Cardano’s first quarter report 25 shows good progress with new governance and system growth

- Cardano activated the on-chain governance according to CIP-1694 and thus gets the decision-making process that is controlled by the community.

- Stablecoin acceptance and the diversity of defi rose in the first quarter, while transaction activity dropped, which shows a relocation of long-term system growth.

With the formal introduction of on-chain governance and the activation of a community-guided constitution under CIP-1694, Cardano has entered an important phase of its development. The changes mark a change from theoretical governance structures to a functioning, decentralized decision model.

The report Q1 2025 from Messari outlines the first effects of this transition and highlights an increase in joint participation, the stable coin acceptance and the variety of defi. Although the report also indicates a decline in transaction activities, the trend indicates that Cardano lies the basis for sustainable long -term operation through formalized governance and an increased resistance of the platform.

State of @cardano Q1

Key Update: Cardano enacts its Constitution, ushering in full decentralized governance with active DRep participation.

QoQ Metrics

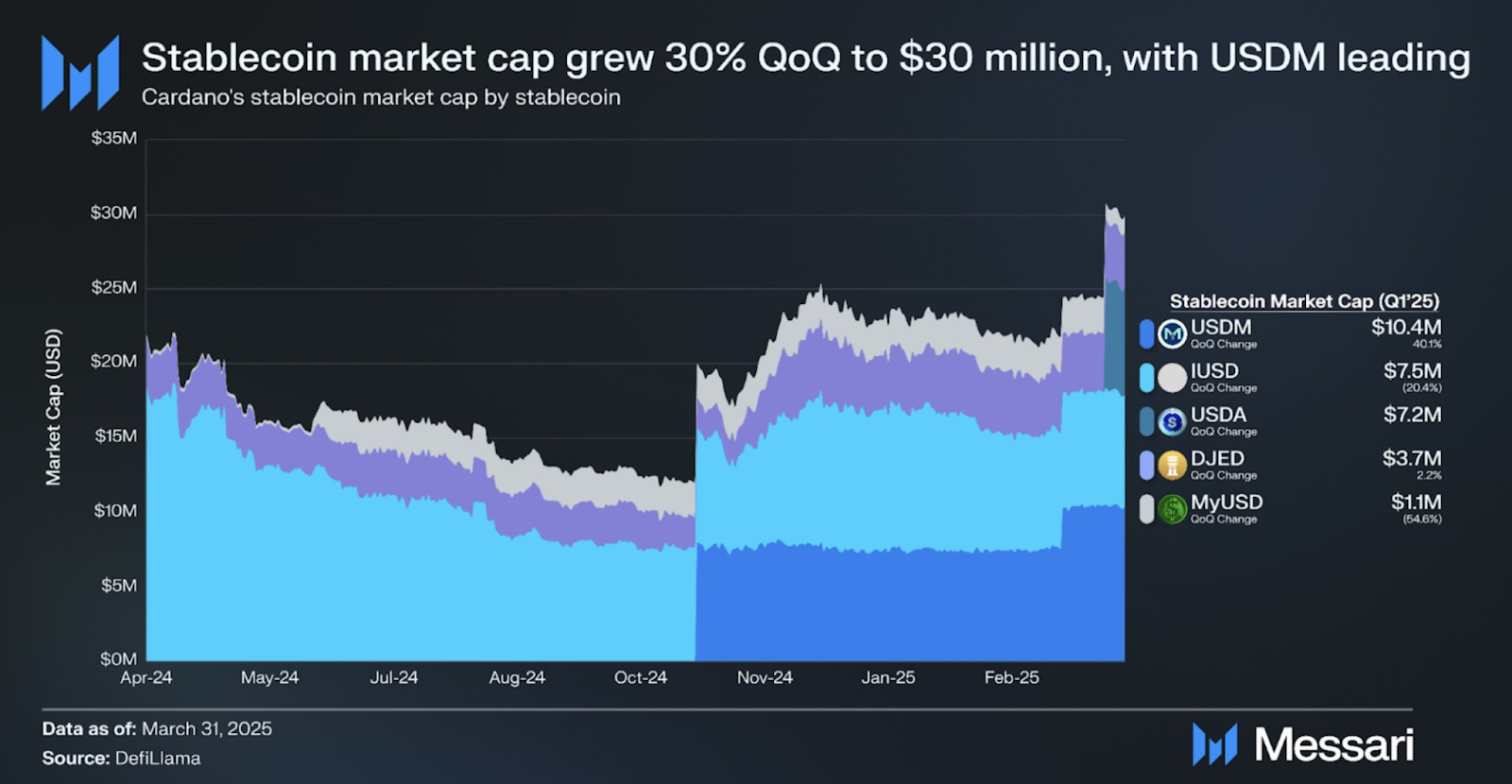

• Stablecoin market cap30%

• DeFi diversity score13%

• Treasury balance (ADA)5%

Read the full report

https://t.co/UCX6XzB4hT

– Messari (@messaricrypto) May 21, 2025

On February 24, 2025, Cardano passed his constitution and formally initiated governance according to the CIP-1694 proposal. The system introduces Dreps (Delegate Representative), which now vote on the Chain on behalf of the ADA owners.

This model enables the token owners to transmit their governance power and at the same time ensure that the coordination remains consistent and efficient. Spos (Stake Pool Operators) and a constitutional committee support the role of the DREPs and ensure a balance between technical supervision and process technology integrity.

As part of this structure, Governance suggestions go through a life cycle that includes the elaboration, discussion, coordination and implementation. The aim is to make governance both transparent and participatory. The system represents the core target of the “Voltaire” phase of the Cardano Roadmap, namely the establishment of a self-sufficient and decentralized blockchain, which is no longer dependent on central leadership.

Stable coins and treasury reflect positive momentum

In addition to governance, the report also deals with developments in the financial infrastructure of the network. The Cardano StableCoin market capitalization rose by over 30% in the first quarter and reached $ 30.2 million. The increase is due to the growing activity to attribute the two primary stable coins USDA and USDM, both of which gain traction within the ecosystem.

In addition, the Cardano trasure recorded an increase of 5 %this quarter. These funds are used for the future development of the network, including proposals of the community and improvements supported by the new governance process.

Different trends in defi and network use

Messari’s report also highlights a 13% increase in Cardanos Defi Diversity Score. This key figure shows that users use a broader spectrum of decentralized applications instead of relying on a few dominant protocols. This indicates a mature defi ecosystem in which users experiment more and use wider applications.

However, not all metrics pointed out to growth. Cardano recorded a decline in transaction volume and fees by 28%, which could be due to changed usage patterns or temporary market conditions. Nevertheless, the developers and participants focus on basic upgrades and not on short -term activity peaks.

Implementation of CIP-1694 by Cardano is one of the most comprehensive examples of a living, decentralized blockchain government. In contrast to advisory framework works that are used by many projects, Cardano now works with a formalized structure in which the community actively shapes the network through DREPs.

This change is more than just a technical step; It is a reference for other blockchain networks that consider how to decentralize power and at the same time maintain order and responsibility.

No Comments