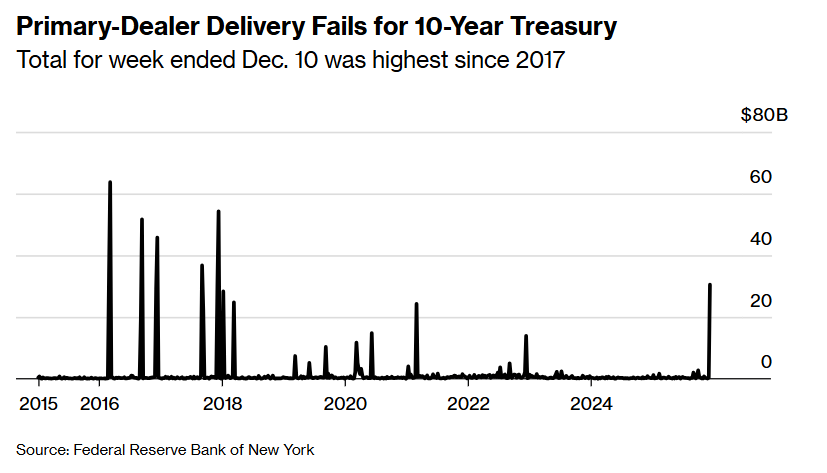

- Unusual shortage of 10-year US Treasuries signals possible liquidity shortages and increased volatility potential for Bitcoin.

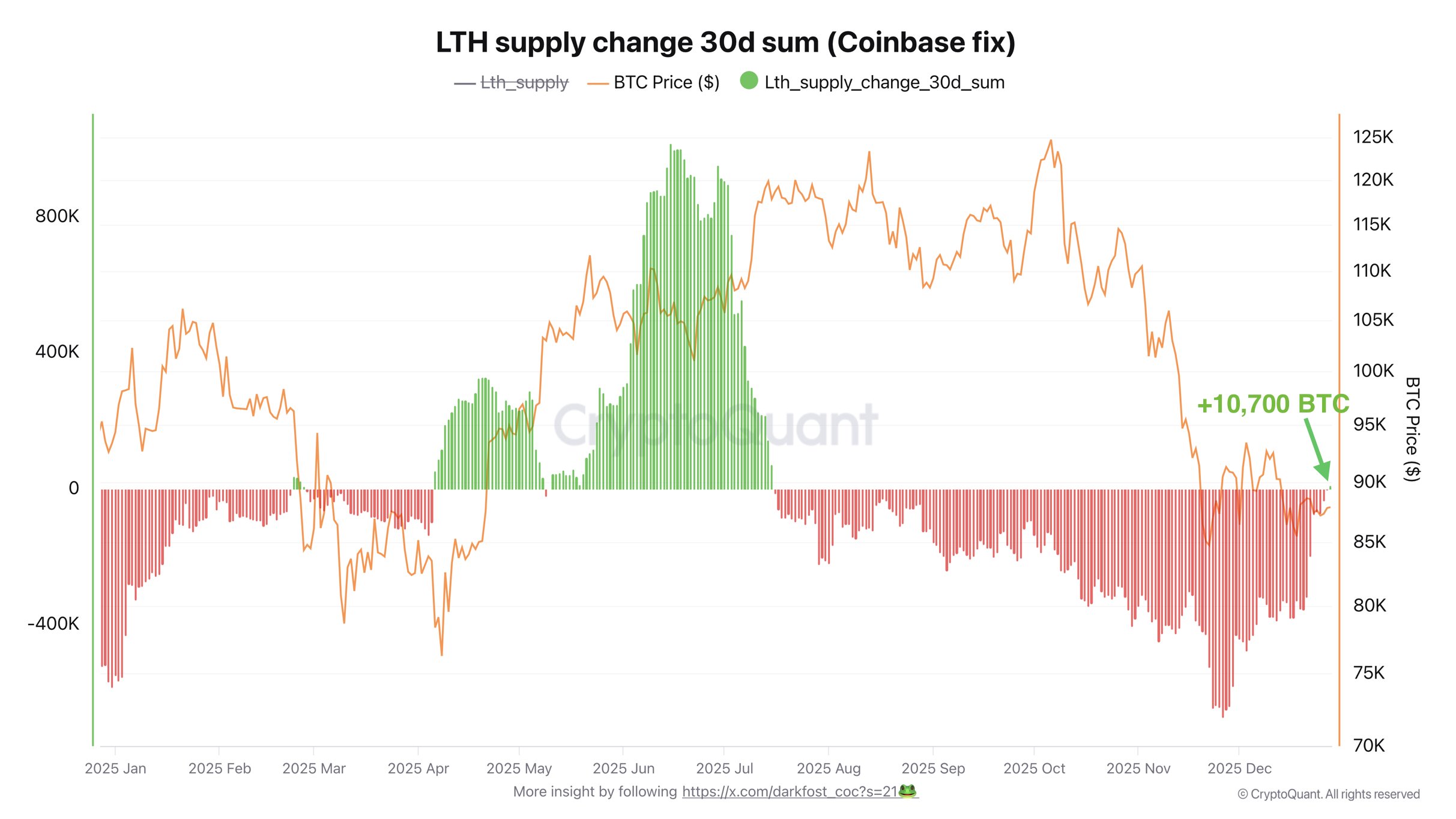

- Long-term Bitcoin holders reduce their selling pressure; the LTH supply is turning positive again, which is historically rather bullish.

At the turn of the year, two rather inconspicuous but very relevant signals come into focus: tensions in the US bond market and a noticeable change in mood among long-term Bitcoin investors (LTH). Both data points suggest that there could soon be more volatility in the market.

US Treasury Bond Shortage: What This Means for Bitcoin

The first data point comes from the bond market. As the well-known YouTuber and expert Furkan Yildirim writes on In just one week, so-called “fails” affected a volume of around $30.5 billion. This is the highest value since 2017.

Yildirim explains the mechanism like this:

“Imagine you buy something and the payment goes through, but the goods don’t arrive on time. Not because it’s broken. But because it’s difficult to get. With bonds, this happens when a certain security is suddenly in extremely high demand.”

Specifically, numerous market participants needed exactly this ten-year bond at short notice, for hedging, to close positions or for technical reasons in trading. The result: scarcity. A particularly striking detail was that investors sometimes had to pay to borrow the bond. An atypical signal indicating demand exceeding available supply.

According to Yildirim, part of the reason lies with the US Federal Reserve.

“Part of the explanation is pretty simple: The Fed has been holding fewer bonds since 2022 because it is reducing its holdings. And: If the Fed has less of this new ten-year bond in its portfolio, it can also make less of it available to the market. This reduces the freely available share,” said Yildirim.

This is relevant for Bitcoin investors because such tensions can indicate when liquidity in the financial system is becoming scarcer or more expensive. Not a crisis signal, but an environmental factor that influences risk assets. “Such friction is often an early indicator that something is becoming tighter in the financial system,” explains Yildirim, adding the connection to Bitcoin:

“Bitcoin reacts strongly to liquidity. When there is enough leeway in the system, risky assets often perform better. When things get tight, things can quickly become unsettled. This bond shortage is not a direct Bitcoin trigger. But it is an example of how technical bottlenecks suddenly become visible in the background.”

Long-term Bitcoin holders are accumulating again

The second data point comes directly from the Bitcoin on-chain space. CryptoQuant CEO Ki Young Ju refers to an analysis by analyst Darkfrost (@Darkfost_Coc), which shows that long-term Bitcoin holders have recently significantly reduced their selling pressure.

In his analysis, the CryptoQuant expert eliminated disturbing effects, in particular the movement of around 800,000 BTC from Coinbase, and discovered a bullish signal.

Darkfrost explains via X:

“Since July 16th, the monthly change in LTH supply (30-day total) was clearly in a distribution phase until recently. In other words, the proportion of the supply held by LTHs has been steadily declining for months. Now we have returned to positive territory – around 10,700 BTC have moved into long-term held coins.”

While it’s only a moderate shift so far, “historically, such shifts have often preceded the formation of consolidation phases – or even bullish recovery moves, depending on how the overarching trend evolves,” said the on-chain analyst.

Taken together, both data points do not indicate an immediate trigger for strong price movements, but provide important contextual information for the new year, especially for market participants who are keeping an eye on the mechanics in the background alongside central bank policy and technical analysis. As CNF reported yesterday, the vast majority of experts are bullish for 2026.

No Comments