Bitcoin’s weakness is a result of asset reallocations by long-term investors

- Bitcoin experienced a sharp decline as long-term investors rebalance their portfolios. In addition, many small investors gave up at a loss.

- Large gaps in price action over the weekend suggest local reversal zones, with $92,000 potentially proving to be a crucial level.

Bitcoin’s recent decline is flagfounder and CEO of CryptoQuant, is not a sign of systemic weakness, but is due to the behavior of long-term investors. He explained that older Bitcoin investors are moving portions of their assets into ETFs and to institutions such as MicroStrategy, sovereign wealth funds, pension funds and corporate treasuries.

This dip is just long-term holders rotating among themselves. Old Bitcoiners are selling to tradfi players, who will also hold for the long run.

The reason I predicted the top early this year is that OG whales were dumping hard. But the market structure has changed. ETFs, MSTR,… https://t.co/eGTRqPivFT

— Ki Young Ju (@ki_young_ju) November 17, 2025

These new holders are expected to hold on to Bitcoin for the long term, creating new liquidity channels that were not previously available.

Ju added that he predicted the market would peak due to whale selling on OG when it happened in early 2025. Nevertheless, due to inflows of institutional capital, there is a shift in dynamics that generally keeps markets in balance.

Inflows are strong on-chain and this decline suggests positioning by old holders rather than fear-driven selling.

New investors are seeing heavy losses

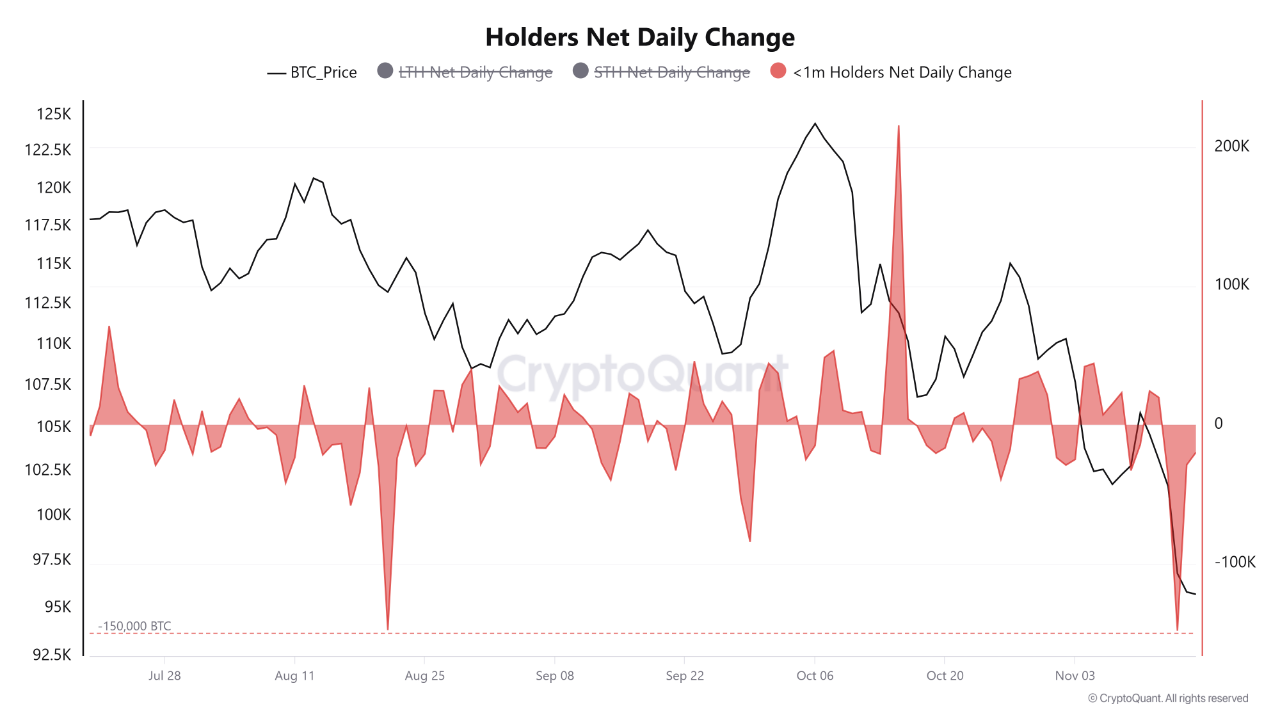

As long-held Bitcoins rebalance, newer Bitcoin investors have been confronted with a more brutal reality. A Report from CryptoQuant titled “New Money Bleeds” showed that on November 14, 2025, those who held less than 1 million Bitcoins made a big sale, dumping 148,241 coins.

The deciding factor is price: The coins sold for about $96,853, well below their average purchase price of $102,000 to $107,000. This was not about taking profits, but about realizing losses on a large scale.

This is a type of capitulation usually experienced by those who buy during market peaks and experience their first market downturn. The $100,000 mark, which is usually a psychological level, caused them to panic and sell.

They sold due to the pressure and therefore released coins to more patient traders at a cheaper price, ultimately improving Bitcoin’s base. Bitcoin is currently at $95,021.15, reflecting strong short-term pressure.

Historical Bitcoin gaps signal potential reversals

Analyst Daan Crypto Trades has statedthat Bitcoin is near a range of around $92,000, which is open from April 2025. Weekend gaps occur when Bitcoin starts above or below its Friday closing price. These gaps tend to fill up over time, leading to reversals in most cases.

The significant gaps previously observed, such as the one in November 2024 from $77,000 to $81,000, took more than four months to fill but eventually triggered a rally to $110,000. The smaller gaps, including the one in July 2025, were closed within a few weeks.

Analysts believe that due to increased market volatility, the gaps could become very large in the next few weeks, making weekend prices less predictable. The $92,000 level is currently an important level to watch.

Bitcoin’s plunge combines the repositioning of long-term holders with the forced exit of newer investors, highlighting complex market dynamics.

While retail investors are feeling the pinch of losses, institutional accumulation and gap analysis suggest a more stable foundation could be forming in the coming months.

No Comments