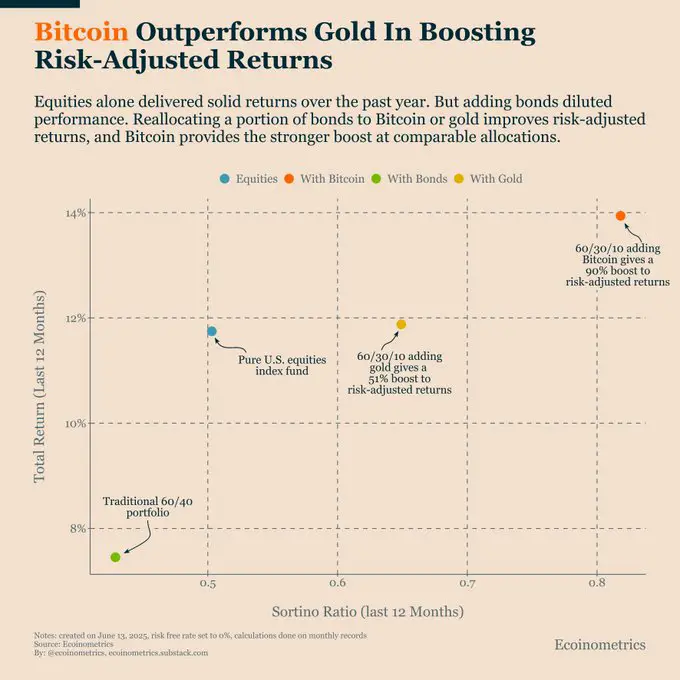

BTC or gold? 10% Bitcoin allocation brings 90% ROI and is twice as efficient

- A BTC allocation of 10% in a traditional portfolio exceeded gold with a profit of 90% in the risk-cleaned return.

- The experts from Fidelity emphasize The growing rolevon Bitcoinbecause bonds in the current financial climate lose reliability.

Im last yearsaw The investors a sharp contrast between Bitcoin and gold as Safety systems. Recent data from Show ecooinometricsthat the replacement of only 10 % of a classic 60/40 portfolio (stocks/bonds) in Bitcoin increases its risk-clean return by a whopping 90 %.

In comparison, the replacement of the same percentage in gold brought only a modest increase in return of 51 %. The same study showed that a portfolio with exclusively stock positions would have brought about 12 % with a risk -controlled key figure of 0.55.

If bonds were added to the portfolio, the key figure dropped to 0.45 and The overall return to 8 %. While gold succeeded , to bring the portfolio to a ratio of 0.62 and a return of 12 %, cut Bitcoin with a ratio of 0.80 and a return of 14 % better. With this adaptation, Bitcoin becomes a more sensible diversification candidate on the current volatile market.

Fidelity points to changed investment standards

The past of the past could be forgottenemphasize Vice President of Research bei Fidelity Digital Assets Chris Kuiper und Director of Global Macro bei Fidelity Investments Jurrien Timmer im The Value Exchange Podcast.

They refer to that dwell Trust in that tried -and -tested 60/40 portfolio, which combined share growth with bond protection for many years. The investment scene is completely different today. Deglobalization tendencies, persistent inflation and a dovish behavior of the central banks have Earlier pattern of portfolio behaviorbroken.

Kuiper points out that bonds, the Not too long ago a stable balance to shares, today just one more Annual nominal return from 1 to 2 % offer And with it the Inflation only around Ein Hairbe ahead. Real investors have suffered 55 % loss in long -term bonds, which has shaken the trust of investors into fixed -interest securities.

Timmer also found that the earlier role of bonds As a safe haven in Year 2022 was no longer given as stocks and bonds fell at the same time.

That was a reality check. Bonds not only did not offer effective protection for portfolios, but also stokealso Losses. Kuiper added that the sole recourse to ancient security instruments may not offer any sensible downtight protection today.

Bitcoin network grows despite the market resistance

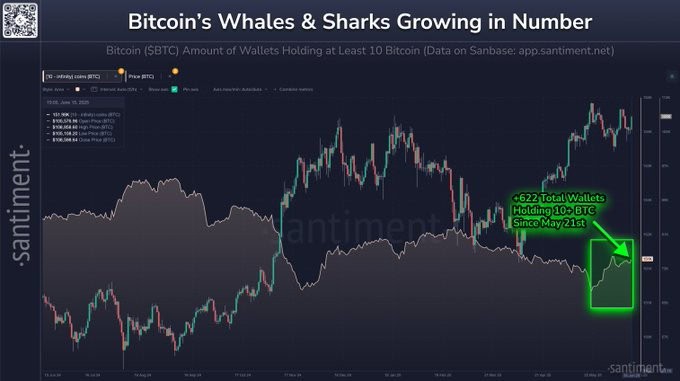

The potential From BTC is no longer hypothetical. Laut Santiment the cryptocurrency has increased to $ 108,947 and has almost reached its previous high of $ 112,000.

It is of great importance that addresses with 10 BTC have obtained 622 BTC in the past four weeks, which indicates that the whales are targeting the coin.

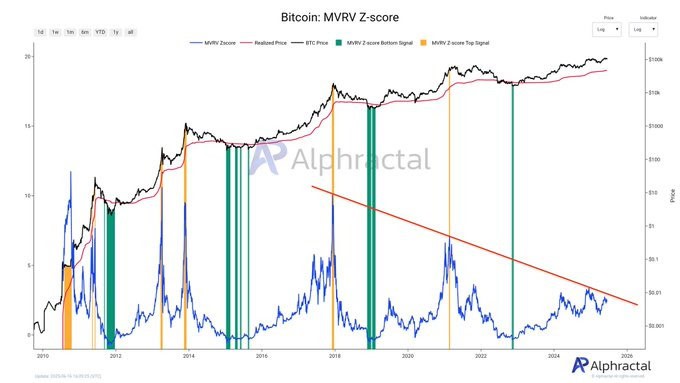

At the same time, Alphractal found that Bitcoin’s MVRV Z-Score important Resistance area approaches. In the past, this key figure was a loyal indicator of market text treme whether Bitcoin is traded above or below fair value. If the Z-Score can overcome its current upper limit, the next rally could be important.

No Comments