- Opened in Canada on June 18 via purpose investments The first XRP ETF of the world.

- Meanwhile, the legal dispute extends SEC./.Ripple Continue in the USA.

Canada once again overtaken the United States by approving the first stock market-traded XRP Spot Fund (ETF), which on June 18 Under Purpose Investments start.

The fund manager with an managed assets of over $ 24 billion will be under a series of tickets on the Toronto stock exchange How XRPP, CRPP.B and XRPP.U act . Dies is a premiere for Canadian investors who will now be able to use XRP in their tax -free accounts How TFSAS and RRSPS to own .

June 18th. TSX. Get ready.

Announcing the Purpose XRP ETF, offering regulated, direct exposure to spot #XRPthe native token powering fast, low-cost cross-border payments

Fund page: https://t.co/CfCEdbOUEp

Press release: https://t.co/8v1FPkXSdU… pic.twitter.com/uzNgZyRpC3

— Purpose Investments (@PurposeInvest) June 16, 2025

With active Ethereum and Bitcoin ETFs, this new Approval Canada brings a big deal closer to the top of the regulated crypto investment products.

For its part, the United States has been stuck with the considerations of the SEC and inertia of the regulatory authorities. The step also provides a subtle challenge for Donald Trumps Campaign rhetoricbut To develop crypto innovations in the United States.

delay there sec and Ripples persistent legal problem

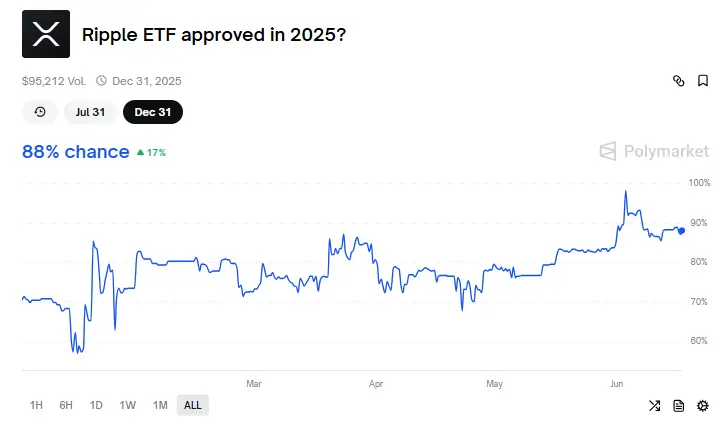

Since the US ETF issuers themselves delay the decision beyond their XRP applications, goes the Slow pace of the Sec. While Bloomberg predicts a bullish probability of 85 % for a period in the 4th quarter of 2025, it comes above all because of of the unsolved Legal dispute Between Ripple and the SECFurthermore to delays .

In one recently submitted by Ripple and the SEC joint application The appeals were requested to the second circuit until August 15, 2025expose a step that indicates that both parties Without a signal from the district court unspoilt want.

The application dated June 12, together with an application for the $ 125 million order, which the SEC offers $ 50 million and returns the remaining amount to Ripple by a courtdecided.

Translation: The @SECGov and @Ripple have filed a status report with the Second Circuit and are asking it to keep a pause on the appeals while waiting on a decision from the district court. https://t.co/YEeEjlt5yX

— Eleanor Terrett (@EleanorTerrett) June 17, 2025

Experts like James Filan believe that the campaign is a carefully well thought -out plan on both sides, but the doubts about the case are great. The step could have an impact on other ETF registrations in the USAhave .

XRP forecast of $ 10,000 triggers controversy reactions

Jake Claver, Head of the Digital Ascension Groupsees the XRP course rise to $ 10,000 by 2027. The main point he gives is network efficiency and that, the more expensive XRP becomesthe less coins are grown to carry out transactions of high amounts of money.

XRP & Digital Assets – The Greatest Wealth Transfer in History – Live Q&A https://t.co/6Xj8rF6nPa

— Jake Claver, QFOP (@beyond_broke) June 17, 2025

Using the earlier characterization By Ripple-CTO David Schwartz Claver again emphasized that higher prices increase the institutional benefits of the network. Some, including Alex Caraco, have dismissed this argument as speculative and misleading for conservative small investors.

To achieve the price of $ 10,000, an astronomical market capitalization would be requiredwhat many see as unrealistic. Regardless of this, Claver insists that standard metrics not are applicable to XRP, something that From some XRP bulls divided becomes.

No Comments