Cardano investor loses $7 million after purchasing USDA stablecoins with ADA

- A crypto investor lost almost $7 million by buying the stablecoin USDA for 14.4 million ADA, which then lost 90% of its price.

- The incident has renewed warnings about the dangers of trading large amounts in pools with low liquidity.

November 16th was an unfortunate day for an investor. He lost 14.4 million ADA worth about $6.9 million in a single transaction and exchanged it for a little-known stablecoin called USDA, using an extremely illiquid liquidity pool.

Cardano Wal wandelt ADA in USDA um

Blockchain researcher ZachXBT reported the event on November 16th, drawing attention to a dramatic example that rarely occurs. According to on-chain data, the Cardano wallet had been in an inactive state since September 2020. On that day, the wallet executed a small test transaction of 4,437 ADA just 33 seconds before the massive swap.

What is noteworthy is that the user has his remaining ADA holdings in USDA converted and only received 847,695 USDA for it. This represents a loss of more than 90% of the original asset value. Since the USDA pool did not have the necessary liquidity to process such a large transaction, the order was executed at an extremely unfavorable rate, wiping out millions of dollars in a very short period of time.

ANZA Surges Following USDA Whale Activity

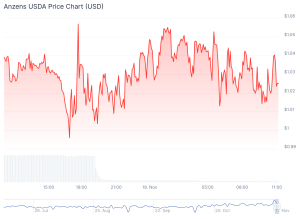

Since the market didn’t know it was a slippage loss, it reacted accordingly. Loud CoinGecko The sudden surge in USDA trading temporarily pushed the market price of the ANZA token from $1.43 to $1.26 before later stabilizing at around $1.04. USDA’s total market capitalization is approximately $10.6 million.

Analysts who have looked into the matter believe that whoever executed the trade did not understand the liquidity risks or may have completely misidentified the stablecoin since blockchain records do not show any previous USDA activity on the wallet.

This event has reignited discussion across the crypto world about the dangers of large swaps in low-liquid pools. Illiquid markets are known for causing extreme slippages, but this incident stands out due to the size of the loss and the years of wallet inactivity.

Analysts warn that both retail and institutional investors need to carefully check the liquidity and legitimacy of the tokens before making high-value transactions.

The Cardano user’s mistake is not an isolated case. The crypto market has seen other high-profile glitches in 2024 and 2025, including one involving Paxos, the issuer of several regulated stablecoins.

In October, Paxos accidentally minted 300 trillion PayPal USD (PYUSD) during an internal transfer. Although the company burned the tokens 22 minutes later and assured users that there was no security breach, the flaw briefly rocked the market and forced platforms like Aave to temporarily halt PYUSD trading.

According to the IMF, the amount minted in error exceeded twice the total global GDP, underscoring how quickly even institutional actors can disrupt markets through technical errors.

At the time of going to press, ADA is trading with us 0,4930 $ the owner as the token is down 17.01% over the past week and has a market cap of 17.68 billion. Despite the decline, analysts see strong support near the $0.47 level.

No Comments