- The Binance Coin course stays above the 100-dayemaema and thus proves its potential for a stable trend in the green area.

- However, derivative data show a declining mood, with the open interest and long/short ratio back.

Binance Coin (BNB) recovers after a strong decline in market, whereby the course above the 100-dayema (exponential moving average) stabilized. On Friday, BNB recorded a modest increase in intraday of 2% and acted at $ 643.

Although this recovery is remarkable, the old coin is still 4.42% below the highest level of Thursday. In view of the prevailing market uncertainty, investors are now observing whether this momentum BNB can drive towards the critical $ 700 mark or whether a stronger correction is imminent.

Technical indicators indicate a fragile momentum

The BNB spa chart shows a cautious recovery, with the bulls keeping the coin over the 100-dayema at $ 633. BNB is currently $ 644 and has also recaptured the 50-dayema at $ 642. This double support is a certain technical consolation in the middle of market volatility. The 50, 100 and 200-day EMAS are all positive, so the long-term trend is still being directed upwards.

The course development shows a recreational pattern that maintains the outbreak from the previous falling channel. Despite the latest losses, this structure has not been broken. At the weekly Chart, BNB fell 1 % last week and is already 2.5 % in the minus this week. However, the increase on Friday could be a short -term relief, as retailers try to push BNB to the psychological brand of $ 700.

The momentum indicators are inconsistent. The relative strength index (RSI) recovers from a value below the middle. An RSI that lies above the middle could increase the zinsbullic momentum. According to the technical analysts, a daily closing course over the 50-dayema would increase the chances that BNB will again reach the $ 700 mark. A falling below the 200-day table at $ 624 would destroy the current interest bully signals and could throw BNB back to $ 600 and even $ 554.

Appointment market reflects a negative mood

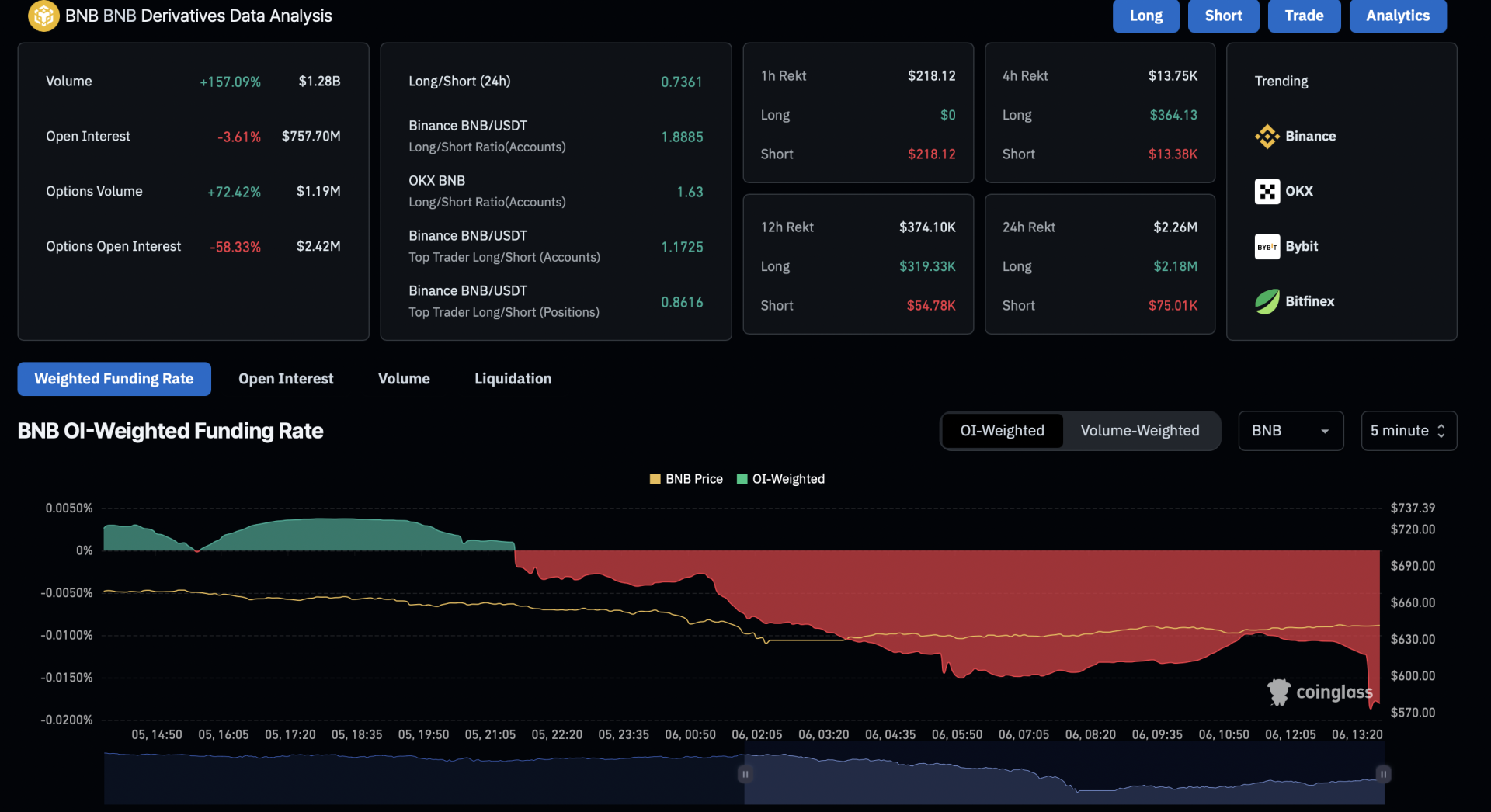

While the Kassamarkt tries to relax, the BNB terminal market shows a different picture. The open interest in BNB futures has dropped by 3.61 % and is now $ 757.70 million. This means that the derivative retailers lose their trust despite the underground price increase.

The liquidations have reached $ 2.18 million in the last 24 hours, which were mostly long positions. The long/short ratio is 0.7361, which means that interest in short positions has increased. The financing rate is 0.0178 %, which means that the bears are willing to pay for keeping their positions. These numbers indicate that the BNB could not be able to keep the relaxation.

Market analysts warn that BNB can hardly maintain its upward dynamics if the mood in the derivatives does not improve. Since the asset moves just about important levels of support, the next trading days will be decisive. A crucial movement – either in the direction of resistance of $ 700 or with the support of $ 624 – could determine the short -term trend for Binance Coin. When writing this article, BNB is traded for $ 648.01 – a decrease of 1.5 percent.

No Comments