- BNB broke through the $ 800 mark when whales such as Nano Labs captured $ 120,000 to $ 707.

- Seven weeks of silent accumulation are now over and now everything is looking closely.

BNB rose to an ATH of $ 809 on July 23, setting a new yardstick after more than seven months of price consolidation. BNB is currently in fifth place after market capitalization and had An increase of 16.21%last week.

It marks the end of a longer phase of stagnation and gives rise to new speculation that more could come.

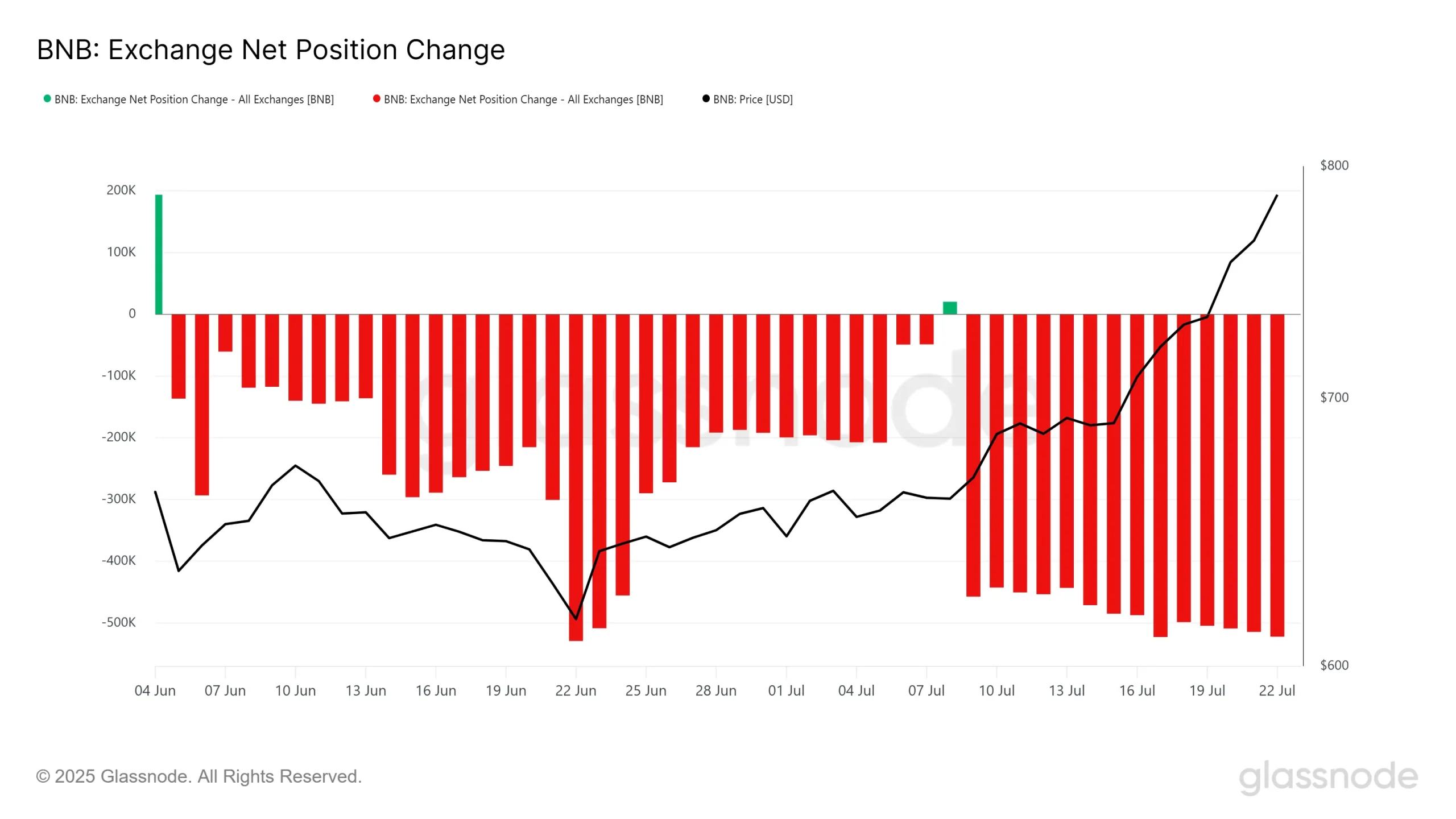

The increase coincides with a constant pattern of accumulation that started almost seven weeks ago. The data on the net positions on the stock exchanges indicate significant relocation towards higher stocks, which reflects the growing trust of investors. The wider market environment has also developed cheaply, which further reinforces the dynamics of the BNB.

The optimism of the market and the continuing inflows have pushed the coin out of its previous range. Analysts and dealers see the $ 800 mark not only as a milestone, but also as a gateway to a possible wider market activity in other old coins. The timing agrees with a similar market behavior from 2021 when a BNB price increase was preceded by an important old coin rally.

Institutional support strengthens the upward trend

Large institutional purchases were an important driving force for price development. On July 22nd, Nano Labs gave Ltd. known that it had bought 120,000 BNB tokens in out-of-the-counter transactions. The average price paid was $ 707 per token, with the overall assessment of the participation for almost $ 90 million. The company described BNB as a strategic core reserve and confirmed its plans for future purchases.

Institutional purchases of this size are regarded as the main catalyst for the current dynamics of the coin. Analysts assume that this support will keep the BNB course over the $ 800 threshold and may encourage further growth.

If the purchase pressure on this level continues, the coin $ 850 could reach a price level that the dealers considered psychologically significant.

Potential for growth of the Altcoin market

Some market observers believe that the outbreak of the spark for a wider Altcoin rally can be. A similar picture was shown in 2021 when a BNB top with general activity in the Altcoin sector collided. Whether this is repeated depends on the ongoing support and the general conditions on the market.

The coincodex analysts pretendthat BNB could reach $ 1,100 in November 2025 if the institutional purchases and price dynamics stop. However, this prediction depends on persistent tributaries and an overall positive mood in the cryptom market.

Despite the uncertain future, the development of BNB shows in the past week that the trust of investors is intact. The current data indicate that the price movement is supported by a real demand, and the coming days will show whether this level can be kept or increasing.

No Comments