- The ETF offers a direct SEI engagement plus staking bonuses in a secure structure.

- Double custody from Bitgo and Coinbase strengthens the trust of investors in the protection of their assets.

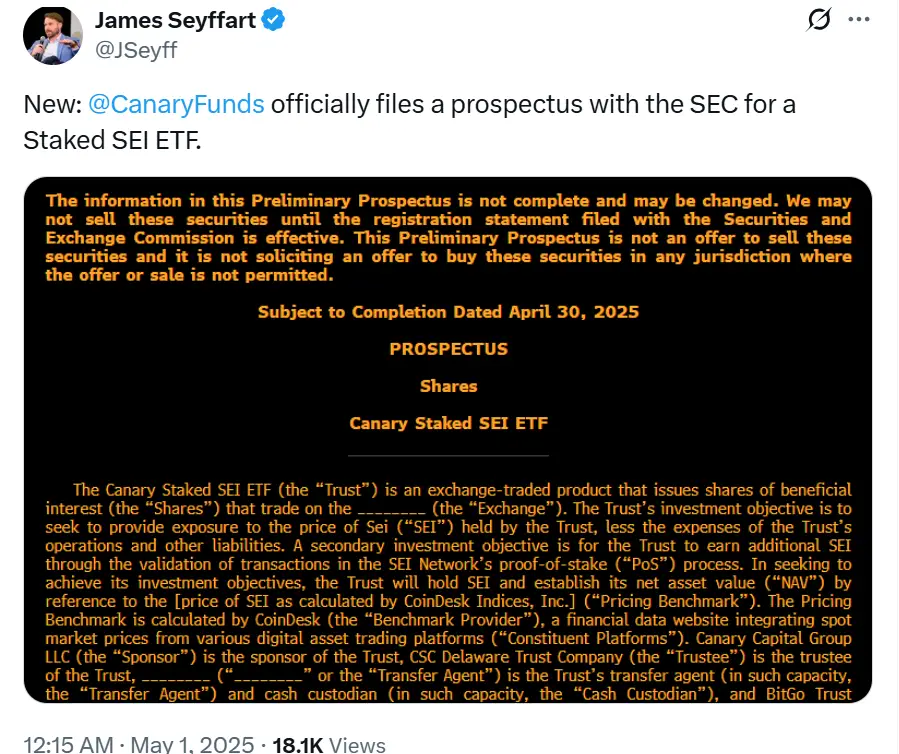

As CNF reported, Canary Capital submitted a declaration of registration for his latest stock market-traded fund, the Canary Staked, ETF. It is intended to offer investors direct engagement in the Sei tokens, generate the native asset of the SEI network and at the same time generate returns through staking.

The initiative represents a strategic expansion of crypto -based products that are intended for traditional investors. If the ETF is approved, it could open a new way for institutional access to blockchain assets without being necessary.

Direct token engagement without derivatives

The Canary Staked is ETF is designed in such a way that it follows the cash course of Seit without the use of derivatives. According to the submission, Coindesk Indices, Inc. will be the official source of pricing, with Eastern TIME calculated every day at 4:00 p.m..

This is based on aggregated spot prices of several trading platforms for digital assets to ensure transparency and accuracy. In contrast to products based on derivatives, the fund will have actual Sei-token in custody. Canary has expressed very clearly about his structure of direct property, which in his opinion is the key to the interest of institutional investors.

In order to secure the digital assets, the Fonds Bitgo Trust Company, Inc. and Coinbase Custody Trust Company, LLC has appointed LLC. The ETF will not be FDIC insured, but both storageers are privately insured. Double dwelling is intended to offer additional security and risk reduction.

Staking increases the return potential

In addition to the price tracking, the ETF also has a staking component that matches the Proof-of-Stake (POS) consensus protocol of the SEI network. This process is validated by ETF network transactions and deserves staking rewards in the form of additional SEI-TOKEN.

Canary Capital said that all missions will take place under strict official supervision, with recognized validers performing the transactions. The custodians will monitor the staking operations to ensure the integrity of the assets and compliance with the regulations.

By offering SAS and staking reputers in a regulated framework, the fund is intended to reduce the entry hurdle for mainstream investors. The structure enables users to participate in standard brokerage accounts without having to manage private keys or interact with blockchain interfaces. Canary Capital described this as an important factor in order to gain more people for investing in digital assets.

This is the first stock market-traded Canary Capital fund for the SEI network and follows an earlier application for a similar product for TRX (Tron). The company is expanding its portfolio of ETFs that enable the use of shares, which is a big step towards the introduction of cryptocurrencies in the traditional markets.

The approval of the SEC is still pending. If it comes, the Canary Staked can be a model for future crypto investment products that combine direct engagement with the generation of returns in a safe and compliant way.

No Comments