BitWise assumes that with a 100-time increase in the transaction volume, 0.75 % of the XRP could be pulled out of circulation annually, which would lead to higher prices. This combustion mechanism could increase the value of XRP, since the demand for cross -border payments and tokenization increases.

Bitwise identifies three success factors for XRP as a long -term facility

Coins 0 261

4 minutes reading

- BitWise predicts that XRP can reach $ 29.30 by 2030, driven by transaction fees, token burning and RWA tokenization.

- XRP depends on its function as a bridge currency, the clarity of US regulation and increasing international acceptance.

The potential of XRP as a leading cryptocurrency depends on several factors, the tokenomics focused on the promise of value. A current one Message BitWise Asset Management identifies three main factor drivers for the long -term value of XRP. This includes transaction fees and burning, spam prevention and its role as a bridge currency. Each factor plays a key role for the growth potential of XRP.

The company predicts that XRP could achieve a price of $ 29.30 by 2030, based on the acceptance of the assets, the growth of the tokenization market and the efficient blockchain structure. With a current price of $ 2.09, the forecast growth of an increase of over 850 %.

Transaction fees and tokenburn

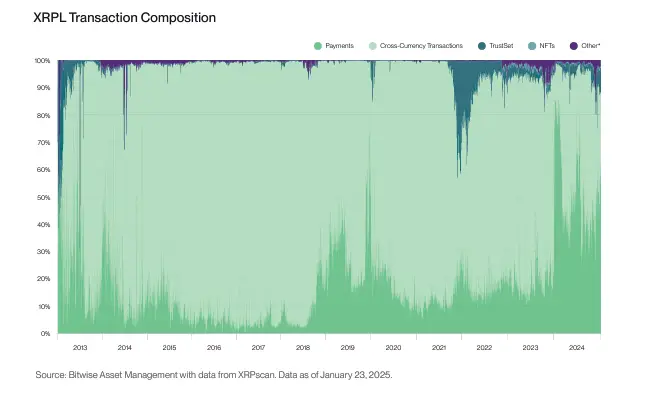

On the XRP Ledger, transaction fees play a decisive role in the entire tokenomics of the system. Each transaction costs about 0.00001 XRP, which is permanently burned, which reduces the circumferential amount of token.

In January 2025, around 13.46 million XRP was burned, which has dropped the circulating offer to almost 100 billion XRP. This property has a significant impact on the value of the token, especially with regard to the potentially growing turnover.

This Bitwise investment report on #XRP has a clear, succinct and relevant description of what drives XRP’s value: 1) TX Fees, 2) Spam Prevention, and 3) Bridge Currency & Liquidity reserve for a Large Ecosystem. pic.twitter.com/x5IiHsqovx

— WrathofKahneman (@WKahneman) May 6, 2025

Spam protection and requirements for the account reserves

Another important factor for the value of XRP is the basic reserve, which ensures that the network remains free of spam and the accounts are properly managed. To avoid disorders, each account in the XRP Ledger must keep at least 1 XRP as a basic reserve.

This reserve is not a significant driver for the XRP stock in the system, but fulfills an important function to secure network integrity. With currently over 6 million active accounts, the total requirement of XRP for account management is relatively low and is less than 1% of the tokens as a whole.

However, the reserve mechanism ensures the longevity and safety of the network, while its use increases and gives the XRP ecosystem an additional level of stability.

Bridge currency and liquidity reserve

According to Bitwise, the best application for XRP is use as a bridge currency in a growing global ecosystem. Due to the low transaction costs and the fast resolution times (3-5 seconds), XRP is perfect for cross-border payments.

The token is particularly attractive for the tokenization of real assets such as bonds and real estate. As it is expected that the market for tokenization will be $ 10.9 trillion by 2030, Bitwise believes that XRP can take 1-2% of this market and reach $ 2.9 trillion.

The role of XRP as a bridge currency can be further strengthened with the advent of decentralized identity systems and multi-purpose token. These will make XRP more attractive for regulated financial institutions. The ability of XRP to serve as a liquidity reserve for a large ecosystem, especially for cross -border transactions, makes it an important player in the financial landscape. Bitwise also expects that the role of XRP in cross-border payment transactions, which McKinsey estimates at $ 150 trillion in 2022, will grow to $ 250 trillion by 2027.

The regulatory uncertainty has disappeared with a crypto -friendly government in the United States. The SEC has dropped the lawsuit against Ripple, which strengthens the trust of investors. As CNF reported, the Defacto marks the end of cryptor regulation through compulsory measures at the end of the sec./.ripple process and replaces it with a legal rules.

XRP forms a wedge on the chart, ready to break out 3 dollars. The course is $ 2.09 and has fallen by 3.74% in the last 24 hours. The increasing interest of institutions, the submission of XRP-ETF applications and the takeover of Hidden Road by Ripple worth $ 1.25 billion can be expected to have a good future for XRP.

No Comments