BlackRock expands ETH holdings – Ethereum is threatened with monopolization

- There is a risk of monopolization with Ethereum. A few institutional players hoard extremely large inventories.

- The current ETH price trends are bearish, but a short-term recovery is expected.

Ethereum’s decentralized ethos is under scrutiny as major institutional asset managers, including BlackRock, accumulate Ethereum at unprecedented levels. Ethereum inventor Vitalik Buterin warned on the Devconnect conference in Buenos Aires that the influx of institutional money could threaten the network’s core principles.

Nine Wall Street firms offering Ethereum ETFs now collectively hold over $18 billion in Ether, while other financial firms have another $18 billion on their balance sheets.

Institutional holdings could soon exceed 10% of Ethereum’s total supply and counting. While such accumulation brings legitimacy and capital to Ethereum, Buterin pointed out two existential threats to the network.

The first threat is community alienation. As the influence of institutions grows, Ethereum risks losing the builders and developers who have spent years creating permissionless and censorship-resistant systems.

These individuals prioritize decentralization over profit-driven incentives, and too much focus on the needs of Wall Street could drive them away.

Without their technical expertise and ideological commitment, Ethereum’s decentralization could be weakened and the fundamental principles that differentiate it from traditional finance could be undermined.

Institutional priorities drive technological change

The second risk lies in technical decisions driven by institutional priorities. Buterin noted that pressure to optimize Ethereum for high-frequency trading or large-scale institutional use could lead to impractical changes to the protocol.

As an example, he cited the introduction of extremely fast block times of 150 milliseconds. While such speeds are beneficial for financial centers like New York City, they would make it virtually impossible for ordinary users or globally distributed hubs to participate efficiently.

An Ethereum network optimized for Wall Street would be geographically centralized, excluding privacy-conscious users and regular node operators.

This shift could make Ethereum a network that only a handful of institutions have full access to, in direct contradiction to the open-access design that has attracted developers and communities worldwide.

Ethereum is approaching critical support between $2,950 and $2,835

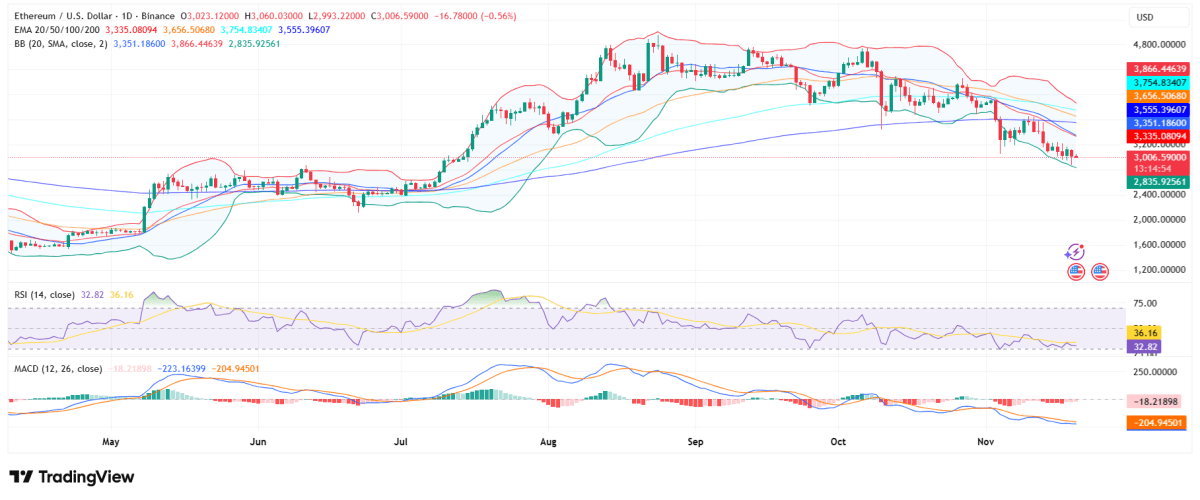

Meanwhile, Ethereum’s market performance is under constant pressure. ETH is trading at $3,006, down from its recent high of $3,800.

The cryptocurrency is below all major exponential moving averages (20/50/100/200), and the 20-day EMA is a moving average and dynamic resistance level that has repelled recovery efforts multiple times.

The Bollinger Bands are squeezed in the lower area, suggesting that the bearish momentum continues but a recovery phase is imminent.

The RSI is near the oversold level at 32.8, suggesting sellers still have the upper hand but bearish pressure may be easing.

The nearest support is between $2950 and $3000 and further support is around the $2835 level. Resistance levels lie at $3,150, the 20-day EMA at $3,335, and major EMAs at $3,555-$3,650.

For Ethereum to reverse its current downtrend, it needs to reclaim the 20-day EMA and break the descending channel while holding above the $2,950-$2,835 support.

Until then, the downward momentum is likely to continue, even as Buterin’s warnings about institutional capture underscore that the challenges facing Ethereum are as ideological as they are technical.

No Comments