPI) From swift compared. While Swift GPI accelerates tracking, transparency and payment routing, concentrateddie architectureFrom Ripple on bidirectional communication and interoperability.

The recording From Ripple into such a top -class work reflects the growing trust in the Prospects from XRPOn a coexistence With official monetary systems wider . Since both solutions are considered by the central banks, Seems the approachFrom Ripple as an alternative.

Die Rolle from XRP In the new financial regulations

Nick, a well-known XRP supporter, recognized The complementarity From Ripple to Development of today’s financial infrastructure. Ripple Has more than one For decade worked on integrating banks and institutions in the XRP Ledger.

As he says, companies like Finastra, Thunes, to and Accenture are already Through integrations or cooperation with Rippletied together And have a network that can support institutional applications.

Both Finastra and Accenture have connected over 17,000 institutions. Die ongoing takeover From Ripple has also expanded its range through conventional financial methods. They speak for the thesis that Ripple is more than just another blockchain company and maybe paving their way into a new era of financial system.

From payment transactions to tokenized RWA

Industry expert Max Avery wies on the Progress hin die Ripple Outside of the Transfer transfers might. Originally developed to optimize the sluggish and expensive cross -border payment transactions, XRP has successfully penetrated into over 70 markets and wraps billions of dollars über Ripple Payments ab. However, the broader benefit is the goal of things.

It’s clear that XRP’s future is expanding way beyond its originally discussed use cases. Ripple solved the challenge of making cross-border payments faster and cheaper, and they’ve done that with impressive results. Ripple Payments moves billions across 70+ global markets, which…

— Max Avery (@realMaxAvery) June 12, 2025

According to Avery, the XRP Ledger continues to receive new functions, underneath Smart contracts, crisschain interior operability and customizable fees. Such functions support the Position from XRP as the basis for tokenized assets, including stocks, real estate and bonds, so that their issuers can use the XRPL for processing and liquidity.

Ripple presented plans for hundreds of millions of assets in the physical world, and The forecast According to the token-based economy a trillion volume by 2030 to reach.

No Comments