Cardano: The ada course falls and whales are getting in massive: in such a position there has already been 4000% bullrun.

- Whales have accumulated over 180 million ADA, which is a sign of trust in long -term growth despite the latest price fluctuations – or some people know more than others and smell a fish train.

- Because the Cardano course pattern reflects a historical cycle that led to a bull run of 4,000 % and fueled speculation about another outbreak.

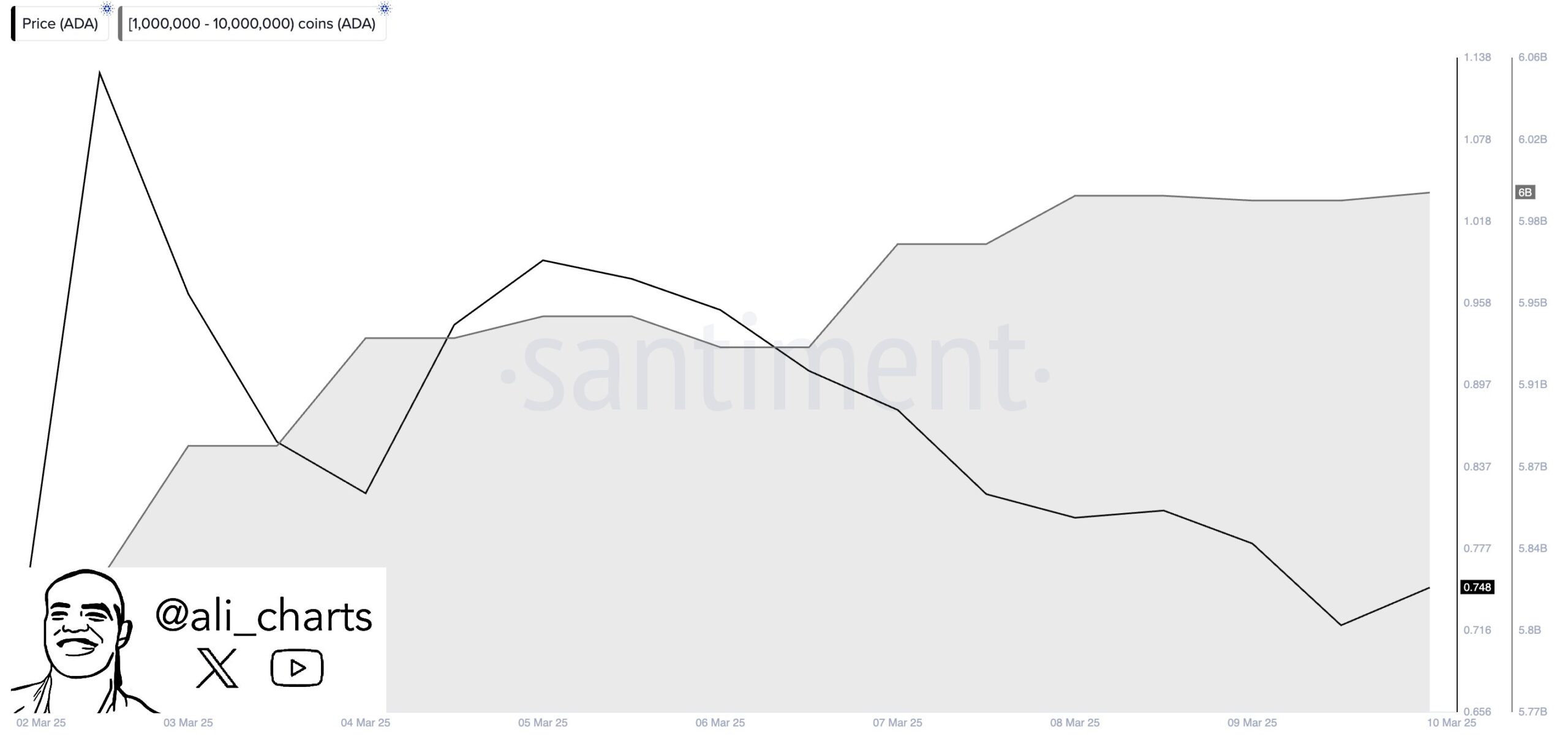

Cardano (ADA) has experienced a massive accumulation phase, with large investors having acquired over 180 million tokens in the past few days. The cryptoanalyst Ali Martinez Givethat wallets that hold between 1 million and 10 million ADA significantly increased their stocks.

The aggressive buying behavior reflects strong confidence in Ada’s long -term growth. In the past, similar accumulation phases have played a crucial role in price stabilization and often paved the way for an upward trend. Large purchases reduce the circulating offer, which could trigger upward dynamics if it lasts.

Despite the strong accumulation, the Cardano Prize has remained volatile and has experienced fluctuations in the past few weeks. Market analysts indicate important levels of support and resistance that are decisive for whether the cryptocurrency continues to consolidate or break into a new rally.

Will the 11-week pattern of ADA repeat itself for a massive outbreak?

Crypto-analyst Eilert Hat Compare Between the current price structure of Cardano and the previous market cycle pulled. In the last cycle, Ada went back 52 % from his maximum, before he consolidated for 11 weeks, which led to a significant outbreak. This accumulation phase made it possible for the old coin to collect strength before shot up.

At the moment, ADA has declined by 47 % of its latest cycle high and is now in a consolidation in the fifth week in a row. This pattern reflects the trends of the past and indicates that the whales could position themselves before a larger price movement. If the market conditions match, historical behavior indicates the possibility of strong upward push.

During the last upward cycle, Cardano scored 4,000 % after it had consolidated at a similar level of support. Even if the story does not always repeat itself exactly, the data indicates that longer accumulation phases often precede significant profits. Investors observe exactly whether ADA is going through the same development again.

Institutional investors drive the rally

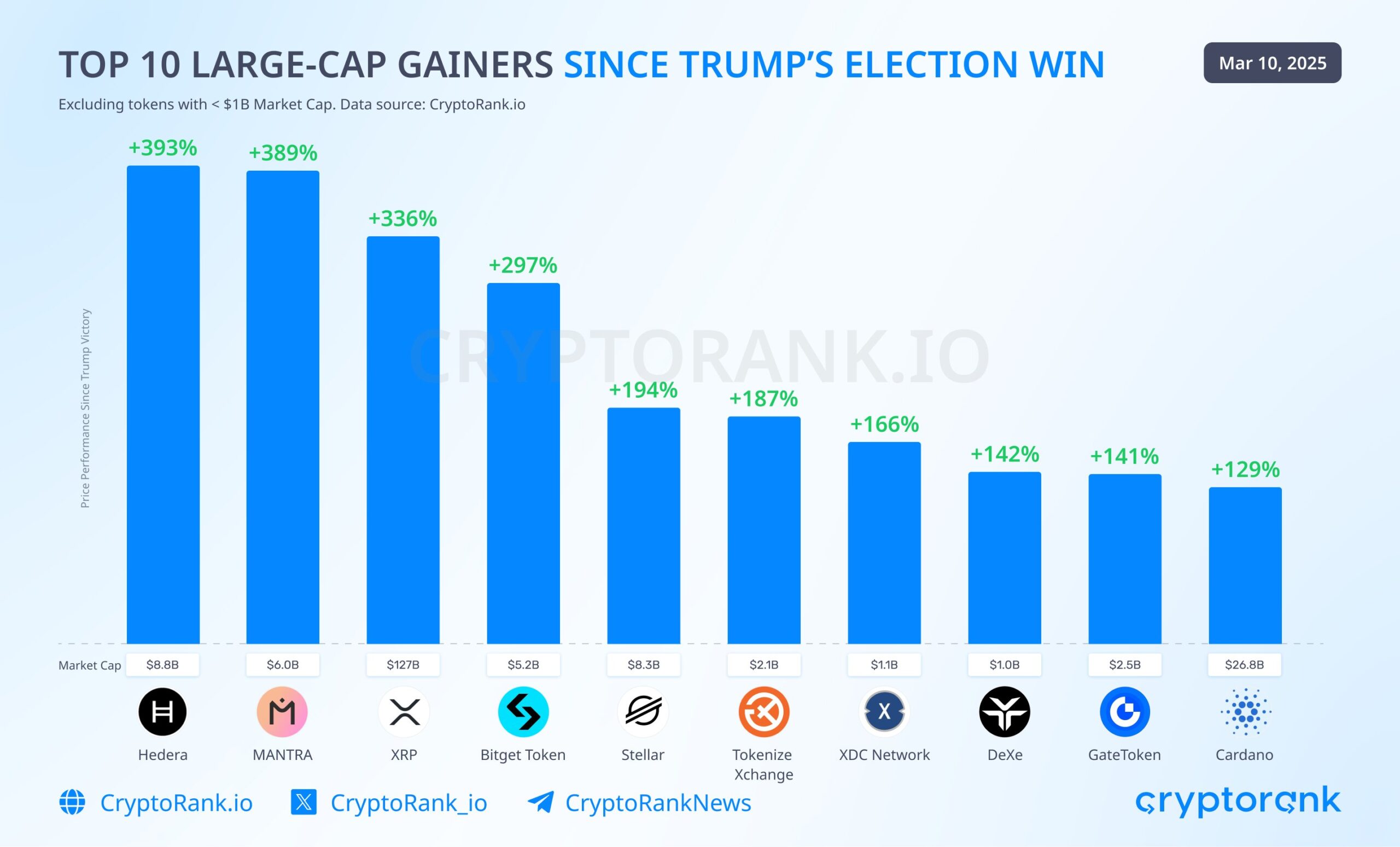

Cardano has risen by 129 % since Donald Trump’s election victory and is therefore one of the ten largest winners among the large caps. Cryptorank.io reportedthat the Ada rally coincides with the increasing trust of investors, especially the institutions. The growth of ADA signals another institutional interest and strengthens its potential as a long -term asset in strategic portfolios.

With a market capitalization of $ 26.8 billion, ADA remains a dominant force in the Altcoin sector. Analysts assume that the upward dynamics could last if the institutional demand remains stable.

“The top winners are primarily US projects that could form strategic reserves, such as $ hbar, $ XRP, $ XLM and $ Ada,” says Cryptorank.

At the time of the creation of this article, Cardano is traded at $ 0.7274, which reflects a decline of 10.20% in the past seven days. Market capitalization has also dropped 28% of its maximum age of 35.26 billion on March 5. However, the trading volume rose by 19% and reached 2.13 billion in the last 24 hours.

No Comments