Cardanos Ada could stand in front of the Bullrun – but everything looks at Bitcoin

- Cardano breaks out of a falling wedge pattern and stays over the 50-dayema potential for price increase to $ 0.73.

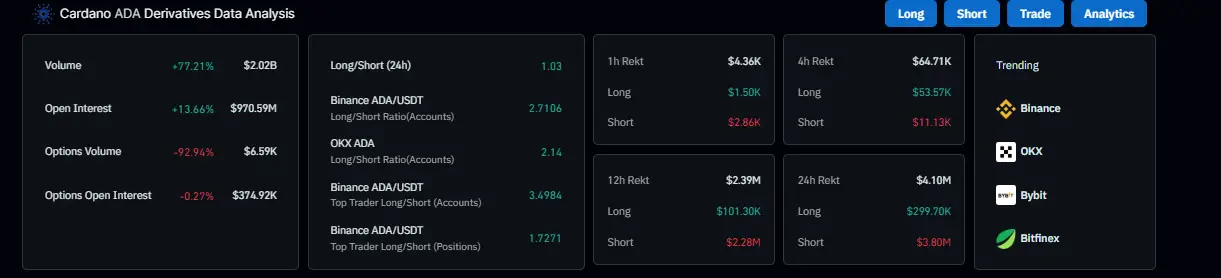

- The Ada-Futures Open Interest increases by 13.66% with $ 3.8 million in short liquidations, which explains the increasing trust of the dealers and the bullrun mood.

Cardano (ADA) draws the interest of the market again after an interest bullic technical outbreak that coincides with the increase in Bitcoin to new record heights. While the optimism of investors spreads to the cryptom market, Ada seems to adjust to a possible increase. After the outbreak through an important level of resistance, the asset stabilized at almost $ 0.62, which indicates that upward moment could develop.

Ada broke over the upper resistance of a falling wedge pattern at the beginning of the week. This pattern, which has been pursued since the beginning of May, is usually considered an indicator of an interest bully trend reversal. Cardano’s ability to stay above the upper trend line of the pattern was followed by a test of the 50-day exponential moving average (EMA), a frequently observed dynamic resistance level.

When writing this article, ADA was traded at $ 0.625 after testing the 50-dayema again. Should the course on the daily chart close above this level, this could confirm an interest bully continuation of the trend. The high from June 11th at $ 0.73 now serves as the next noteworthy resistance. On the downward side, a failure of maintaining the momentum could lead to a decline towards $ 0.60 or the low on Tuesday at $ 0.57.

The relative strength index (RSI) is currently 54 and is directed upwards, which indicates a moderate interest bully momentum. The Moving Average Convergence Divergence (MACD) shows an interest bullish crossover that appeared on June 29th. The histogram beams also stay above the neutral line, which further underpinned the interest bullish views.

Derivate indicators ensure a positive mood

The Open Interest at the Futures market of Cardano has risen by 13.66% to $ 970.59 million in the last 24 hours. This increase shows that new capital flows into the market, which is often interpreted as a sign of growing trust among dealers. The increase in the open interest fell with an important wave of short liquidations worth a total of $ 3.8 million.

The ratio of long-to-short positions at ADA is now 1.03, which reflects a slight tendency to bullish positions. If more market participants keep long-to-short contracts, this usually signals the expectation of a persistent price increase.

Market activity supports short -term optimism

Our data show that ADA recorded an increase of 2.13 % within a day and 0,6252$ reached. The market capitalization rose to $ 22.12 billion, an increase of 2.14 % compared to the previous day. The 24-hour trade volume of ADA rose by 38.7% to over $ 1 billion. The ratio of volume to market capitalization of 4.54% indicates healthy market liquidity and persistent activity.

The all-round ADA token wall is 35.38 billion of a maximum of 45 billion. With an overall offer that approaches the upper limit of $ 44.99 billion, the fully watered assessment now reaches $ 28.13 billion. The course of the last day shows that ADA started at $ 0.59 and steadily climbed to a maximum of over $ 0.63 before setting up at $ 0.625.

No Comments